World Liberty Financial Signals Imminent Solana Rollout for USD1 Stablecoin

World Liberty Financial, a DeFi venture connected to President Donald Trump, is preparing to extend its USD1 stablecoin to the Solana blockchain.

On August 29, Charles, who heads the venture’s Solana ecosystem strategy, announced that the move would happen “sooner than you think.”

USD1 Prepares to Enter Solana’s $12 Billion Stablecoin Market

The Trump-related DeFi venture co-founder Zach Witkoff later echoed the message in an X post, saying:

“Solana here we come.”

At the same time, the company’s official X account also published an image of its logo rebranded in Solana’s signature green and purple colors.

Indeed, independent blockchain analysts had already spotted early signs of the move.

On August 28, Dumpster Dao, a research collective, reported that a wallet tied to World Liberty Financial deployed a Chainlink CCIP program on Solana to bridge its WLFI token.

A day later, the group traced activity suggesting that integrations with major Solana protocols like Kamino were underway.

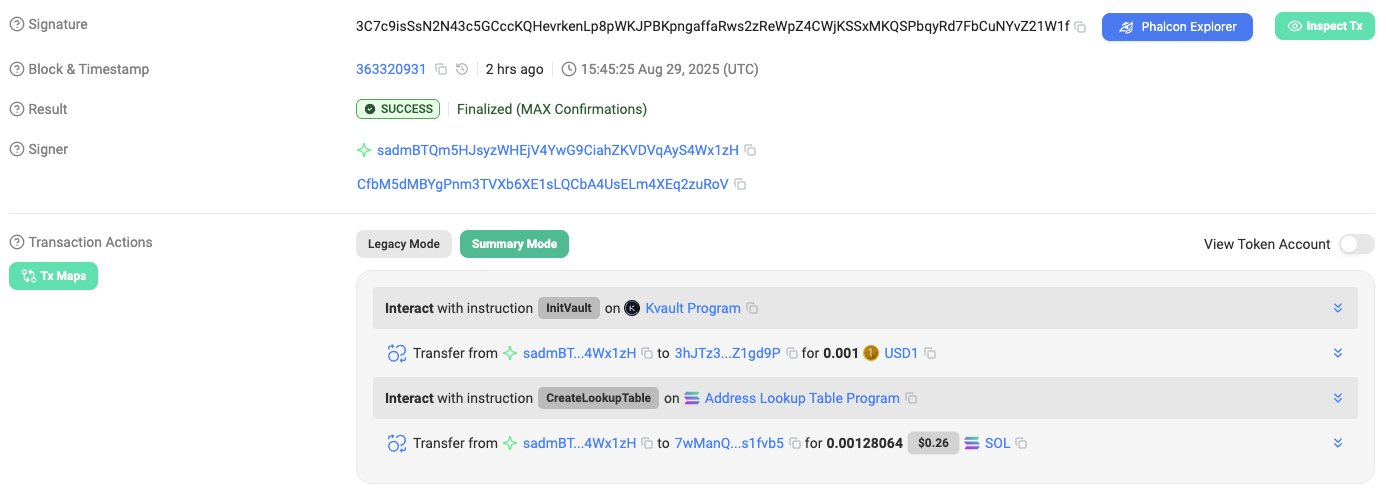

According to Dumpster Dao, Kamino Finance — Solana’s largest lending platform — has set up a dedicated USD1 vault.

USD1 Vault on Kamino Finance. Source: Dumpster DAO

USD1 Vault on Kamino Finance. Source: Dumpster DAO

The vault’s deployer address matched details found in Kamino’s documentation. On-chain flows also showed the stablecoin moving from Kamino’s multisig wallet back to the WLFI deployer on Solana.

These details suggest that the rollout is progressing beyond announcements into technical implementation.

Meanwhile, this expansion comes as Solana’s stablecoin market capitalization has surged past $12 billion. This is its highest level in nearly four months.

According to DeFillama data, Circle’s USDC dominates the chain with $8.7 billion in supply, followed by Tether’s USDT at $2.17 billion.

Solana Stablecoin Market. Source: DeFiLlama

Solana Stablecoin Market. Source: DeFiLlama

Market analysts argue that additional liquidity from USD1 could strengthen Solana’s DeFi markets by supporting lending, settlement, and trading activity.

World Liberty Financial’s USD1, pegged to the US dollar and backed by Treasuries and cash equivalents, has already been deployed on Ethereum, BNB Chain, and TRON.

Over the past months, the stablecoin has quickly gained traction with crypto exchanges Binance and Bullish using it in their separate investment deals.

This level of adoption has helped push the digital asset to rank among the top six stablecoins in the industry. Its circulating supply is near $2.5 billion, most of it concentrated on BNB Chain.