Ripple Price Forecast: XRP offers bearish signals amid low retail interest

- XRP extends losses for the second day in a row as bears tighten their grip on Wednesday.

- Retail interest in XRP fails to sustain momentum, with the Open Interest remaining below $4 billion.

- Declining exchange reserves indicate reduced potential selling pressure, bolstering XRP’s bullish outlook.

Ripple (XRP) is trading bearishly and slightly below $2.40 at the time of writing on Wednesday. The cross-border money remittance token was rejected at $2.55 on Monday, encouraging early profit booking.

Meanwhile, the odds of the downtrend extending this week remain significantly high, especially with low demand characterizing the derivatives market.

XRP wobbles as risk-off sentiment persists

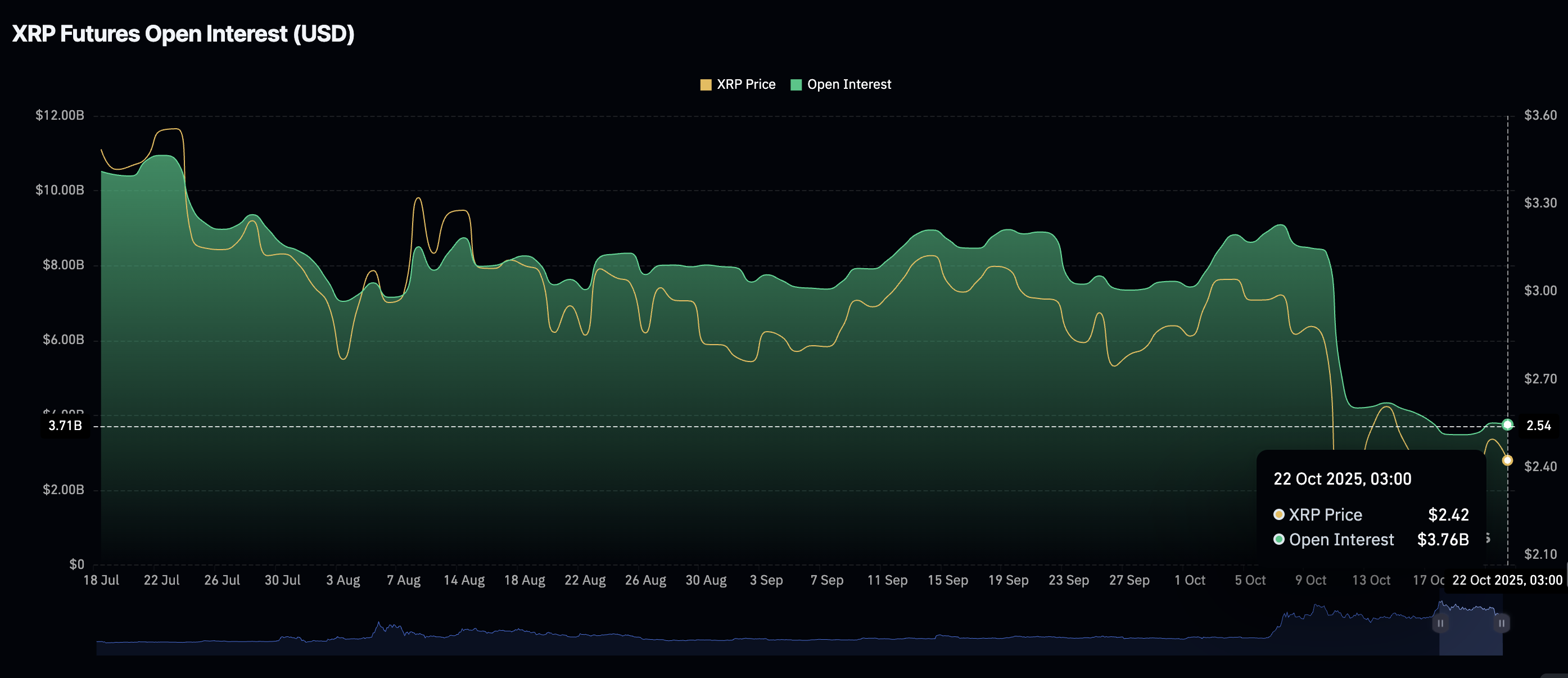

The XRP derivatives market is stable, as evidenced by the futures Open Interest (OI) averaging $3.76 billion, down from approximately $8.36 billion on October 10. Despite the relative stability in the OI, overhead pressure remains elevated in the spot market. Sentiment in the broader cryptocurrency market has deteriorated since the largest crypto liquidation event on October 10, which saw $19 billion in assets wiped out.

The XRP OI peaked at $10.94 billion days after the price reached a historical high of $3.66 on July 18, underscoring the impact of steady retail demand. Hence, there is a need for a sustained uptrend in OI to bolster bullish momentum.

XRP Futures Open Interest | Source: CoinGlass

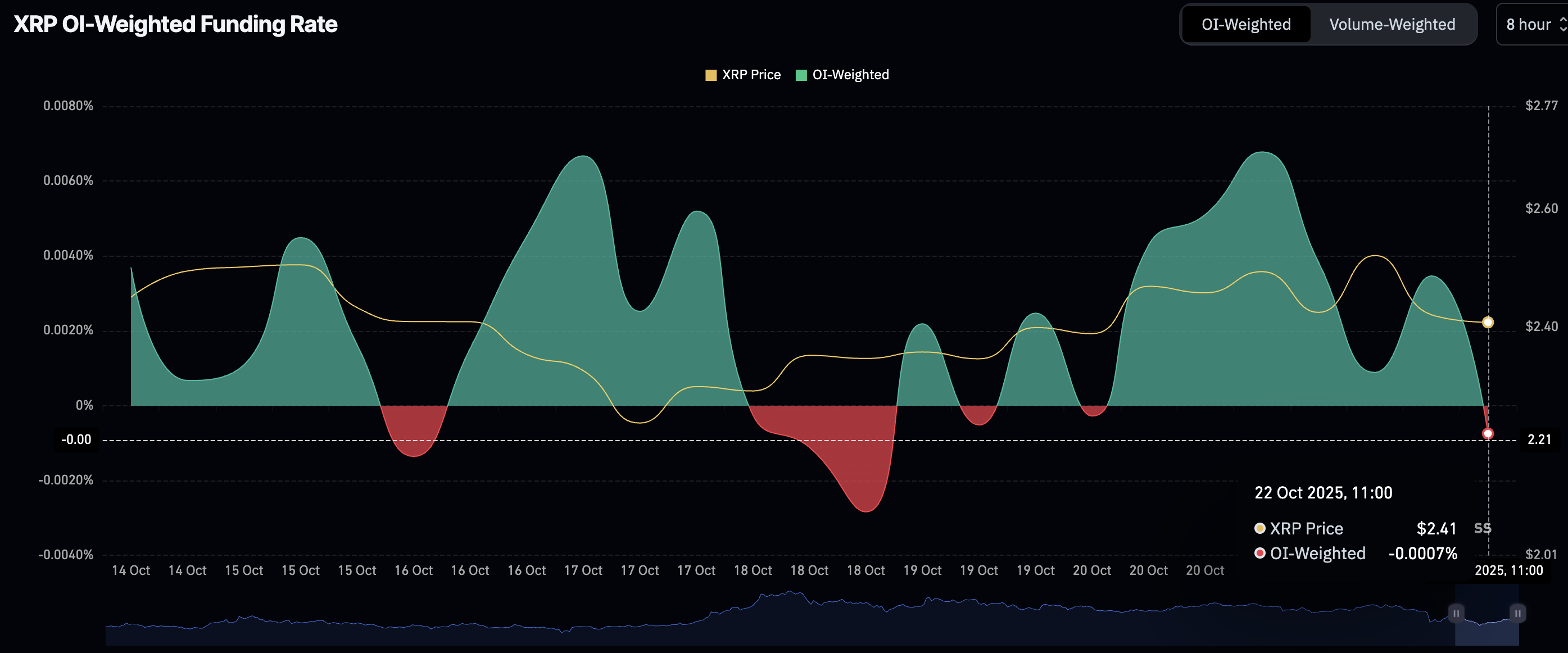

A steep drawdown in the OI weighted funding rate to -0.0007% as of writing from 0.0035% on Tuesday suggests that traders are increasingly piling into short positions, citing negative sentiment surrounding XRP.

Still, the situation is not extremely bearish, considering the OI weighted funding rate holds marginally below the mean line on Wednesday. The next sessions could provide insight into the direction retail interest may take.

XRP Futures OI Weighted Funding Rate | Source: CoinGlass

On the other hand, XRP exchange reserves on Binance have fallen by 3.36% since October 1, averaging 3.45 billion tokens. The prolonged decline suggests investors are optimistic that the price will recover in the short to medium term.

Investors often transfer their holdings to self-custody wallets when intending to hold longer. This reduces the available supply in the open market and improves XRP’s bullish outlook.

-1761144113694-1761144113695.png)

XRP Exchange Reserves - Binance | Source: CryptoQuant

Technical outlook: XRP edges lower, bears take control

XRP trades below $2.40 at the time of writing on Wednesday. The token showcases a bearish picture, as evidenced by a downward-trending Relative Strength Index (RSI) at 38.

A Death Cross pattern was established on Friday when the 50-day Exponential Moving Average (EMA) crossed and settled below the 100-day EMA. This is a bearish technical pattern that reinforces the sticky risk-off sentiment.

The Money Flow Index (MFI), tracking the amount of money entering or leaving XRP, is stable at 40 but remains in the bearish region. Traders will look out for a recovery above the midline to validate growing interest in XRP. However, a sustained decrease toward oversold territory could subdue all recovery attempts.

XRP/USDT daily chart

A daily close above the immediate resistance at $2.40 could encourage risk-on sentiment. Demand for XRP must surpass the available supply in the open market for a sustainable recovery. Key milestones include a break above the 200-day Exponential Moving Average (EMA) at $2.70 and the 50-day EMA at $2.71.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.