Bitcoin Crashes, But Strategy Unveils Fresh $100 Million Buy

Michael Saylor’s Strategy has announced a new Bitcoin buy involving 850 BTC shortly after the cryptocurrency’s price tumbled below $113,000.

Strategy Has Added Another $100 Million Worth Of Bitcoin To Treasury

As revealed by Strategy Chairman Michael Saylor in an X post, the Bitcoin treasury company has just added more of the cryptocurrency to its holdings. With this new purchase, the firm has acquired 850 BTC for an average price of $117,344 per token, or $99.7 million in total cost.

According to the filing with the US Securities and Exchange Commission (SEC), the buy occurred in the duration between September 15th and 21st. Strategy sold shares of its STRF and MSTR at-the-money (ATM) offerings to fund the acquisition.

After this purchase, the company holds a total of 639,835 BTC at a cost basis of $47.33 billion. At the current BTC price, the firm’s treasury is worth $72.47 billion, putting it into a gain of around 53%.

The announcement of Strategy’s acquisition has come following a plunge in the BTC price. It doesn’t correspond to dip buying, though, as the average price of the coins suggests the buy occurred around the asset’s recent high.

Strategy isn’t the only Bitcoin treasury company that has revealed a new buy on Monday. Japan’s Metaplanet has also made an acquisition, as announced in an X post by Simon Gerovich, the company’s president.

Metaplanet’s purchase has been significantly larger than Strategy’s, involving 5,419 BTC bought for a total of $632.53 million or $116,724 per coin. In fact, the buy is the largest in the firm’s history so far.

The acquisition has pushed the company into the top five BTC treasury companies in terms of holdings, as the table from BitcoinTreasuries.net shows.

Before the latest purchase, Metaplanet held 20,136 BTC, making it the sixth largest company behind Bullish. Now, the firm has overtaken Bullish with treasury holdings amounting to 25,555 BTC.

While the company’s latest acquisition has outshined Strategy’s, the latter still continues to be by far the most dominant Bitcoin treasury in the world, with the difference to second-largest Mara Holdings being a whopping 587,358 BTC (about $66.42 billion).

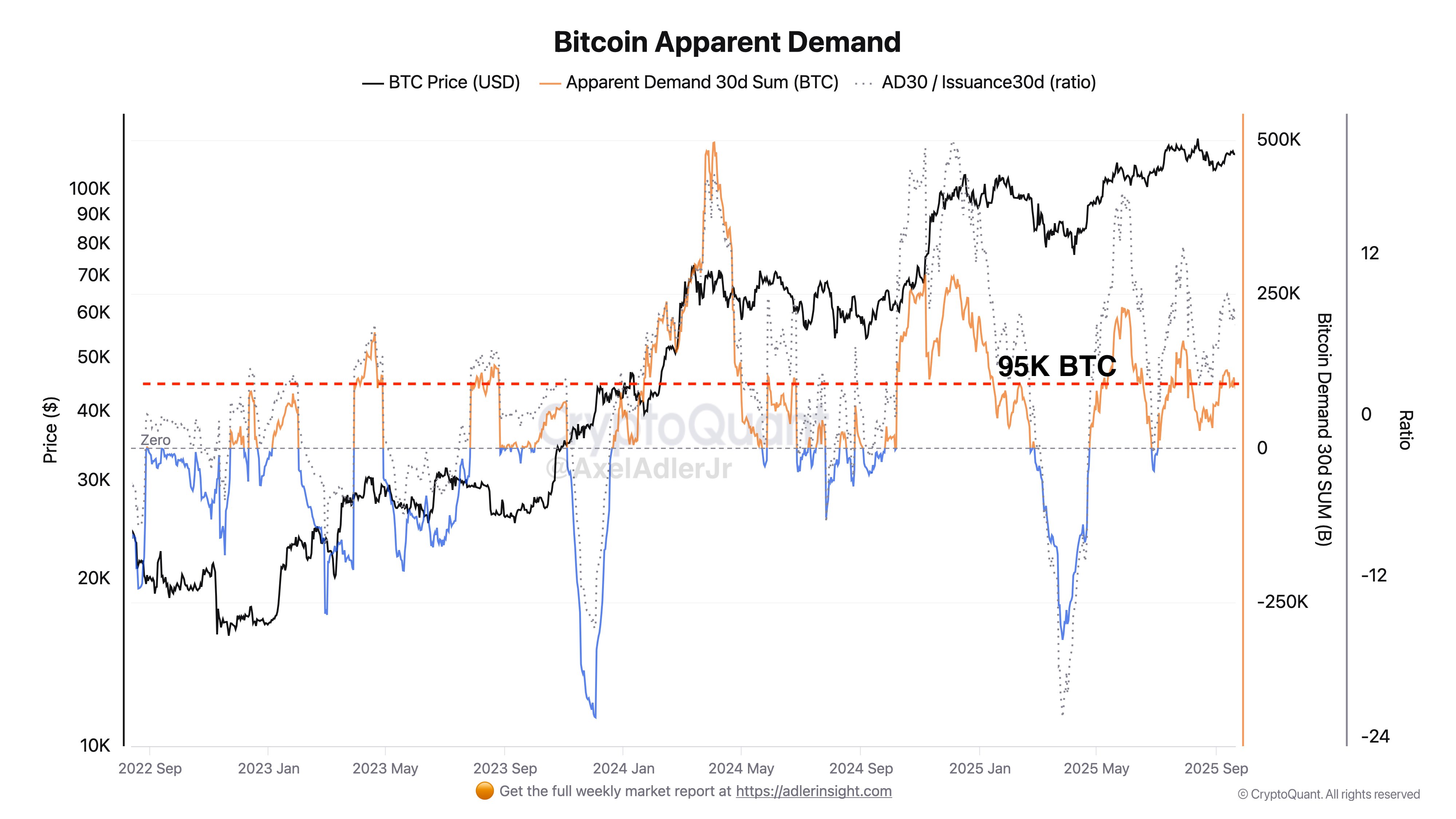

Speaking of buying, the Bitcoin Apparent Demand indicator has risen to a notable level recently, as CryptoQuant author Axel Adler Jr has pointed out in an X post.

The Apparent Demand measures the difference between the daily amount of Bitcoin being mined and net change in the 1-year inactive supply. From the chart, it’s visible that the 30-day value of the metric is currently sitting at a notable positive level of 95,800 BTC.

“This sustained buying interest is keeping prices pinned near the upper boundary of the range, even as short-term bearish pressure builds in the futures market,” notes Adler Jr.

BTC Price

At the time of writing, Bitcoin is floating around $113,000, down more than 1% over the last seven days.