Bybit users see lower BTC and ETH balances in latest audit

Cryptocurrency exchange Bybit released its 27th Proof of Reserves report, revealing declining Bitcoin and Ethereum holdings among user accounts.

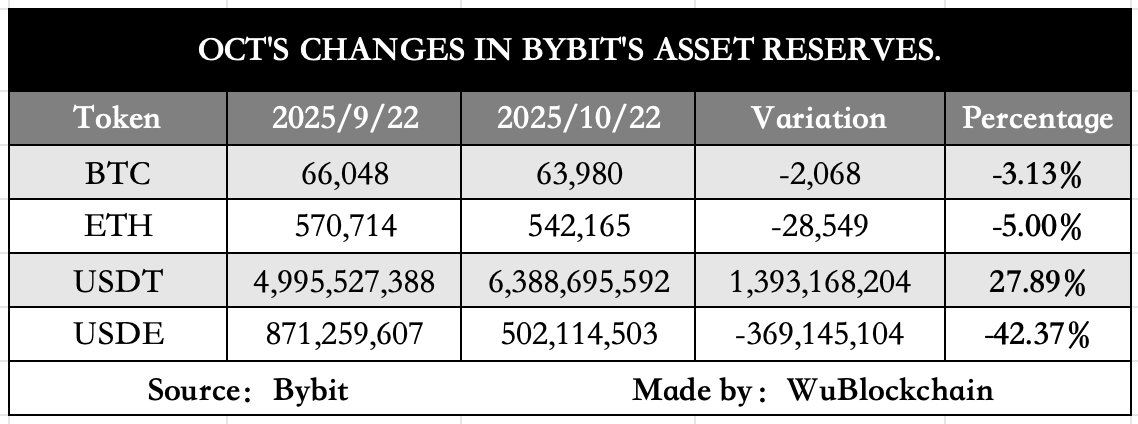

Bitcoin balances stood at approximately 64,000 BTC and are a 3.13% decrease from the previous September 22 snapshot. Ethereum holdings fell 5% to around 542,200 ETH. The declines occurred while USDT balances surged 27.89% to approximately 6.389 billion tokens. The proof of reserves snapshot provides transparency into the exchange’s asset backing. Bybit maintains these monthly reports to show sufficient reserves backing all customer deposits.

Bitcoin holdings decline 3.13% in October

The Bybit user Bitcoin balance fell from 66,048 BTC on September 22 to 63,980 BTC on October 22. The drop of 2,068 BTC is notable considering the price of Bitcoin at the moment. This decrease in funds held may indicate users withdrew Bitcoin, or rotated into other assets during the past month. The exchange kept its reserve ratio for Bitcoin at 103%, meaning the wallet assets were 3% above user deposits.

The Bitcoin reserve ratio calculation shows 61,976 BTC in user assets versus 63,980 BTC in wallet assets. Monthly Bitcoin outflows from exchanges typically indicate bullish sentiment by users as they move their holdings to self-custody wallets.

Ethereum reserves fell by a larger percentage than Bitcoin, slipping from 570,714 ETH to 542,165 ETH. The 28,549 ETH decline is the equivalent of roughly $105 million at today’s prices. The 5% cut surpassed Bitcoin’s decline of 3.13%.

User assets totaled 532,033 ETH while wallet assets contained 542,165 ETH, producing a 101% reserve ratio. The reserve ratio remains healthy but lower than Bitcoin’s 103% backing.

USDT’s holdings surge 27.89% as users seek stability

While Bitcoin and Ethereum balances declined, USDT holdings rose from 4.995 billion to 6.389 billion tokens. The increase of 1.393 billion USDT equates to a 27.89% gain, the largest percentage change among major assets in the snapshot.

The user USDT assets stood at 5.802 billion while wallet holdings reached 6.389 billion, producing a 110% reserve ratio. Stablecoin reserve ratios above 100% instill confidence in the capability of redemption.

Ethena’s USDE stablecoin declined the most in the October snapshot. Holdings fell from 871.26 million to 502.11 million tokens, or by 369.15 million USDE. The decline of 42.37% is substantially larger compared to the declines witnessed among the other major assets.

The total user assets of USDE stood at 496.25 million with wallet holdings totaling 502.11 million to maintain a 101% reserve ratio. Wallet assets on Bybit still exceeded user deposits for USDE.

Reserve ratios show healthy backing across assets

The October snapshot revealed reserve ratios exceeding 100% for all major cryptocurrencies. Bitcoin maintained 103% backing, Ethereum showed 101%, while most other assets ranged from 100% to 110%.

Several tokens displayed higher reserve ratios. USDC reached 153%, UNI showed 117%, and SHRAP maintained 109%. These elevated ratios shows substantial excess reserves beyond customer requirements. PEPE, COMP, CRV, DOGE, and DYDX each maintained 102% reserve ratios.

Other tokens like BLUR, OP, DOT, POL, RENDER, S, SAND, SHIB, WLD, and USDE showed exactly 100% or 101% reserve ratios. Stablecoin reserve ratios show particularly strong backing in the October snapshot. USDC led with 153% backing, showing Bybit wallet holdings of 920.25 million versus user assets of 599.38 million. USDT maintained 110% backing with 6.389 billion in wallet assets versus 5.802 billion in user deposits. USDE showed 101% backing at 502.11 million wallet assets.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.