Bitcoin Cash Price Prediction: BCH aims for monthly high as Uptober spirit returns

- Bitcoin Cash holds above $550 after a 10% jump on Sunday.

- On-chain data points to a steady rise in network activity and a rebound in BCH demand.

- Derivatives data indicate a rise in retail and whale demand, capitalizing on negative funding rates.

Bitcoin Cash (BCH) trades above $550 at press time on Monday, holding the 10% gains from Sunday as the market anticipates a positive week to end this month as an “Uptober.” A rise in active addresses, coupled with the interest of large-wallet traders in the derivatives market, flashes upside potential for Bitcoin Cash.

Demand surge boosts BCH supply in profit

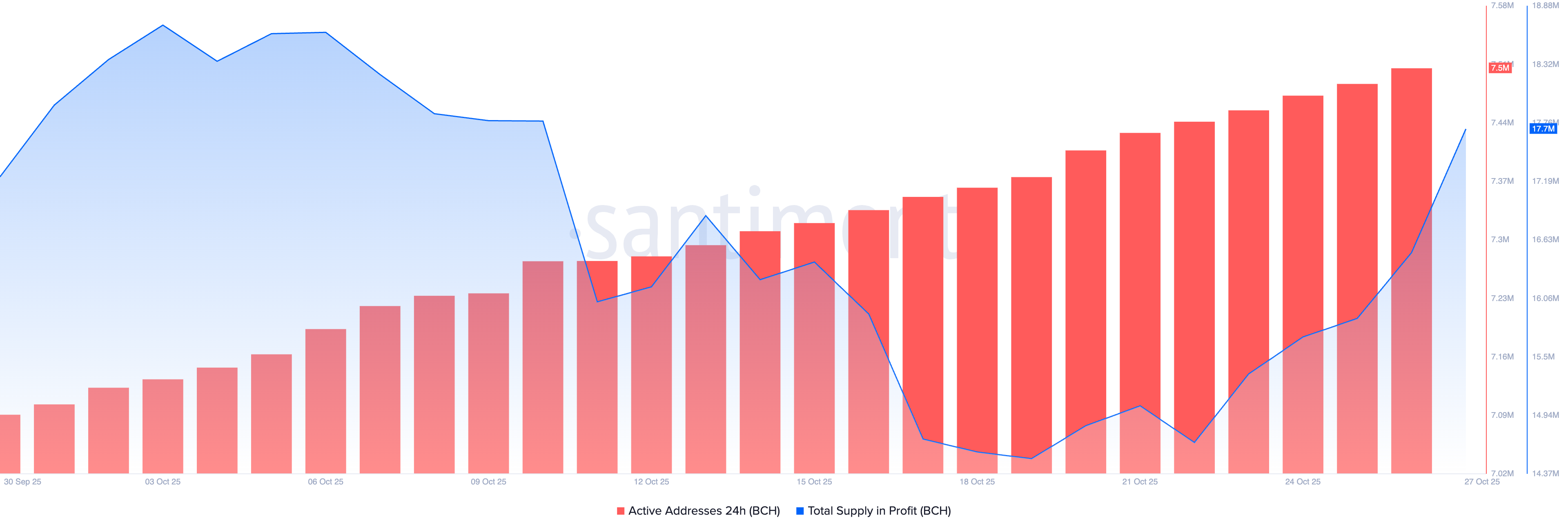

The demand for Bitcoin Cash’s native token, BCH, returns amid consistent network activity. Santiment data shows that the number of active addresses on Bitcoin Cash has grown every day this month, reaching 7.5 million on Sunday, indicating a stable rise in network users.

On the other hand, the supply in profit rebounds to 17.7 million BCH tokens from 14.67 million on Wednesday, indicating a significant increase in demand.

Bitcoin Cash active addresses and supply in profit. Source: Santiment.

Overall, the rise in network users and their demand for BCH could further drive the market price higher.

Whales capitalize on negative funding rates

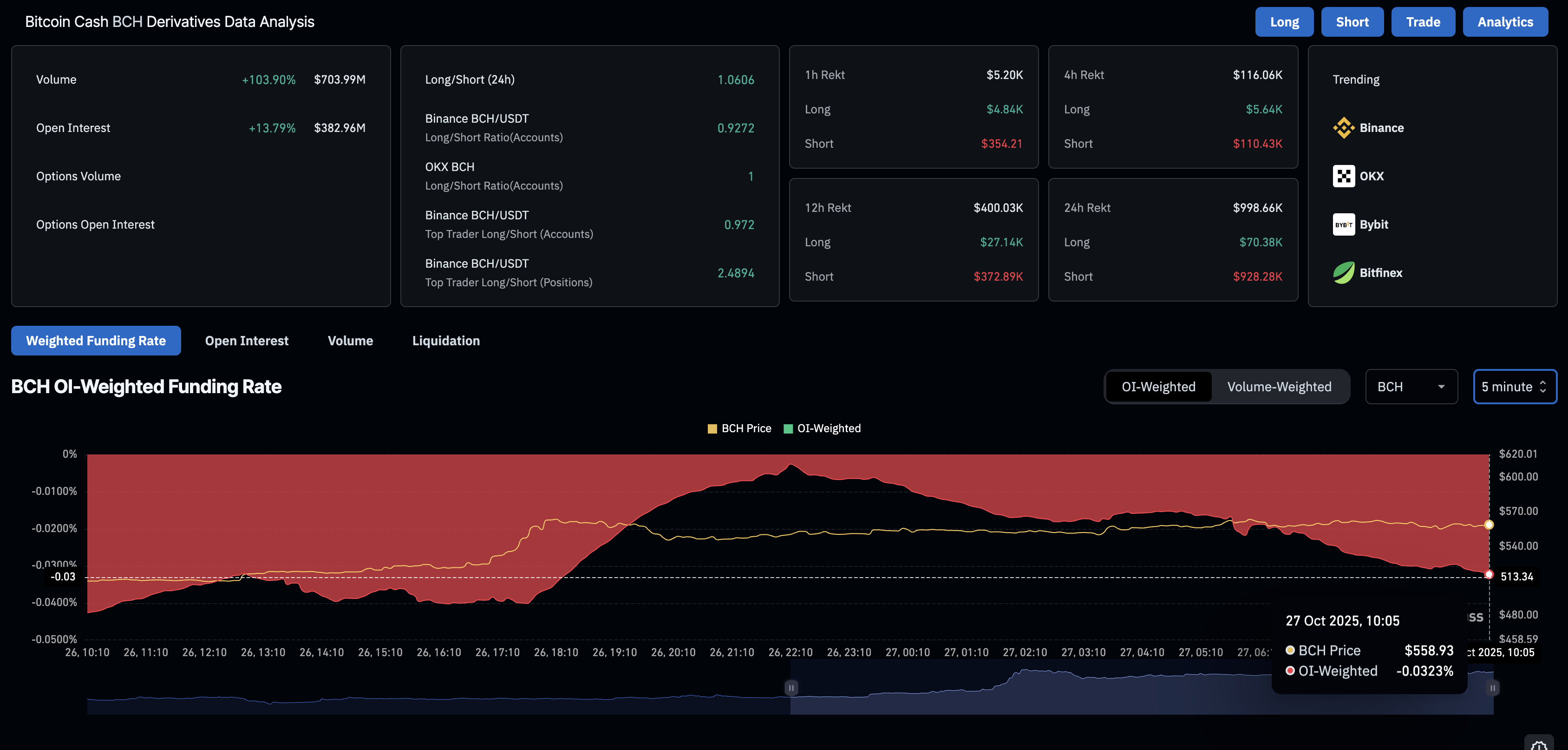

The derivatives market sees a surge in demand for Bitcoin Cash as traders capitalize on the sudden shift in market sentiment. CryptoQuant data indicates that the deep-pocket traders, popularly known as whales, are placing large orders in Bitcoin Cash futures. Typically, an increase in whale activity in the futures market foreshadows a price rally.

BCH futures average order size. Source: CryptoQuant.

In line with high demand, CoinGlass data shows a 13.8% increase in BCH futures Open Interest (OI) over the last 24 hours, bringing it to $382.96 million. An increase in futures OI suggests risk-on sentiment among traders as the notional value of outstanding long positions increases.

Meanwhile, the OI-weighted funding rate is at -0.0323%, down from -0.0026% on Sunday, indicating that bears are paying a premium to hold short positions against the demand hike. This premium from bears provides an incentive for bullish-aligned traders, which could further boost demand.

BCH derivatives data. Source: CoinGlass.

Bitcoin Cash recovery eyes key resistance breakout

Bitcoin Cash takes a breather near the $560 mark after the 10% gains registered on Sunday. At the time of writing, BCH trades broadly stable between the 78.6% and 61.8% Fibonacci retracement levels at $573 and $542, respectively.

As the whales' interest grows, a successful push above $573 could extend the BCH rally to the $615 peak from October 3.

The Moving Average Convergence Divergence (MACD) trends higher on the daily chart, with its signal line rising as green histogram bars emerge from the zero line, indicating a surge in bullish momentum.

Meanwhile, the Relative Strength Index (RSI) is at 82, in extremely overbought territory, signaling unsustainable buying pressure and thus risking a bearish turnaround as buyers could shift to book profits.

BCH/USDT daily price chart.

In case that happens, the key support floor for Bitcoin Cash remains at $542, followed by the 200-day Exponential Moving Average at $531.