Bitcoin ETF Outflows Persist: Whales Feast and Retail Vanishes

The US Bitcoin exchange-traded funds (ETFs) keep flowing out as the crypto Fear and Greed Index dropped to 11, reflecting extreme fear.

Retail investors have stayed out of the market during this downturn, while data shows that whales are the primary buyers amid the selloff.

ETF Outflows and Retail Absence Signal Market Shift

US Bitcoin spot ETFs have experienced persistent capital flight, with holdings declining from 441,000 BTC on October 10 to about 271,000 BTC by mid-November. This marks a sharp reversal from institutional support earlier this year.

According to Farside Investors data, Bitcoin ETFs have now logged four consecutive days of outflows, extending the defensive tone that has dominated the month. Earlier in the period, redemptions peaked at well over $800 million in a single day, highlighting how sharply sentiment had soured. The latest figure shows a much smaller outflow of around $60 million, but still signals that buyers remain cautious and momentum has yet to turn.

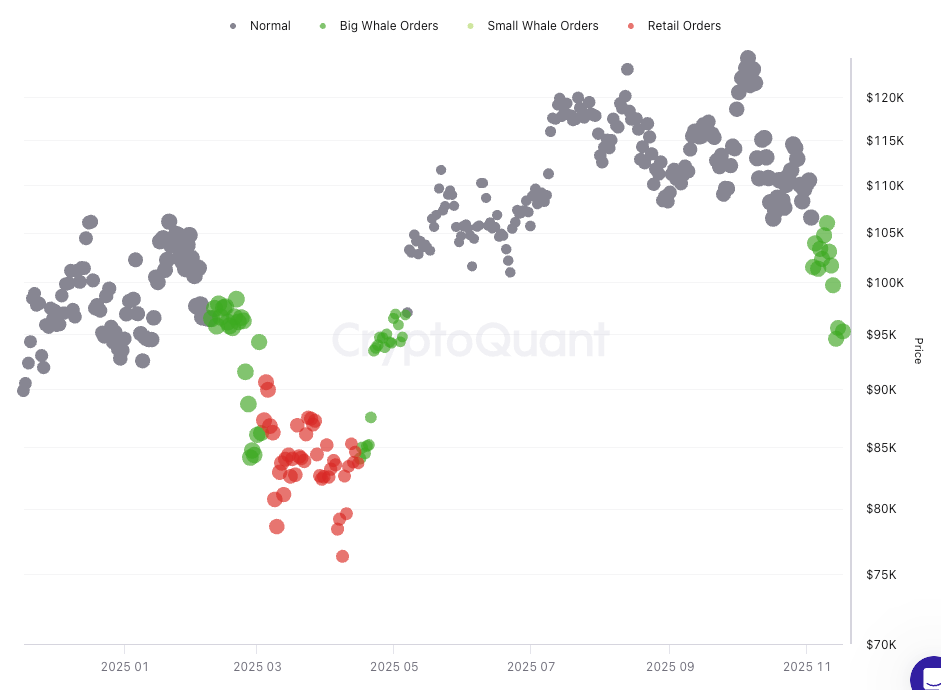

Spot average order size. Source: CryptoQuant

Spot average order size. Source: CryptoQuant

Spot average order size metrics show that retail traders are not returning, even as Bitcoin has dropped almost 27% from its October 6 all-time high of $126,272.76. Exchange data from Binance, Coinbase, Kraken, and OKX indicates larger order sizes, highlighting whale activity rather than small-scale retail buyers.

The Fear and Greed Index plummeted to 11, underscoring extreme market fear. Historically, such levels correlate with market bottoms, but retail investors remain cautious and reluctant to engage. In the morning hours in Asia, Bitcoin traded at somewhere between $91,000 and $92,000, down more than 3% in 24 hours and 13-14% for the week. Ethereum briefly slipped below $3,000, and Solana was at around $130, declining over 5% in 24 hours and 21% over the week.

Whale Accumulation amid Market Weakness

As retail investors sit on the sidelines, large players continue to accumulate aggressively. A whale purchased 10,275 ETH at $3,032 for $31.16 million USDT within 24 hours before November 17, based on on-chain monitoring by OnchainLens. Between November 12 and November 17, this address acquired a total of 13,612 ETH for $41.89 million USDT, at an average price of $3,077.

Nansen transaction log showing whale’s $31.16M ETH purchase over 24 hours. Source: OnchainLens

Nansen transaction log showing whale’s $31.16M ETH purchase over 24 hours. Source: OnchainLens

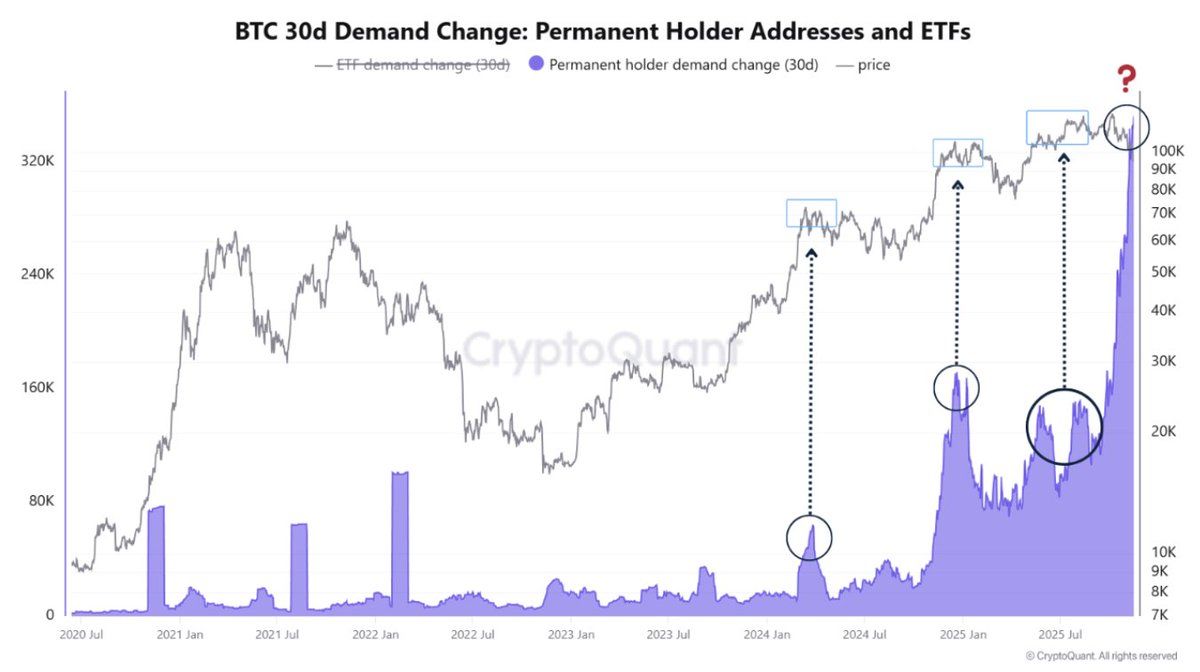

Permanent Bitcoin holders—wallets that have never recorded outflows—are supporting what CryptoQuant describes as the largest accumulation surge in recent selloffs. Permanent holder demand rose from 159,000 BTC to 345,000 BTC, marking the biggest absorption in several cycles. This substantial accumulation occurred even as the price fell, highlighting a stark divergence between long-term and short-term market behaviors.

This divergence between whale accumulation and retail caution highlights a shift in market dynamics. However, CryptoQuant CEO Ki Young Ju notes that the current dip involves long-term holders rotating coins among themselves rather than new money entering the market. This suggests the drawdown does not mark the start of a new bear market, though current conditions may not present the classic buy-the-dip moment sought by retail.

30-day permanent holder demand showing record accumulation during price selloff. Source: CryptoQuant

30-day permanent holder demand showing record accumulation during price selloff. Source: CryptoQuant

Structural Changes and Institutional Dynamics

This selloff differs from past crypto winters. Major financial institutions, including JPMorgan, now accept Bitcoin as collateral for loans despite its price weakness. This evolving infrastructure offers more support compared to previous bearish cycles. Deeper liquidity is available, helping to steady the market.

Technical signals remain bearish for now. Bitcoin has dropped more than 20% from its record high; recently, its 50-day moving average fell below its 200-day moving average—a “death cross.”

Macroeconomic factors add more pressure. The Federal Reserve delayed interest rate cuts, and global central banks maintain tightening. Falling Treasury liquidity creates headwinds for risk assets. Still, analysts see longer-term macro trends—such as high sovereign debt and ongoing geopolitical tensions—as supportive for Bitcoin in the future.

Mining firms are adjusting accordingly. Frank Holmes, executive chairman of HIVE Digital Technologies, emphasized that his company will continue mining and holding Bitcoin, unlike competitors who are pivoting to high-performance computing. He contends that building Tier 3 data centers for GPU work is both costly and complex, so his mine-and-hold strategy will continue despite volatility.