Bitcoin Struggles at $112,000, But 2 Signals Show Bulls Are Not Backing Down

Since August 25, Bitcoin has been wrestling with resistance near the $112,000 level. It has encountered repeated sell-offs whenever it attempts to break and stabilize above the threshold.

However, despite these struggles, confidence among some investors remains intact. Instead of retreating, these holders have continued to accumulate BTC, strengthening optimism about the asset’s near-term recovery.

2 On-Chain Clues Show Bitcoin Bulls Still Have the Upper Hand

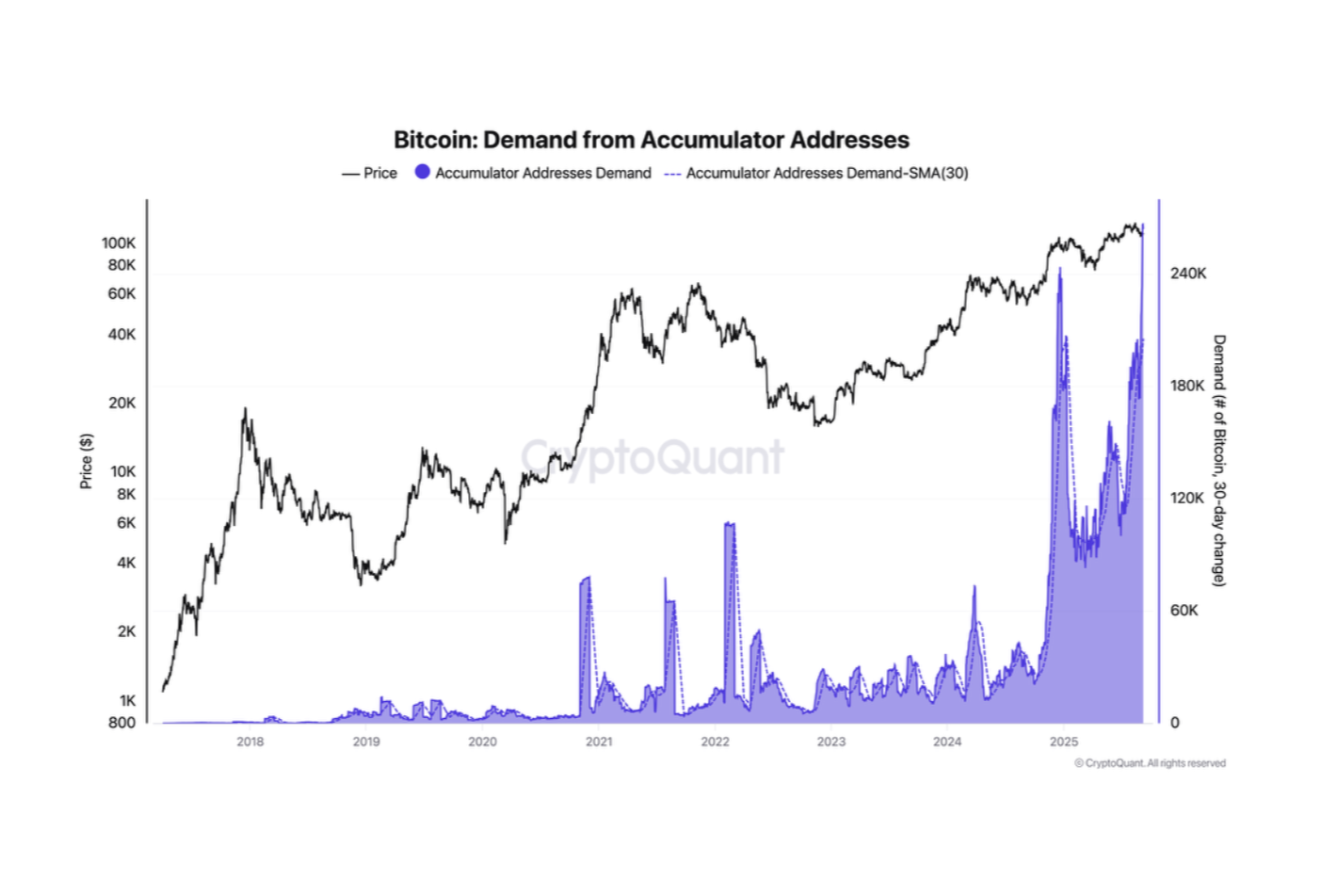

According to a new report by pseudonymous CryptoQuant analyst Darkfost, demand from BTC accumulator addresses is “skyrocketing.”

These are wallet addresses that have made at least two transactions with a minimum BTC amount, without ever executing a single selling transaction. They have now set a new all-time high in holdings.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Accumulator Addresses Demand. Source: CryptoQuant

Bitcoin Accumulator Addresses Demand. Source: CryptoQuant

“We can therefore associate this type of address with long-term holder behavior. In the era of corporate treasuries, growing adoption, and Bitcoin increasingly being recognized as a store of value, it seems that many BTC are now being accumulated with the clear intention of being held for the long term,” Darkfost noted.

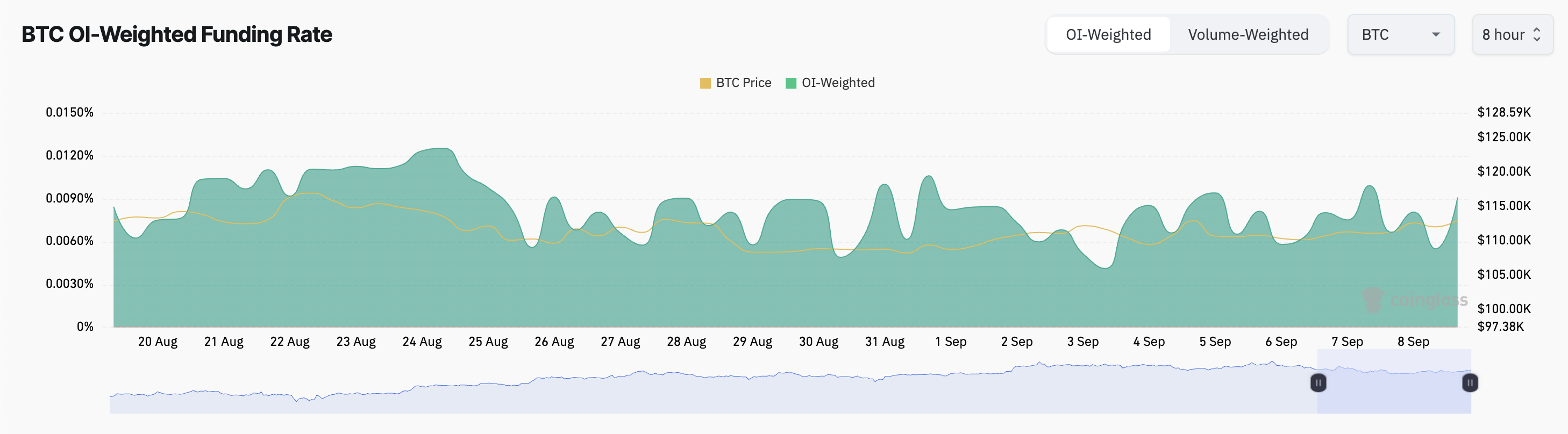

Beyond the surge in long-term accumulation, BTC’s funding rate across major exchanges has also remained firmly positive despite its recent lackluster performance. Per Coinglass, this currently stands at 0.0091%.

BTC Funding Rate. Source: Coinglass

BTC Funding Rate. Source: Coinglass

The funding rate is used in perpetual futures contracts to keep their prices aligned with BTC’s spot price. It represents the periodic fee paid between traders holding long positions (betting on a price increase) and short positions (betting on a decline).

When an asset’s funding rate is positive, it means long traders are paying short traders, signaling that most traders are positioned bullishly and betting on a continued rally.

This means BTC traders are consistently willing to pay a premium to maintain long positions, validating the trend seen in accumulator addresses.

BTC Bulls Stay Hopeful, But Bears Target $110,000 Breakdown

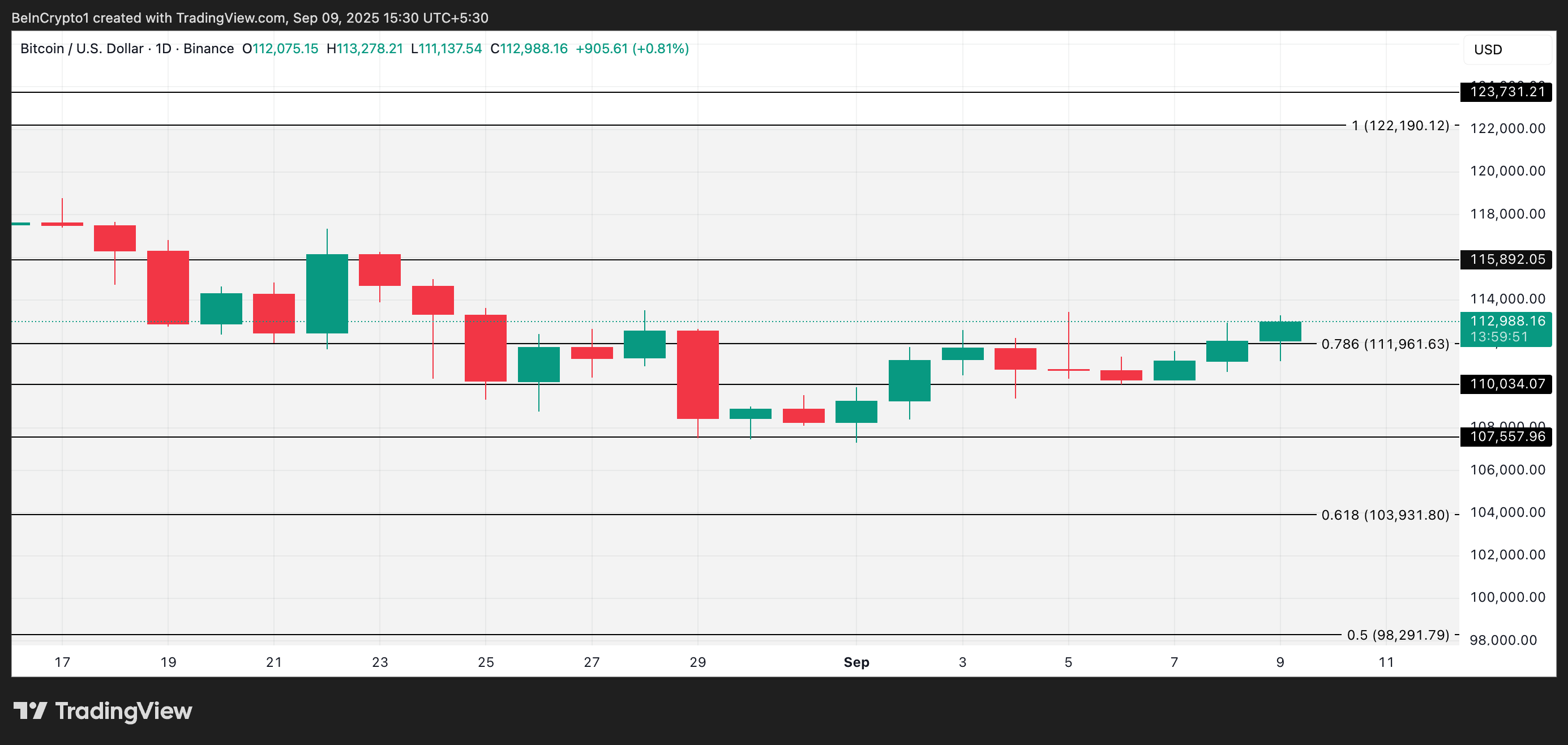

Together, these signals highlight that despite BTC’s repeated struggles at $112,000, both retail and derivatives market participants continue to lean bullish, suggesting that upward momentum may only be a matter of time.

If demand continues to grow, the coin’s price could climb to $115,892.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

On the other hand, if selloffs resume, BTC could fall below $111,961 and trend toward $110,034.