Ethereum Price Forecast: ETH dips below $4,000, sparks heavy liquidations as REX-Osprey debuts staking Ether ETF

- Ethereum's dip below $4,000 triggers over $400 million in futures liquidations, the second time in five days.

- REX Shares has launched the first Ethereum staking ETF in the United States.

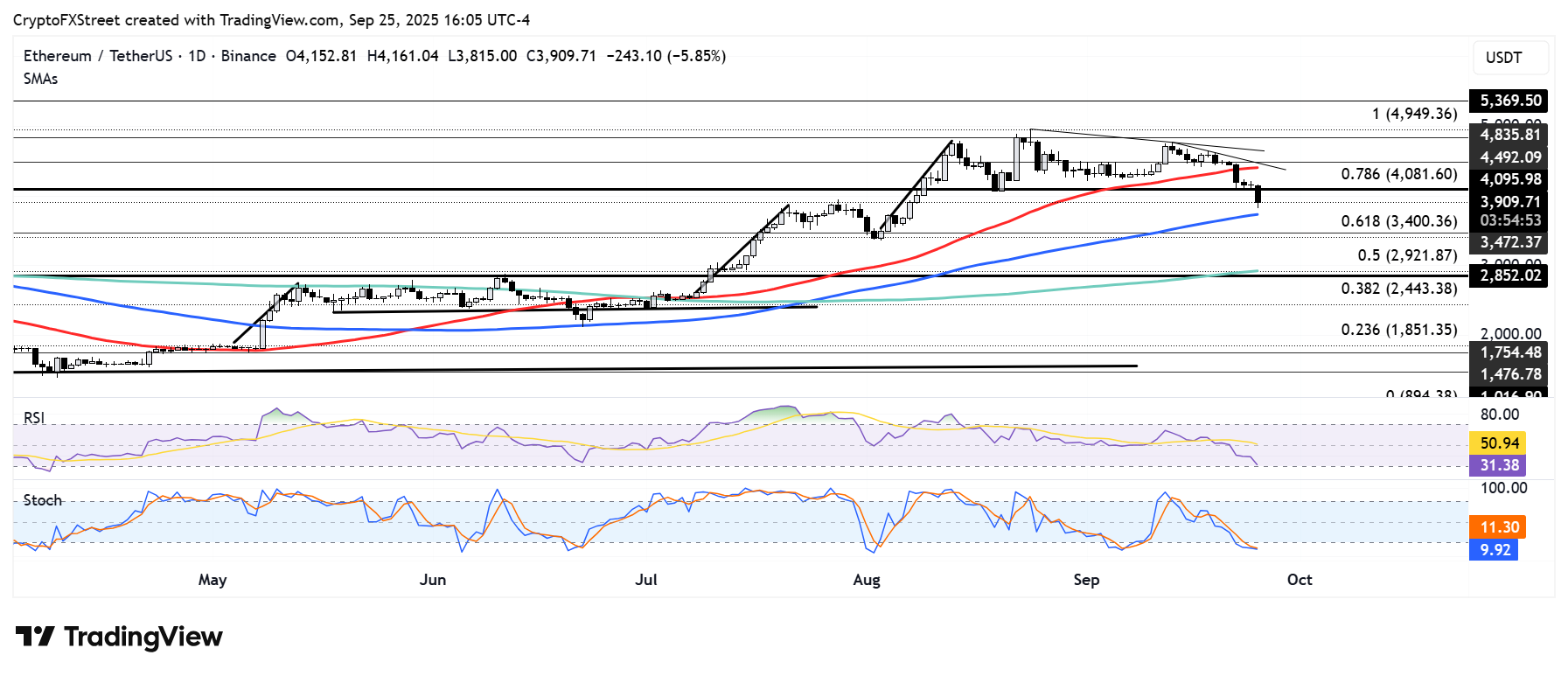

- ETH eyes a bounce off the 100-day SMA after losing the $4,000 critical support level.

Ethereum (ETH) is declining below $4,000 on Thursday, accelerating liquidations among holders of long positions on ETH futures. Long liquidations surged above $400 million for the second time in four days as prevailing bearish sentiment in the crypto market continues to weigh on Ethereum. The decline comes after FXStreet noticed ETH funding rates flashed negative on Wednesday.

Despite the prevailing bearish sentiment, REX Shares debuted the first Ethereum staking ETF in the United States.

REX-Shares launches first US Ethereum staking ETF

REX Shares and Osprey Funds have launched the first Ethereum ETF that provides investors access to staking rewards in the United States.

The firms announced the launch in a statement on Thursday, highlighting that the REX-Osprey ETH + Staking ETF (ESK) will track the spot price of Ethereum and "deliver monthly staking rewards."

"All staking rewards received by the fund are passed directly to investors, with neither REX nor Osprey retaining any portion," the companies noted.

Unlike regular US spot ETH ETFs, REX-Osprey registered the product under the Investment Company Act of 1940, which allows it to be regulated in the same manner as an investment fund that pools capital from several investors. The firms employed the same process in launching the first Solana staking ETF in July. They also debuted the first Dogecoin and XRP ETFs in the US last week.

The launch comes after the US Securities and Exchange Commission (SEC) delayed its decision on applications from BlackRock, Franklin Templeton, and Fidelity to permit staking for their ETH ETFs.

Since launching in July 2024, Ethereum ETFs have garnered a total net asset value of about $27 billion, according to SoSoValue data. However, flows into the products have been weak recently, following three consecutive days of net outflows totalling $296 million.

Ethereum Price Forecast: ETH declines below $4,000, eyes 100-day SMA support

Ethereum futures liquidations climbed to $431.5 million over the past 24 hours, with $401.8 million in liquidated long positions, per Coinglass data.

ETH dipped below the $4,000 psychological level on Thursday for the first time since August 8. The top altcoin is seeking support near the 100-day Simple Moving Average (SMA), a level that previously provided support during a weekend decline on June 22.

ETH/USDT daily chart

Bulls could initiate buy pressure around the 100-day SMA to regain control of the market, as evidenced by the brief recovery in ETH since approaching the level. However, a decline below the 100-day SMA could send ETH to the $3,500 support.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are around their oversold regions, indicating a dominant bearish momentum but with growing potential for a recovery.