Cardano Price Forecast: ADA stabilizes at key support with signs of on-chain recovery

- Cardano price hovers around the daily support at $0.45 on Tuesday, after falling nearly 4% the previous day.

- On-chain and derivatives data support a possible rebound with an undervalued MVRV ratio and funding rates turning positive.

- The technical outlook favors a recovery, provided ADA continues to defend the $0.45 support level.

Cardano (ADA) is stabilizing around the daily support level of $0.45 at the time of writing on Tuesday, after correcting nearly 4% the previous day. Despite the recent dip, on-chain and derivatives indicators are showing early signs of recovery, with the Market Value to Realized Value (MVRV) ratio undervalued and funding rates turning positive. On the technical side, if price action holds above the key $0.45 support level, ADA could be positioned for a short-term rebound.

On-chain metrics suggest ADA may be undervalued at current levels

Santiment’s Market Value to Realized Value (MVRV) metric is used to identify whether a token is undervalued or overvalued in a given time frame. The 30-day and 7-day MVRV ratios for Cardano read negative 20.47% and 13.44% respectively. This means that ADA is currently undervalued.

These negative MVRV values could be interpreted as a buy signal, likely increasing buying pressure on the token across crypto exchanges. Historically, when MVRV has dropped to similar levels, the ADA price has often recovered.

[09-1763438714456-1763438714469.04.30, 18 Nov, 2025].png)

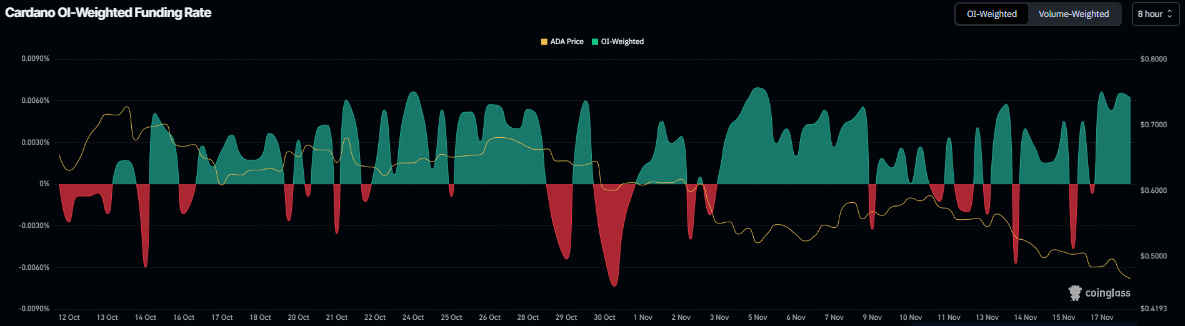

Apart from the undervalued conditions, the derivatives data also support a recovery rally for Cardano. Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of ADA will slide further is lower than those anticipating a price increase.

The metric has flipped to a positive rate, standing at 0.0060% on Tuesday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, Cardano’s price has rallied sharply.

Cardano Price Forecast: ADA finds support around a key level

Cardano's price broke below the key support at $0.49 on Sunday and declined nearly 8% until the next day. At the time of writing on Tuesday, ADA hovers above the daily support at $0.45.

If the $0.45 level continues to hold as support, it could extend the rally toward the next resistance at $0.49. A successful close above this level could extend additional gains toward the 50-day EMA at $0.62.

The Relative Strength Index (RSI) is hovering around 28, deep in oversold territory, indicating that bearish momentum may be fading. For the recovery rally to be sustained, the RSI must move above its neutral level.

On the other hand, if ADA closes below $0.45, it could extend the decline toward the key psychological level at $0.40.