Ethereum Kimchi Premium Spikes To New High — Sign Of Impending Sell-Off?

The price of Ethereum appears to be recovering nicely over the weekend after a period of investor uncertainty. The “king of altcoins”, following what looked like an aggressive return above the $4,200 level earlier this week, is now lagging under the psychological $4,000 mark.

While the Ethereum price has been building some positive momentum over the past day, the shadows of the October 10 downturn still seem to be weighing on investor sentiment. A market phenomenon known as the “Kimchi Premium” suggests a few tedious weeks ahead for the second-largest cryptocurrency.

What Happened Last Time Kimchi Premium Saw A Similar Surge

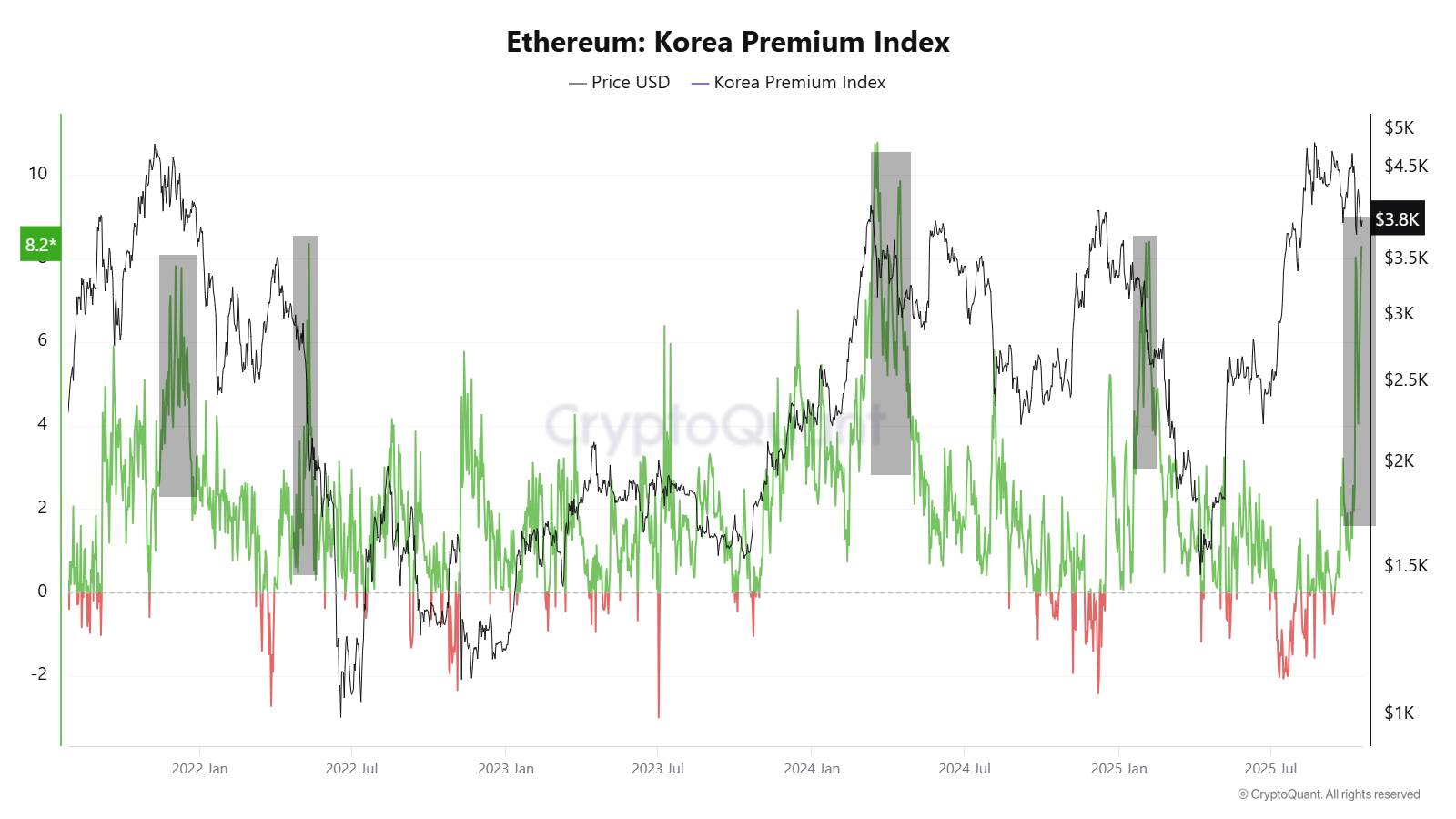

In a recent post on the social media platform X, market analyst CryptoOnchain revealed that the Kimchi Premium has been on the rise over the past weeks. This observation is based on the movement of the on-chain indicator Korea Premium Index, which measures the price difference between South Korean exchanges and other global exchanges.

This metric, or the “Kimchi Premium,” shows how much extra Korean traders are willing to pay for a particular cryptocurrency (Ethereum, in this case). When the index is positive, it means that Korean retailers are willing to pay a premium for the crypto assets. Meanwhile, a negative Korean Premium Index signals that the retailers are only willing to buy the cryptocurrency at a discount.

According to CryptoOnchain, the Korea Premium Index for Ethereum recently saw a notable surge to around 8.2%, its second-highest level this year. The market analyst noted that this level of Kimchi Premium is a troubling sign, as it historically suggests extreme retail FOMO (Fear of Missing Out) and a potential price top.

Typically, whales tend to take advantage of the price gap by selling on Korean exchanges when the Korea Premium Index is on the rise. Due to increased selling pressure, the Ethereum price now faces a greater risk of correction.

For instance, the last time ETH saw a Kimchi Premium this high was in January, coinciding with the price fall to around $1,500. With this in mind, investors might want to tread with caution, as the odds of a sustained downward trend are significantly higher.

Ethereum Price At A Glance

As of this writing, the price of ETH stands at around $3,875, reflecting no significant change in the past 24 hours. In what was expected to be a bullish period for the cryptocurrency market, “Uptober” has not particularly lived up to the expectations of investors. After a positive start to the month, the Ethereum price is currently down by almost 10%.