XRP slides 4%, cedes to BNB as third-largest crypto

- XRP dropped 4% on Tuesday following increased FUD from retail investors.

- The sentiment comes as BNB flipped XRP in market cap to become the third-largest crypto asset.

- XRP could fall to the $2.71 support after declining below the 50- and 100-day SMA convergence.

XRP declined 4% on Tuesday as growing fear, uncertainty and doubt (FUD) triggered increased selling pressure for the asset. The decline was accompanied by BNB overtaking XRP to become the third-largest cryptocurrency by market capitalization.

XRP cedes third-largest crypto position to BNB

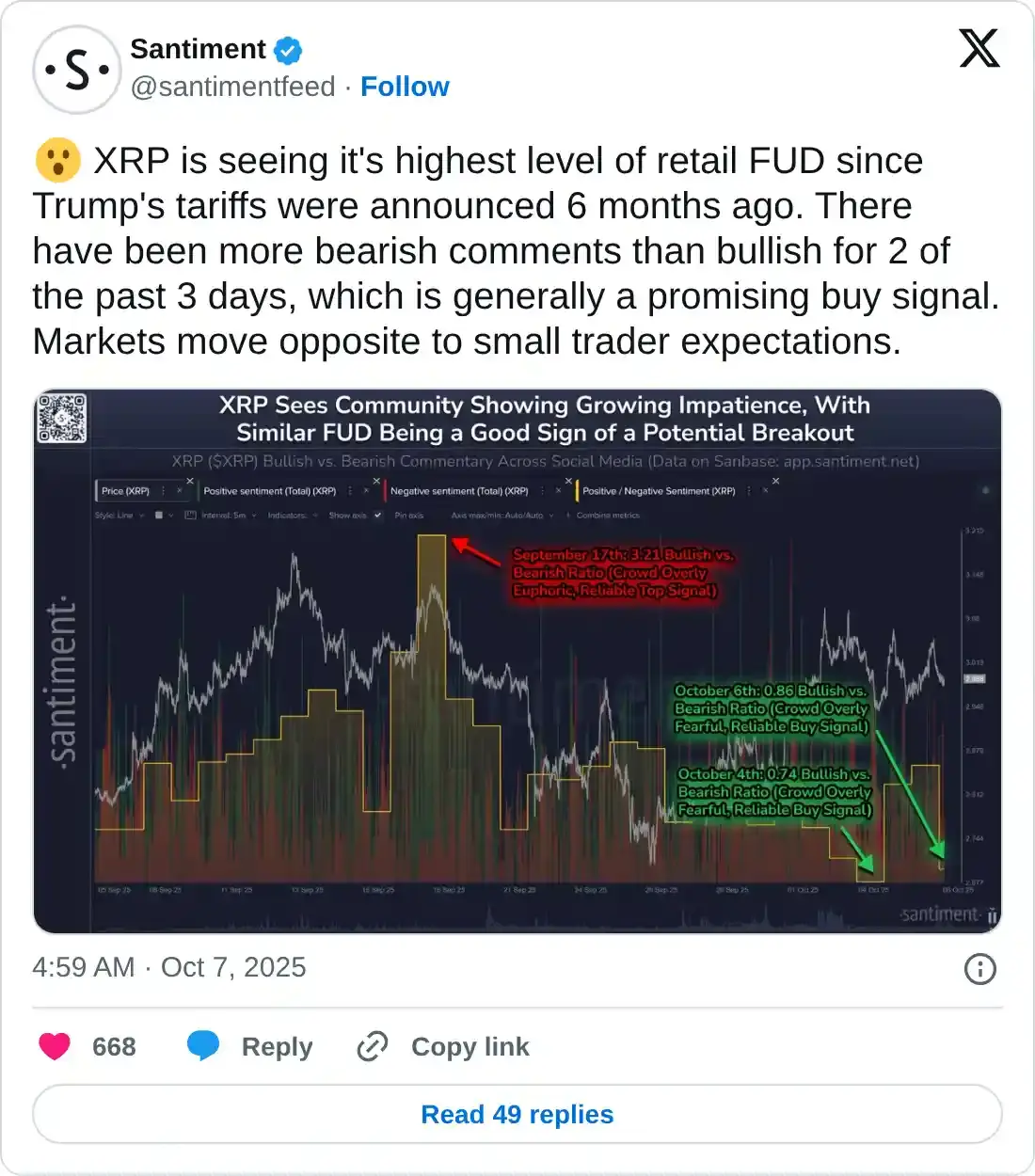

XRP fell 4% in intraday trading on Tuesday, fueled by an increasing wave of FUD among investors. The cryptocurrency saw its highest level of retail FUD since US President Donald Trump announced tariffs in April, according to crypto analytics platform Santiment.

The shift in sentiment signals growing impatience for a rally, with bearish XRP comments outweighing bullish statements across social media platforms.

However, Santiment highlighted that such a move often precedes a potential breakout as markets tend to move in the opposite direction to "small traders' expectations."

XRP's decline was followed by a drop in its rank among the top ten cryptocurrencies on Tuesday. BNB flipped the remittance-based token to become the third-largest crypto asset by market cap, climbing to $179 billion and surpassing XRP's $171 billion.

BNB extended its rally by 8% on Tuesday, clocking a new all-time high of $1,330. The token also outperformed the top 100 cryptocurrencies over the past week, rising by 30%.

The latest surge coincided with a disclosure from CEA Industries (BNC), which announced that it holds 480,000 BNB tokens valued at over $600 million.

It also follows Binance co-founder Changpeng Zhao's (CZ) post on X, calling a "BNB meme season." Alongside CZ's comment, the increased trading volume of decentralized exchange Aster has served as a major boost for BNB's rally.

BNB's trading volume has also soared from over $2 billion last week to $9 billion in the past 24 hours, reflecting strong sentiment among traders, according to CoinGecko data.

XRP risks a decline to $2.71 if bulls fail to recover SMA convergence

XRP experienced $22.3 million in futures liquidations over the past 24 hours, led by $20.3 million in long liquidations, according to Coinglass data.

The remittance-based token saw a rejection at the descending trendline resistance, which extends from July 21, a level it has failed to hold above in the past three months.

XRP/USDT daily chart

XRP has also declined below the convergence of the 50-day and 100-day Simple Moving Average (SMA). On the downside, XRP risks a decline to the $2.71 support if bulls fail to recover the SMAs convergence.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have declined below their neutral levels, indicating a dominant bearish momentum.