Ripple Price Forecast: XRP ETF inflows, steady retail demand boost recovery odds

- XRP rises above $2.00 as bulls push to regain control on Monday.

- XRP ETFs recorded nearly $180 million in inflows last week, as institutional investors turn to altcoin products.

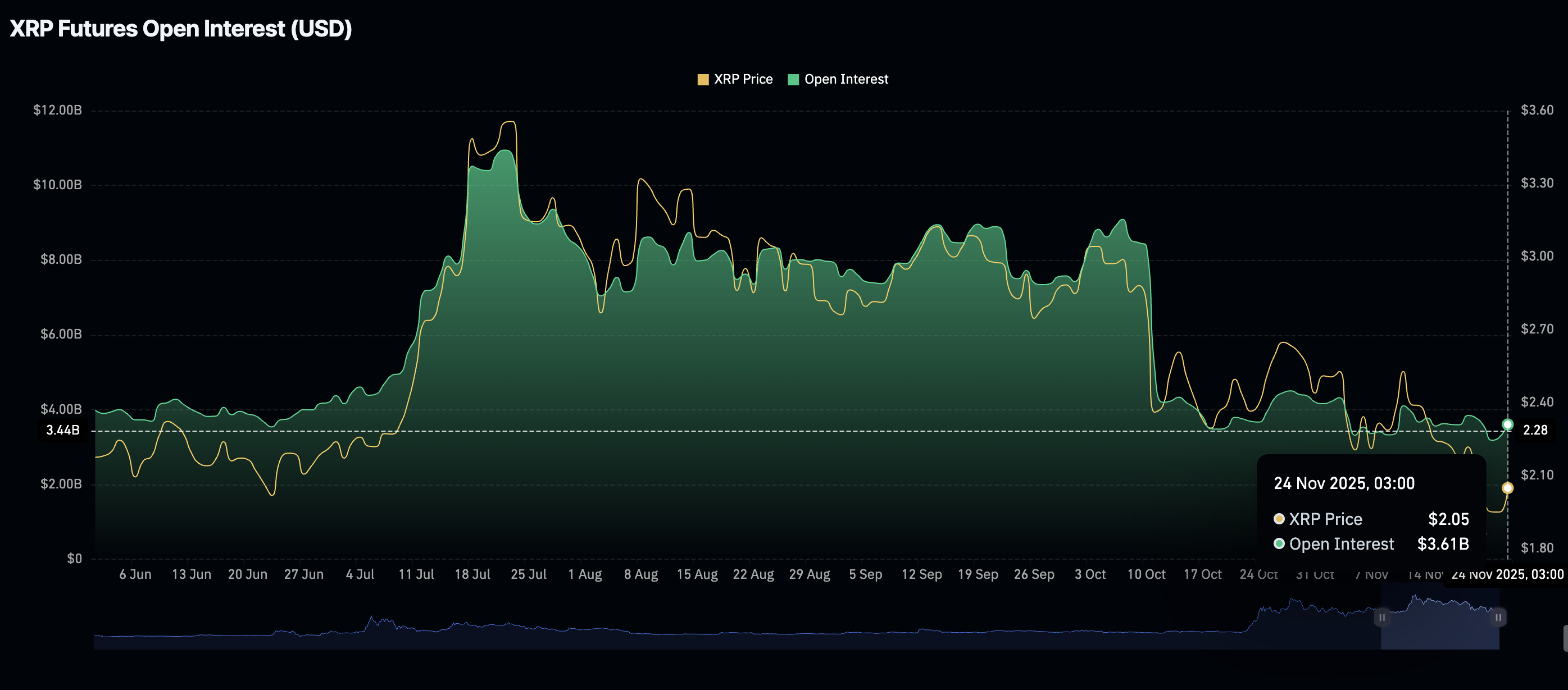

- XRP derivatives market shows signs of stability, with futures Open Interest staying between $3 billion and $4 billion.

Ripple (XRP) is trading at around $2.06 at the time of writing on Monday, as buyers push to regain control despite a generally bearish cryptocurrency market.

The cross-border remittance token opened Monday’s trading at $2.05, building on the increase from $1.95, which marked Sunday’s low. Steady demand for XRP Exchange Traded Funds (ETFs) supports positive market sentiment around the token, increasing the odds of an uptrend forming above $2.00.

XRP eyes breakout as ETF inflows extend

US-listed XRP ETFs had a bullish debut, recording nearly $180 billion in inflows last week and $243 million the week before. SoSoValue data shows the crypto products accessed directly via stock exchanges, with a cumulative total net inflow volume of approximately $423 million and net assets of $384 million on November 21.

Canary Capital’s XRPC ETF posted approximately $619,000 in net inflow on Friday, while Bitwise’s XRP ETF was the best-performing with $11 million.

Steady ETF inflows reinforce positive sentiment around XRP, which could bolster risk appetite and increase the chances of a steady recovery above $2.00 in the short to medium term.

XRP flaunts a weak but stable derivatives market, with the futures Open Interest (OI) averaging between $3 billion and $4 billion over the past two weeks.

CoinGlass data shows OI, which tracks the notional value of outstanding futures contracts, averaging $3.61 billion on Monday, up from $3.28 billion on the previous day. OI must steadily rise to support risk-on sentiment, as investors increase their risk exposure.

Chart of the day: XRP holds key support

XRP is trading at around $2.06 at the time of writing on Monday, supported by an uptrending Relative Strength Index (RSI) on the daily chart. The RSI at 39 and rising indicates that bullish momentum is increasing, as traders position themselves above the critical $2.00 level.

A daily close above $2.00 would back bullish sentiment and increase the chances of an extended uptrend above resistance at $2.24, which was tested on Wednesday. Further action above the same hurdle could pave the way for gains targeting the 50-day Exponential Moving Average (EMA) at $2.38 and the 200-day EMA at $2.52.

Still, the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since November 16, encouraging investors to reduce their risk exposure.

The red histogram bars below the zero line indicate that bearish momentum remains apparent. If short-term support at $2.00 gives way, the path of least resistance will remain downward, as sellers target a retest of support at $1.82.

Traders will watch for a buy signal, which occurs when the blue MACD line crosses above the red signal line, indicating a bullish shift.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.