XRP dives 5% despite Ripple's new license to expand crypto payments in Singapore

- Ripple announced it has secured approval to expand the scope of its payment services in Singapore.

- The firm's Singapore subsidiary will help broaden its regulated payment offerings in the region.

- XRP declined by 5% on Monday and is now testing the $2.00 support level.

Ripple has received expanded regulatory approval from Singapore's Monetary Authority (MAS), allowing the company to widen the scope of its licensed payment services in the country.

Ripple receives green light in Singapore to expand crypto payment service

Ripple has received new regulatory clearance from the MAS to expand the range of services it can provide under its Major Payment Institution license, according to a statement on Monday.

The approval strengthens Ripple's ability to scale its regulated cross-border payments business in Singapore, a market the company views as a core hub for its Asia-Pacific operations.

"With this expanded scope of payment activities, we can better support the institutions driving that growth by offering a broad suite of regulated payment services, bringing faster, more efficient payments to our customers," said Fiona Murray, Ripple Vice President & Managing Director, Asia Pacific.

The enhanced permissions apply to Ripple Markets APAC Pte, its local Singapore entity, allowing the company to offer a broader set of token-based settlement options, including XRP, its RLUSD stablecoin, and other digital assets.

The update also enables Ripple to deliver additional payment services to banks, fintech companies, and crypto service providers operating within Singapore's regulated financial environment.

"The Asia Pacific region leads the world in real digital asset usage, with on-chain activity up roughly 70% year-over-year. Singapore sits at the center of that growth," Murray added.

Ripple's President Monica Long stated that MAS continues to set a global benchmark for clear and progressive digital asset regulation, adding that innovation accelerates when the rules are well-defined.

Long noted that the expanded license will allow Ripple to further invest in Singapore and strengthen the payment infrastructure needed for fast, secure, and efficient money movement.

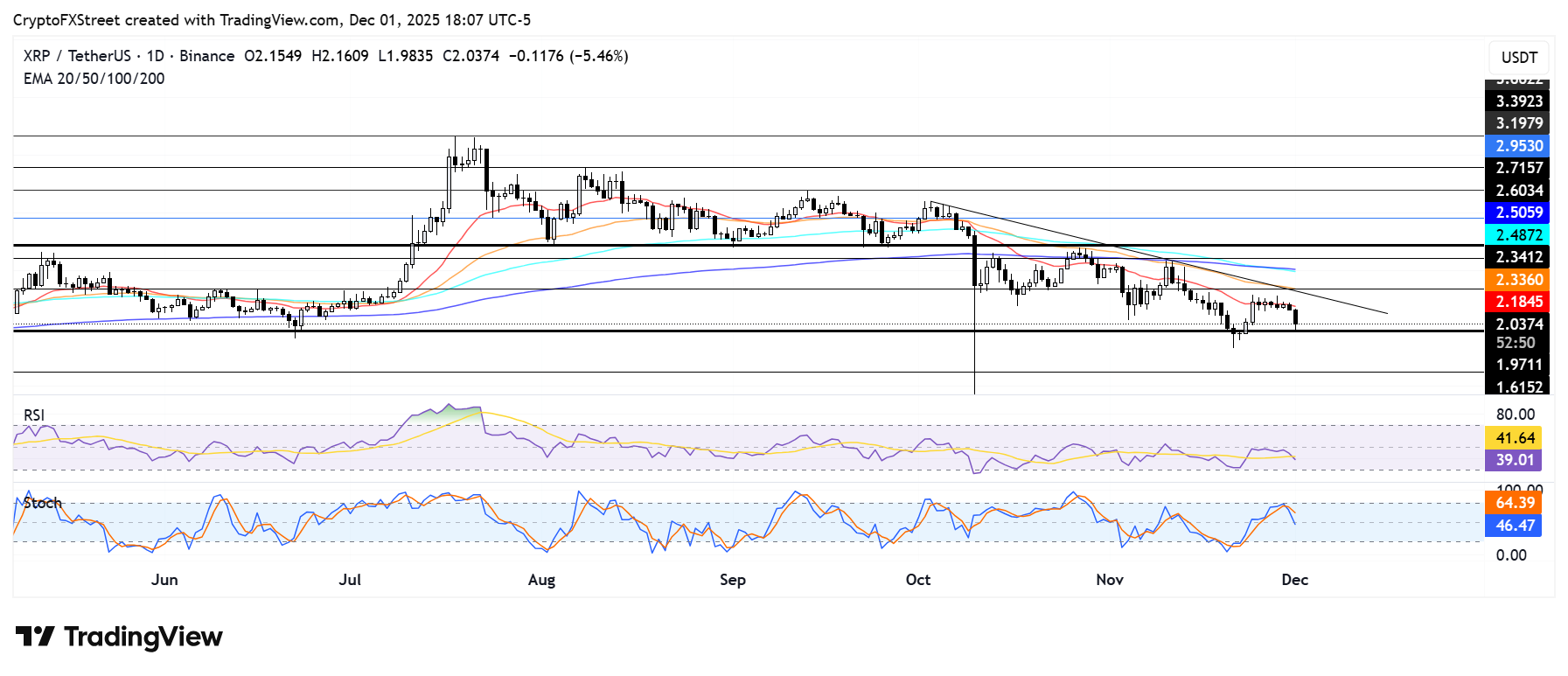

XRP tests $2.00 support after rejection at 20-day EMA

XRP declined by 5% on Monday after seeing a rejection near the 20-day Exponential Moving Average (EMA), which stood as a key resistance all through last week.

The remittance-based token is testing the support near the $2.00 psychological level. A bounce off $2.00 could see XRP retackle the 20-day EMA resistance. However, a decline below $2.00 could see the token find support near $1.60.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downward, indicating an increase in bearish momentum.