Hyperliquid Price Forecast: HYPE poised for new record high as Arthur Hayes predicts 12,500% upside

- Hyperliquid showcases recovery signs for new all-time highs after collecting liquidity below $50.00.

- BitMEX co-founder Arthur Hayes predicts a 12,500% gain by 2028 for Hyperliquid.

- The adoption of decentralized exchanges and the growth of stablecoins could supercharge the next phase of Hyperliquid growth.

Hyperliquid (HYPE) holds in a narrow range of $46.33 to $50.00 on Thursday, backed by renewed optimism for the token native to the decentralized exchange (DEX). Its short-term outlook remains bullish with a break above $50.00 likely to launch HYPE into a new price discovery phase.

Arthur Hayes predicts 126x upside in Hyperliquid

Arthur Hayes, the co-founder of BitMEX cryptocurrency exchange, highlighted three tokens – Hyperliquid, Ethena (ENA) and Ether.fi (ETHFI) – in his latest article that could see their value skyrocket by 2028.

According to Hayes’ analysis, DEXs have the potential to dominate digital asset trading, toppling centralized exchanges (CEXs) like Binance. He likens Hyperliquid to the decentralized version of Binance.

“With the rollout of HIP-3, Hyperliquid is quickly transitioning into a permissionless derivatives and spot juggernaut,” Hayes highlighted in the article.

Hayes believes that by the end of the current cycle, Hyperliquid will be “the largest crypto exchange of any type, and the growth in stablecoin circulation to $10 trillion will supercharge this growth.”

“I believe that HYPE can 126x from the current levels,” Hayes added.

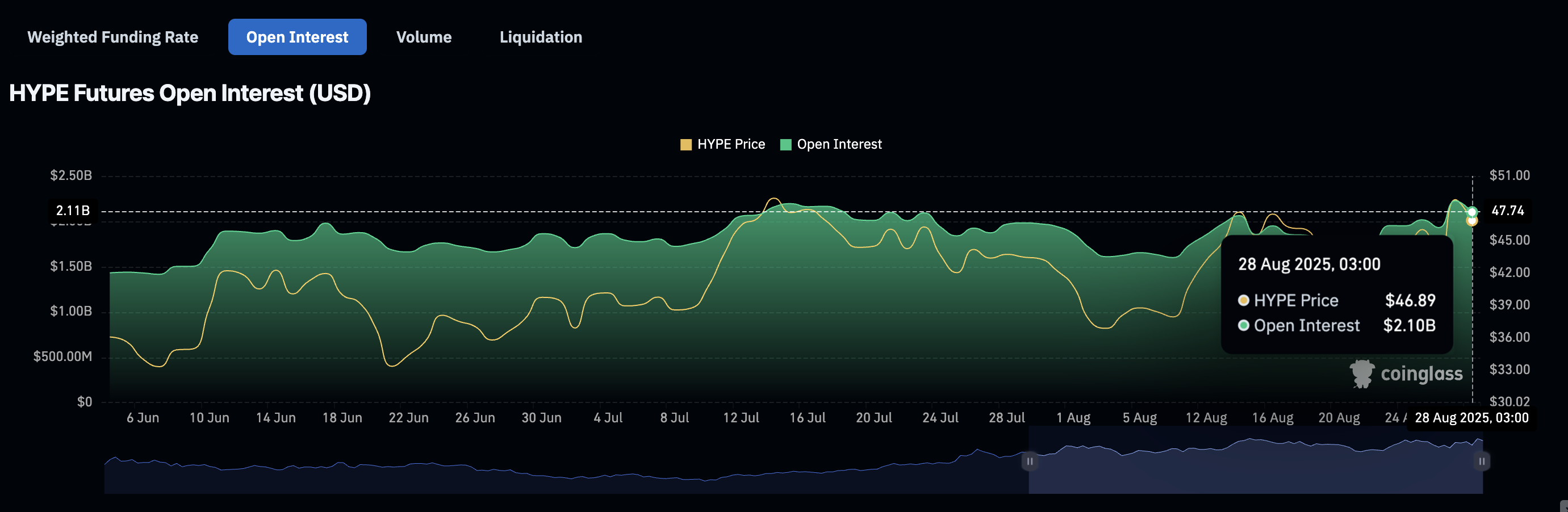

Interest in Hyperliquid remains elevated with the futures Open Interest (OI) holding above the $2 billion mark but slightly below $2.23 billion, the highest level on record. If outstanding futures contracts sustain the uptrend, Hyperliquid could extend the uptrend to new record highs as investor confidence steadies.

Hyperliquid futures Open Interest | Source: CoinGlass

Technical outlook: Hyperliquid holds near record high

Hyperliquid’s technical outlook remains bullish despite hitting a new record high of $51.11 on Wednesday. The Moving Average Convergence Divergence (MACD) indicator backs the uptrend with a buy signal maintained since Monday. This technical picture encourages traders to increase exposure, betting on increases in the HYPE price.

The Relative Strength Index (RSI), currently at 57 and pointing upward, indicates steady buying pressure. Bulls could retain the upper hand underpinned by the SuperTrend indicator’s buy signal, which has been sustained since August 13.

HYPE/USDT daily chart

Hyper is also positioned above key moving averages, including the 50-day Exponential Moving Average (EMA) at $42.97, the 100-day EMA at $39.28 and the 200-day EMA at $32.74, all of which could serve as tentative support levels if a correction occurs due to potential profit-taking.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.