Ethereum Price Forecast: ETH rebounds as SOPR, supply in profit reset

- Ethereum regains bullish momentum above $3,300, signaling a potential shift to risk-on sentiment.

- Ethereum SOPR metric drops below 1.00, implying that traders are selling and realizing losses.

- Ethereum's supply in profit has declined by 32% from its October peak of 78 million ETH.

Ethereum (ETH) is trading upward, building on the short-term support at $3,300 at the time of writing on Wednesday, following two days of steady declines in the broader cryptocurrency market.

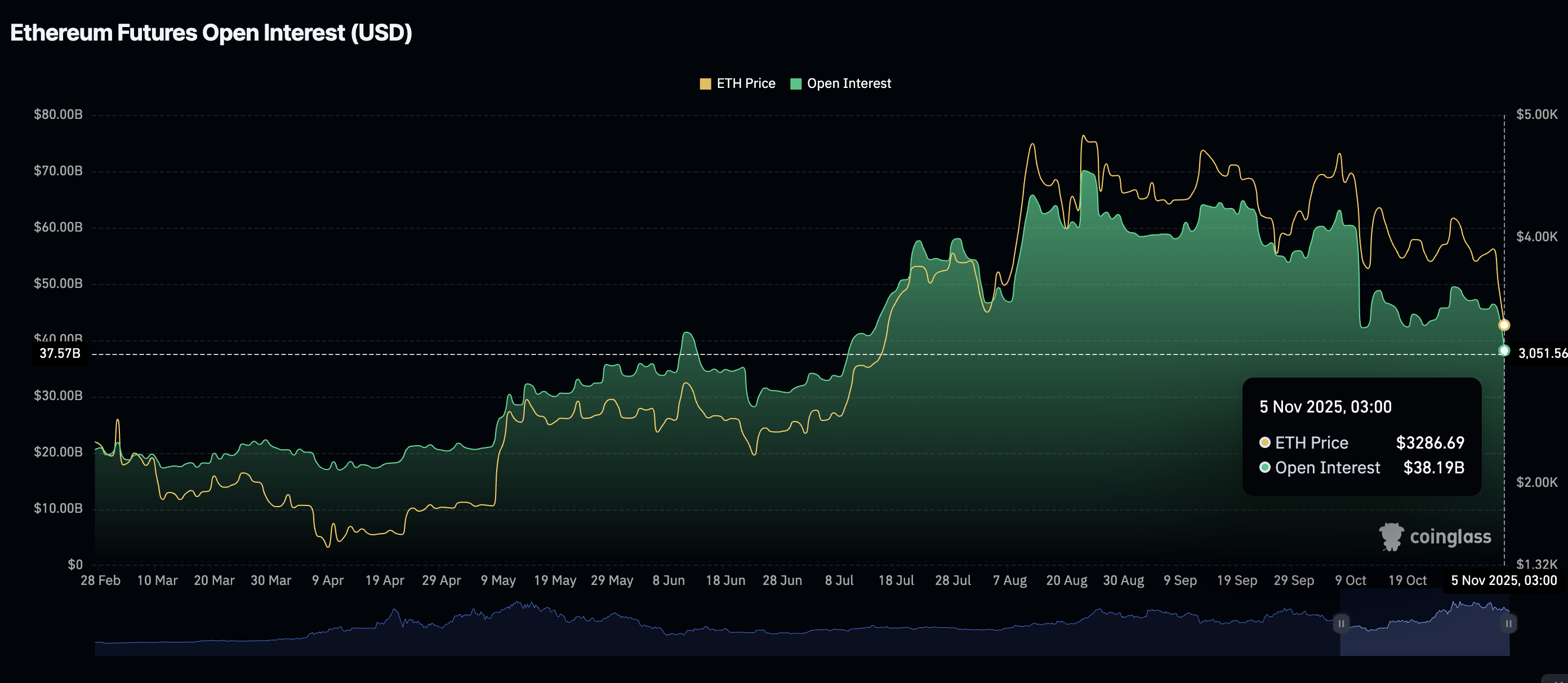

Despite the knee-jerk recovery from ETH's weekly low of $3,057, retail demand remains significantly suppressed. CoinGlass data shows the futures Open Interest (OI) averaging $38 billion, down 19% from approximately $47 billion on Saturday and 47% from its historical peak of $70 billion reached in August.

The steady decline mirrors the risk-off sentiment surrounding Ethereum, prompting traders to retreat into the sidelines until stability returns.

Ethereum bulls eye recovery amid bearish exhaustion

Ethereum has consistently faced a cascade of losses since its record high of $4,956 in late August. Profit-taking, macroeconomic uncertainty and a lack of price catalysts are among the factors that continue to suppress recovery, leaving ETH vulnerable to headwinds.

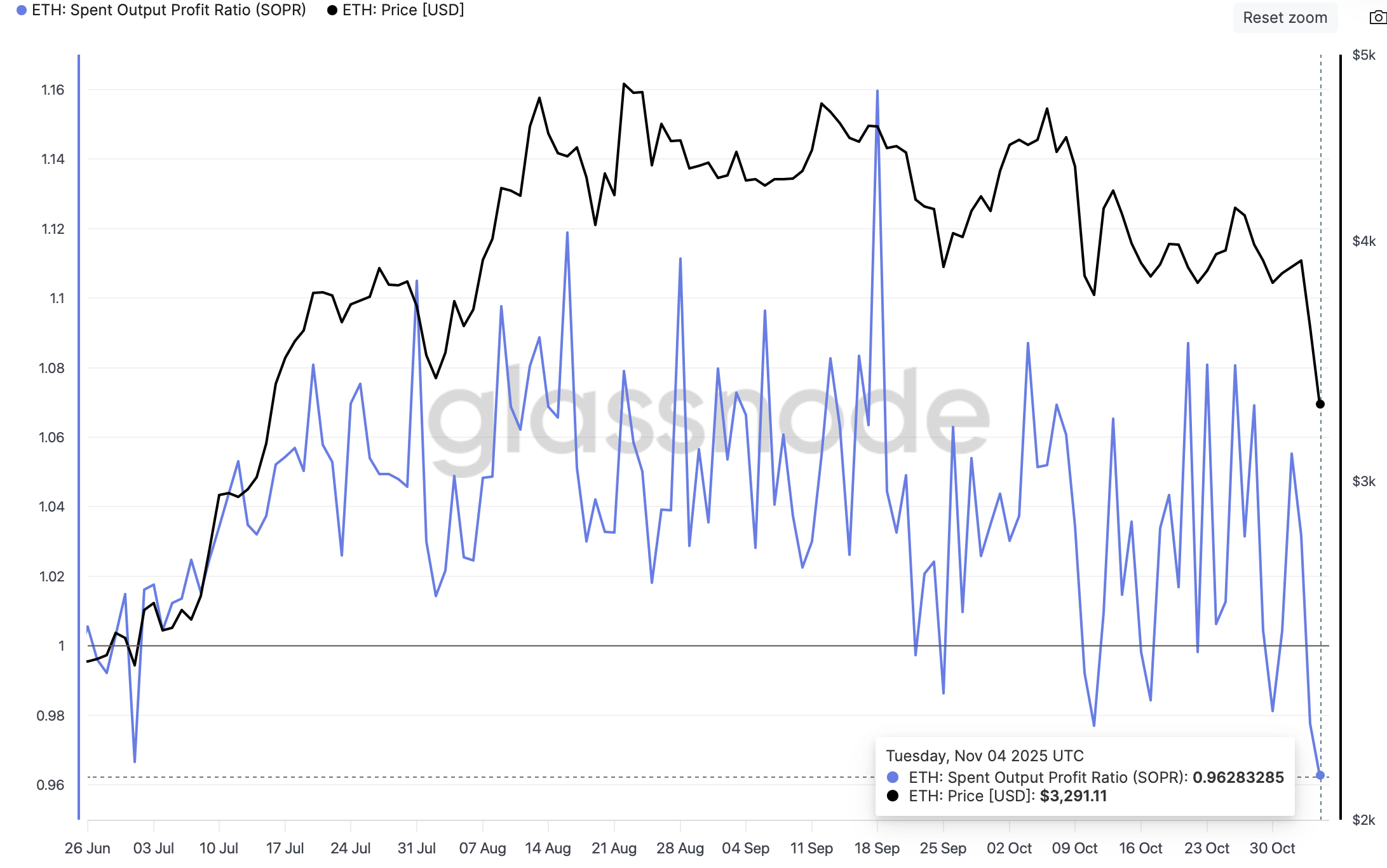

According to Glassnode's data, the Spent Output Profit Ratio (SOPR) metric – which measures the ratio of the realized value in US Dollar (USD) at the time of spending to the cost basis in USD at the time of purchase for all ETH outputs – has declined to 0.97 as of Tuesday from 1.08 in early October, coinciding with the prolonged price correction. This suggests investors are selling amid panic and extreme fear, realizing losses.

However, a SOPR resetting below 1.00 implies potential exhaustion of weak hands, which could present fresh buying opportunities as selling pressure eases. Ideally, investors buy when the SOPR is below 1.00 and sell when it rises above that threshold, due to the risk of overheating.

Glassnode also highlights a significant drop in Ethereum's supply in profit from approximately 78 million ETH to 53 million ETH recorded on October 6. This represents a 32% decrease in supply in profit, subsequently reducing potential selling pressure and predisposing ETH to a recovery in the short to medium term.

Technical outlook: Ethereum bulls seek to regain control

Ethereum is trading above $3,300 at the time of writing on Wednesday, bolstered by macro news after China suspended reciprocal tariffs on some United States (US) agricultural goods.

The Relative Strength Index (RSI), which is currently at 32, up from slightly oversold levels, indicates that bearish momentum is decreasing. Higher RSI readings would tighten the bullish grip, increasing the odds of Ethereum reclaiming the 200-day Exponential Moving Average (EMA) at $3,601.

Still, traders should be cautiously optimistic as the Moving Average Convergence Divergence (MACD) indicator has upheld a sell signal since Monday. Investors may keep leaning bearishly and deleveraging as long as the blue MACD line holds above the red signal line. Key areas of interest for traders if selling pressure increases are $3,057, tested as support on Tuesday and $2,880, tested as resistance in June.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.