Bitcoin Exchange Supply Falls To 6-Year Low — A Signal To Buy The Dip?

Bitcoin’s price decline continues as the crypto market adjusts following its recent all-time high.

This has triggered renewed debate among investors: is this the ideal moment to buy the dip, or could more downside pressure still be ahead?

Bitcoin Falls But Presents Opportunity

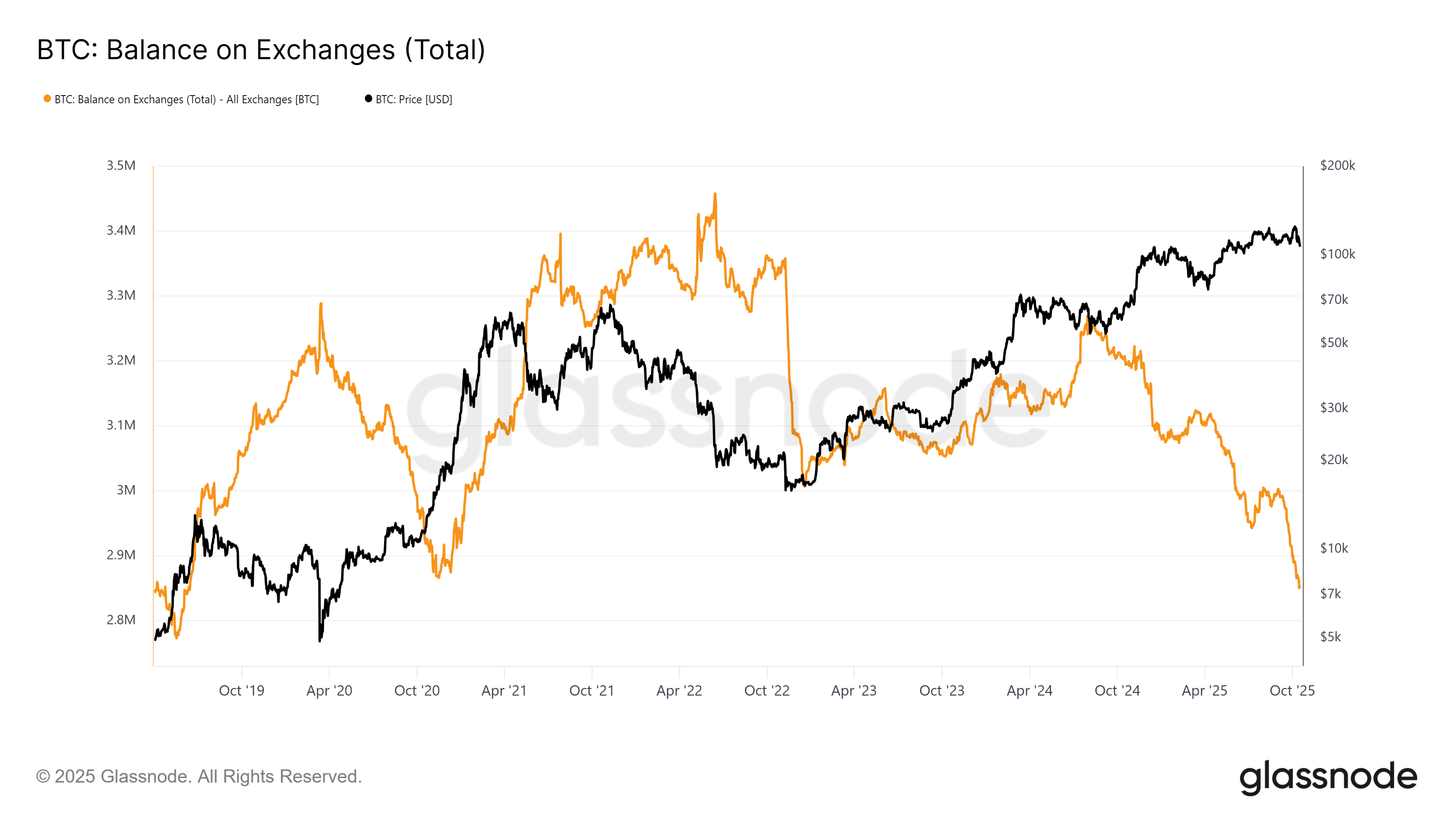

Exchange balances for Bitcoin have plunged to a six-year, four-month low, signaling growing investor accumulation. Since the start of October, roughly 45,000 BTC—worth over $4.81 billion—has been withdrawn from exchanges.

These consistent outflows reflect investors’ conviction that lower prices present buying opportunities amid broader market uncertainty.

This “buy the dip” sentiment has grown stronger as long-term holders accumulate at a steady pace. Historically, declining exchange balances correlate with reduced selling pressure, often preceding market stabilization or recovery phases.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Balance On Exchanges. Source: Glassnode

Bitcoin Balance On Exchanges. Source: Glassnode

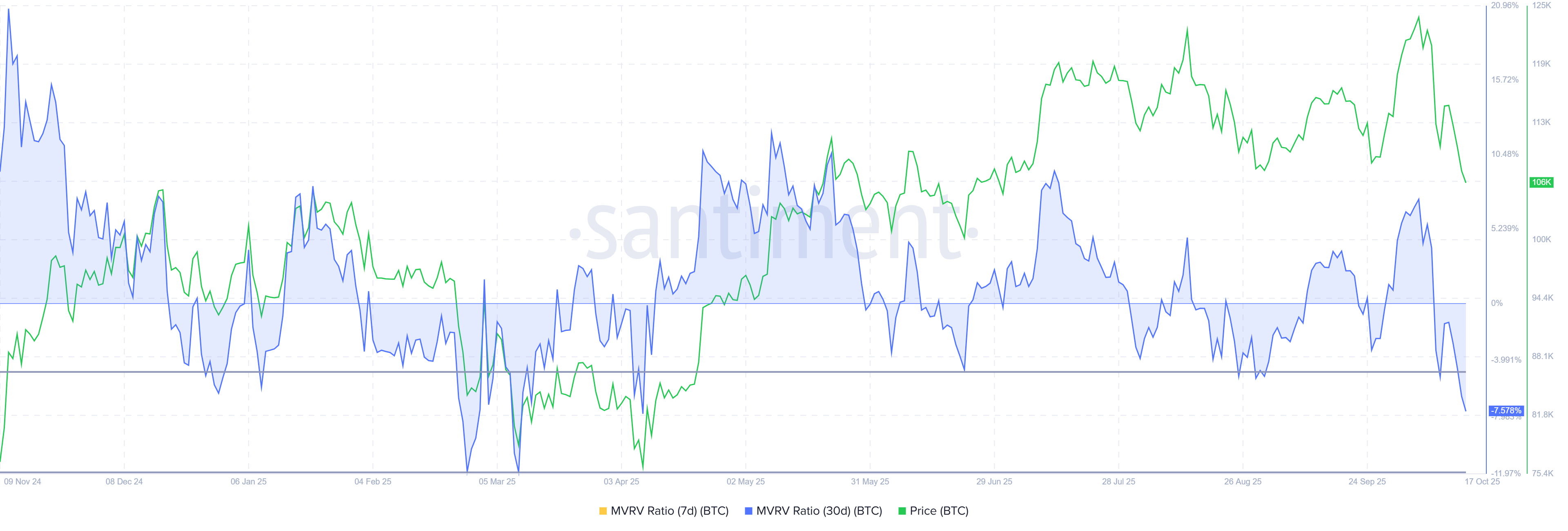

Bitcoin’s 30-day Market Value to Realized Value (MVRV) ratio currently sits at -7.56%, indicating that investors who bought within the past month are holding roughly 7.5% unrealized losses.

While negative MVRV readings often signal short-term pain, they have historically marked attractive entry zones for long-term investors.

The MVRV’s dip into the “opportunity zone” suggests Bitcoin could soon witness a trend reversal if accumulation strengthens. Each past instance of this metric entering negative territory has been followed by a notable rebound.

Bitcoin MVRV Ratio. Source: Santiment

Bitcoin MVRV Ratio. Source: Santiment

BTC Price Aims To Jump

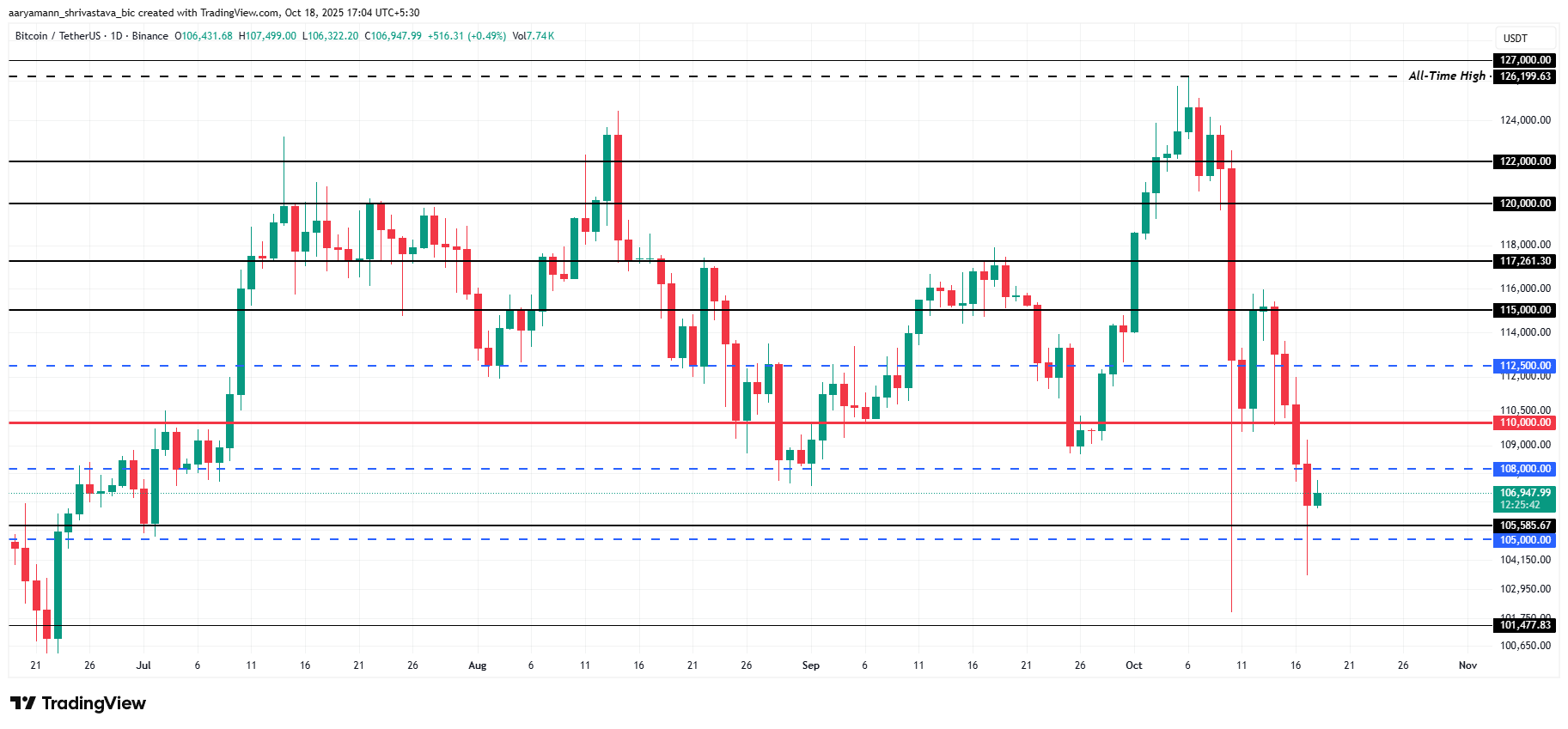

At press time, Bitcoin trades at $106,947, sitting below the critical $108,000 level that previously acted as strong support. This loss has heightened volatility across the market, but a rebound remains possible if buying momentum holds.

Should accumulation persist and investor sentiment strengthen, Bitcoin could reclaim $108,000. This would push it toward $110,000, with a potential extension to $112,500 if momentum builds further. Such a move would indicate renewed market confidence.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

Conversely, failure to maintain current levels could lead to further downside. A drop below $105,000 would expose Bitcoin to additional selling pressure. This would potentially dragging it toward $101,477 and invalidating the short-term bullish outlook.