Ripple Price Forecast: XRP recovery cools as more ETF products debut in the US

- XRP declines as recovery takes a breather, reflecting dull sentiment across the crypto market.

- Grayscale and Franklin Templeton XRP ETFs launch in the US, recording $67 million and $64 million in volume on day one, respectively.

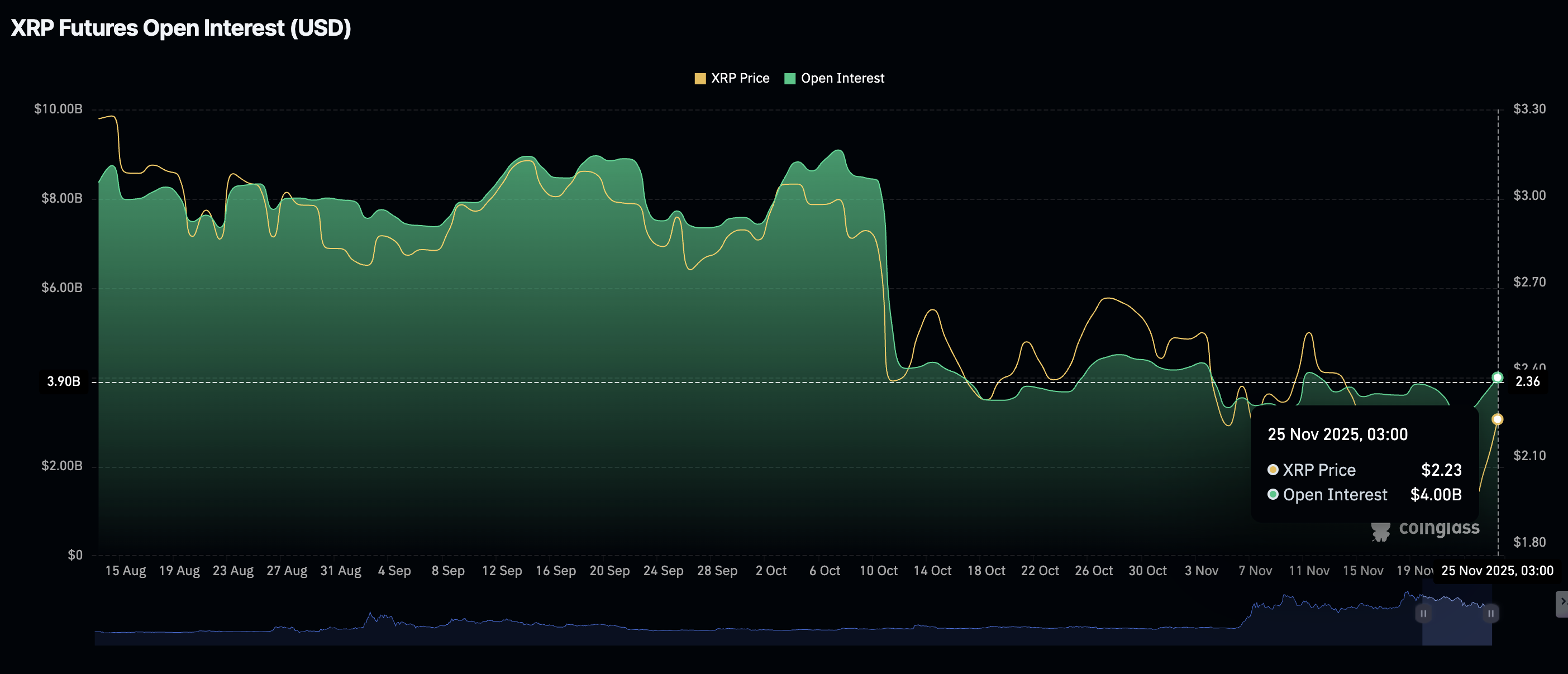

- Retail demand for XRP increases slightly with futures Open Interest above $4 billion.

Ripple (XRP) is edging lower, trading at $2.18 at the time of writing on Tuesday. A bearish wave is budding across the cryptocurrency market, triggering losses amid investors' rush to lock in short-term profits and protect their capital.

If downward pressure persists, recovery toward $3.00 could be a pipe dream, while increasing the odds of another step below the pivotal $2.00 level. However, as retail and institutional demand increase, the path of least resistance may remain upward in the coming days.

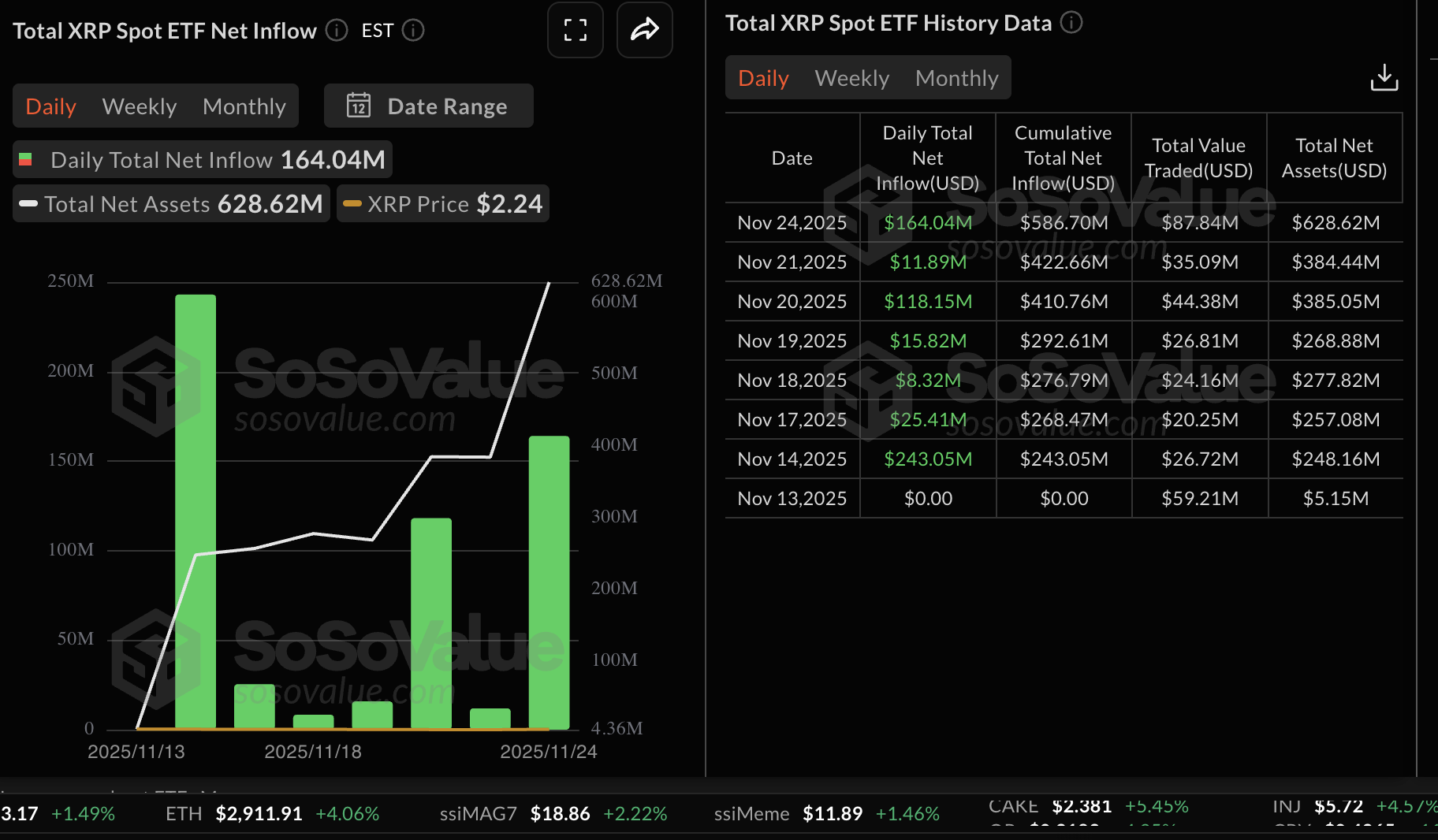

XRP ETFs post steady inflows

Grayscale and Franklin Templeton's XRP Exchange Traded Funds (ETFs) began trading on Monday, bringing the total number of United States (US) spot XRP products to four.

Grayscale's GXRP ETF recorded inflows of $67 million, with Franklin's XRPZ ETF coming second with $63 million on its first day of trading. Previously launched Bitwise's XRP ETF posted inflows of $18 million, while Canary Capital's XRPC recorded inflows of $16 million.

In total, XRP ETFs recorded $164 million in inflows on Monday, bringing the cumulative net volume to $587 million and net assets to $628 million.

Meanwhile, retail demand for XRP derivatives products has picked up this week, as reflected by futures Open Interest (OI) crossing $4 billion on Tuesday, up from $3.61 billion on Monday and $3.28 billion on Sunday.

When OI rises, it supports positive market sentiment, encouraging investors to increase their risk exposure. This creates a health environment that tends to sustain gains.

Technical outlook: XRP risks resuming downtrend

XRP is trading at around $2.18 at the time of writing on Tuesday, while staying below the falling 50-day Exponential Moving Average (EMA) at $2.38, the 100-day EMA at $2.52 and the 200-day EMA at $2.51 as they slope lower and continue to cap rebounds.

The Moving Average Convergence Divergence (MACD) histogram turned slightly positive above the zero line, signaling a bullish crossover. With the Relative Strength Index (RSI) holding at 46 below the midline, upward momentum could remain subdued and the broader tone cautious.

The descending trend line from $3.66 record high limits gains, with resistance seen at $2.68. Meanwhile, the Momentum indicator sits below the zero line and is falling, indicating strengthening bearish pressure. On recovery, the 50-day EMA at $2.38, the 200-day EMA at $2.51 and the 100-day EMA at $2.52 would present interim barriers ahead of the trend line cap. Still, a sustained break above these would improve the outlook, while failure to clear them would keep risks skewed to the downside, targeting lower levels below $2.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

(The technical analysis of this story was written with the help of an AI tool)