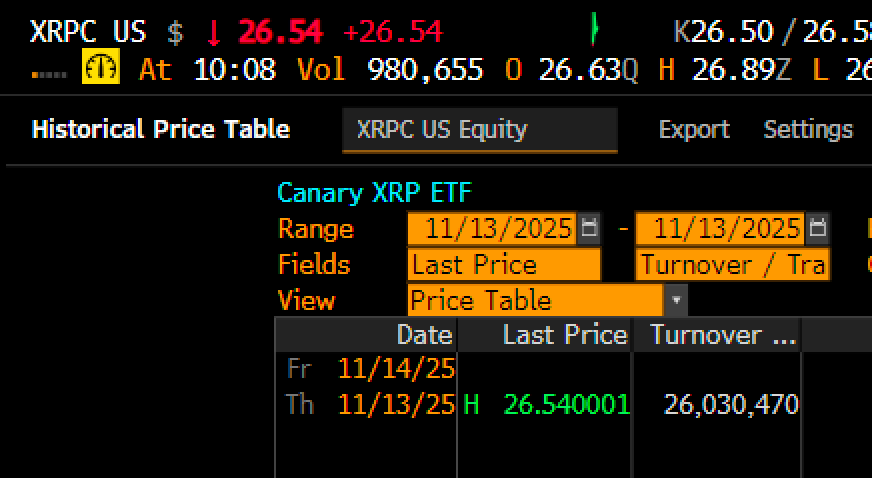

XRPC smashes expectations as trading volume hits $26M in 30 minutes

Trading volume for XRPC exploded to $26 million within just 30 minutes of hitting the Nasdaq on Thursday, flying past the initial $17 million forecast traders had set earlier in the week.

The ETF went live as the U.S. market opened, after being certified the previous evening by Nasdaq under the SEC’s 8(a) automatic-effectiveness rule, based on recent market data and regulatory filings.

The fund, launched by Canary Capital, is the first pure spot XRP ETF in the U.S. It tracks the XRP Ledger, which was built specifically for fast and cheap cross-border crypto transfers.

Futures markets showed early positioning before news broke

Steven McClurg, the CEO of Canary Capital’s fund division, said the firm was ready to move with the ETF once the green light was in. “We are excited to go effective with the first single-token spot XRP ETF,” Steven said, crediting the SEC’s leadership for speeding up the process.

But while Steven and his team were finalizing paperwork, futures traders were already moving. Woominkyu, an analyst with CryptoQuant, said that whale-sized futures orders started building before the ETF was even public.

“Before the XRP Spot ETF announcement, futures data showed a clear rise in whale-sized orders, indicating early positioning while price was still compressed,” Woominkyu said.

Once the news dropped, everything flipped. Retail-sized orders only appeared after the ETF news, though this pattern (whales first, retail last) is actually pretty common in crypto and often means a change in sentiment is coming.

The effect showed up quickly. Over 21,000 new XRP wallets were created in under 48 hours, the fastest wallet growth seen in eight months. At the same time, large holders didn’t wait around.

Wallets holding between 1 to 10 million XRP dumped about 90 million tokens into the market ahead of the ETF’s launch window, pushing short-term supply higher just as retail money started piling in.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.