Top Crypto Gainers: Canton, Zcash, and Luna Classic rally roster double-digit gains

- Canton takes a breather after an 18% surge on Monday, breaking out of a falling channel pattern.

- Zcash struggles to clear the 50-day EMA at $400 after an 18% jump on Monday.

- Luna Classic edges higher by over 4%, advancing the 9% bounce back from the 200-day EMA.

Privacy coins, including Canton (CC) and Zcash (ZEC), alongside Luna Classic (LUNC), rank among the top gainers in the broader cryptocurrency market over the last 24 hours, with double-digit gains. The technical outlook for the privacy coins remains bullish, while Luna Classic’s recovery ahead of Do Kwon’s sentence hearing on Thursday could face volatility.

Canton’s breakout rally could face multiple resistances

Canton ticks lower by 2% at press time on Tuesday after three consecutive days of recovery, including an 18% rise on Monday. The recovery in privacy coin broke out of a falling channel pattern on the 4-hour chart, signaling further gains.

If CC secures a decisive close above the R1 Pivot Point at $0.080 on the same chart, it could extend the rally to the R2 Pivot Point at $0.095.

The momentum indicators on the 4-hour chart suggest intense buying pressure. The Relative Strength Index (RSI) at 63 retraces before reaching the overbought zone, but holds above the halfway line. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator shows the average line in a steady upward trend, indicating a rise in bullish momentum.

Looking down, if Canton reverses below the 50-period Exponential Moving Average (EMA) at $0.072, it could test Saturday’s low at $0.058.

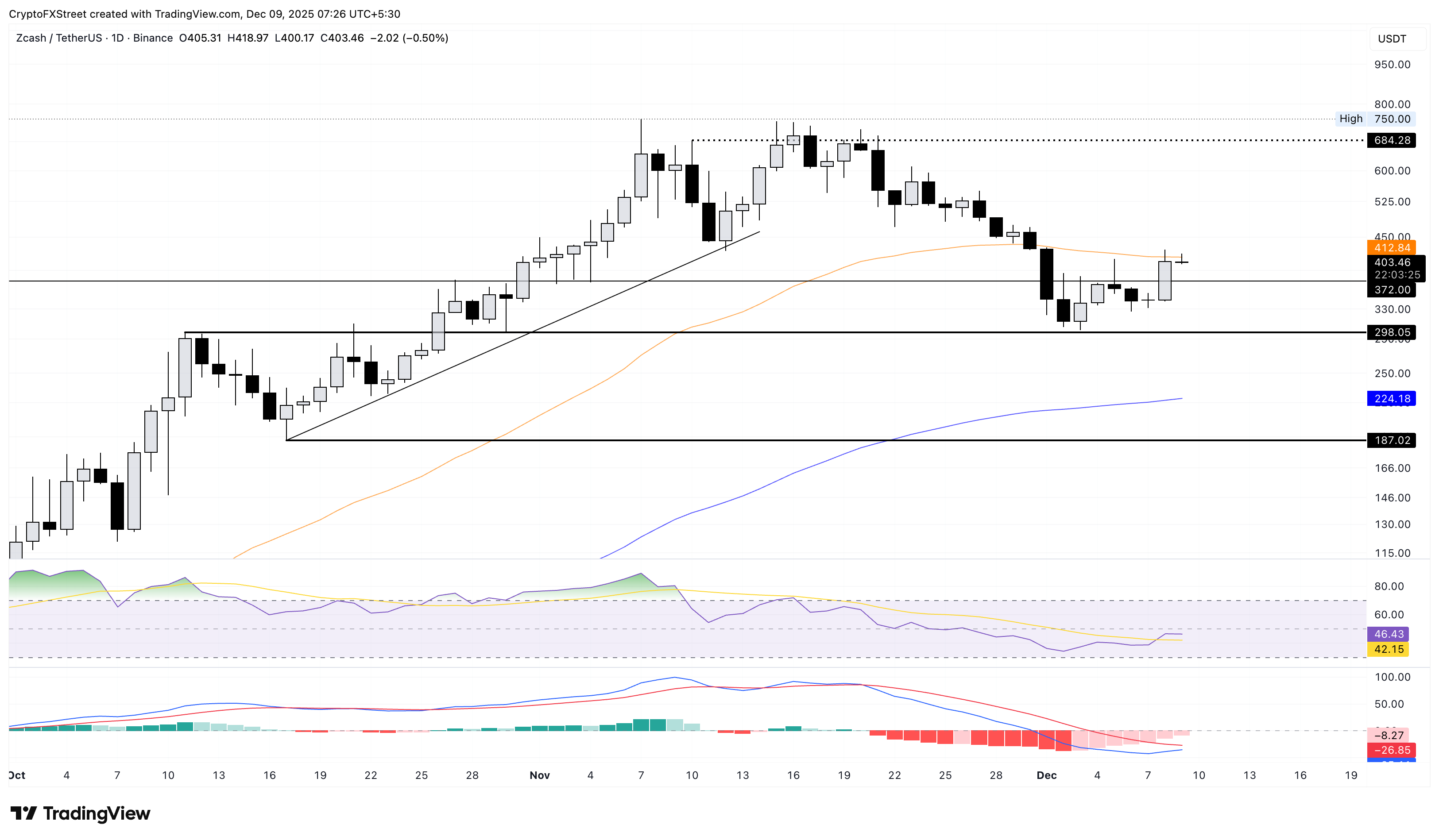

Zcash recovery run halts at the 50-day EMA

Zcash recorded an 18% jump on Monday, reclaiming the $400 mark. At the time of writing, Zcash trades above $400 on Tuesday, with bulls aiming to surpass the 50-day EMA at $412.

A potential close above $412 could extend the ZEC rally toward the $500 psychological mark.

The technical indicators on the daily chart suggest a bullish shift in Zcash. The RSI at 46 approaches the midline from the oversold zone, indicating a reduction in selling pressure. At the same time, the MACD approaches its signal line, teasing a crossover that could confirm a renewed bullish momentum.

If ZEC fails to hold above $400, it could test the $298 support level, marked by the October 11 high.

Luna Classic holds above the 200-day EMA, eyeing further gains

Luna Classic is heating up ahead of its founder Do Kwon’s sentence hearing on Thursday, after he pleaded guilty to fraud over the $40 billion during the Terra ecosystem collapse. At the time of writing, the LUNC edges higher by over 4% on Tuesday, advancing the 9% gains from the previous day.

The LUNC token trades above the 200-day EMA, with bulls aiming for the Friday high near $0.0000700.

The RSI at 69 at the borders of the overbought zone indicates intense buying pressure, while the MACD and signal line soar higher into the positive territory.

If LUNC falls below the 200-day EMA at $0.00005161, it could test the 50-day EMA at $0.00003925.