Bitcoin Price Forecast: BTC halts decline as traders await FOMC meeting Minutes for Fed rate clues

- Bitcoin price stabilizes around $113,500 on Wednesday after falling 4% in the last two days.

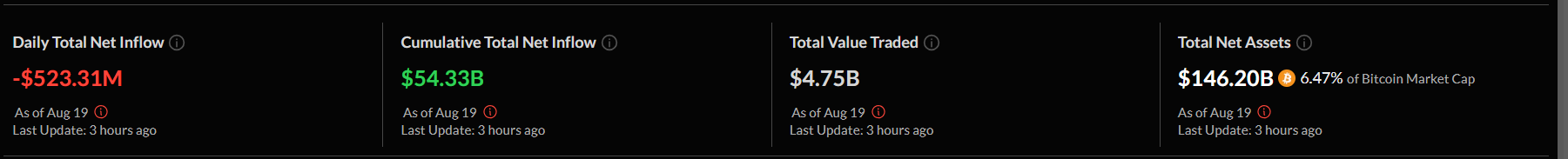

- Institutional demand continues to weaken as spot Bitcoin ETFS recorded an outflow of over $520 million on Tuesday.

- Investors’ attention shifts to the FOMC meeting minutes, as they offer insights into the Fed’s interest rate path prospects.

Bitcoin (BTC) stabilizes around $113,500 at the time of writing on Wednesday after dropping 4% in the last two days. This downturn comes as the institutional demand continues to weaken, as spot Bitcoin Exchange Traded Funds (ETFs) saw outflows exceeding $520 million on Tuesday. Market participants are closely watching for signals on the Federal Reserve’s (Fed) potential rate-cut path, with the Fed's last meeting Minutes due later on the day.

FOMC meeting minutes could trigger volatility for BTC

Bitcoin price has fallen nearly 4% so far this week, reaching a low of $112,732 on Tuesday and recovering slightly to around $113,500 on Wednesday. Last week’s US Producer Price Index (PPI) data figures significantly exceeded economists’ expectations, suggesting that inflation is gradually escalating in the pipeline, which had fueled the correction in riskier assets such as BTC.

Market participants remain cautious as they await the Federal Open Market Committee (FOMC) meeting minutes, scheduled for release late Wednesday, which will provide further cues about the Fed’s interest rate path. This, in turn, will drive and provide a fresh directional impetus and volatility to the top cryptocurrency by market capitalization.

Institutional demand continues to weaken

SoSoValue data shows that institutional investors recorded an outflow of $523.31 million on Tuesday, continuing their third day of outflows. If these negative flows continue and intensify, the BTC price could face further correction.

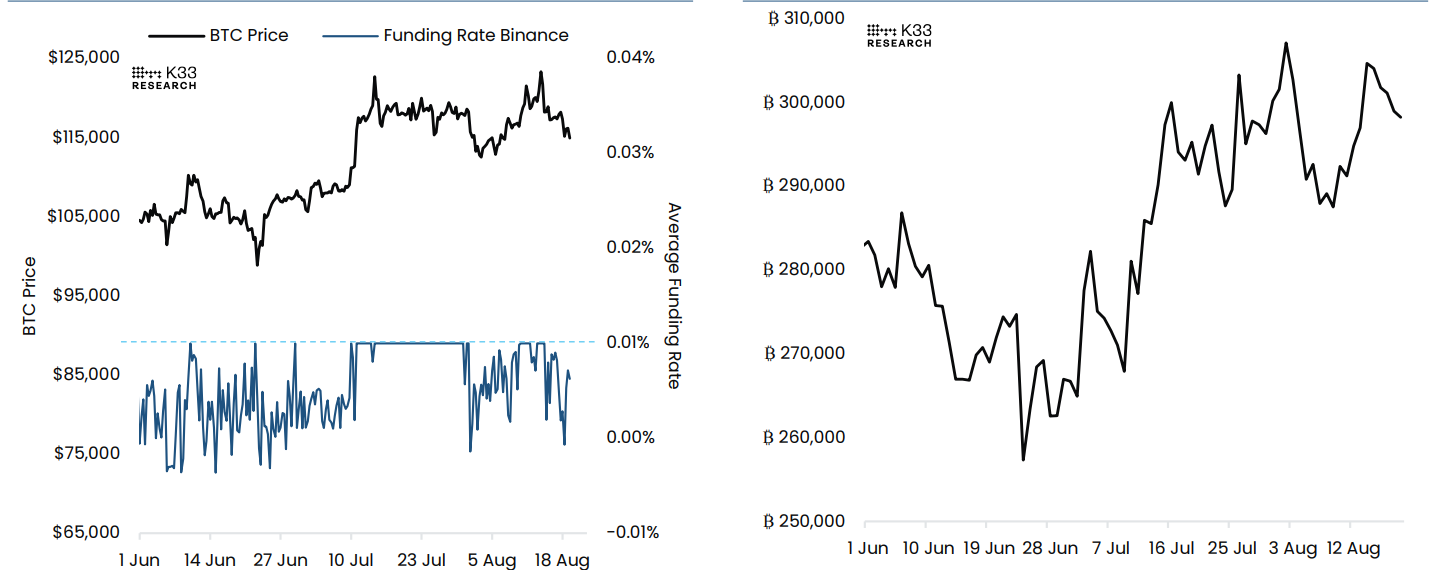

A K33 Research report on Tuesday highlighted that leveraged exposure in perpetual markets remains high, with Open Interest (OI) hovering near 300,000 BTC throughout the past week. The recent retracement has seen funding rates narrow, with Monday seeing BTC’s first negative funding rate interval since August 1. Nonetheless, with heightened open interest, risks remain elevated of squeezes in the near term, with funding rates offering directional ambiguity.

Bitcoin Perpetuals: Funding Rates vs BTC Price (left) chart. Bitcoin Perpetuals: Open Interest (Right chart) Source: K33 Research

Bitcoin Price Forecast: BTC breaks below an ascending trendline

Bitcoin price extended the decline on Tuesday, closing below an ascending trendline drawn by connecting multiple lows since early April. BTC also closed below the 50-day Exponential Moving Average (EMA) at $114,910. At the time of writing on Wednesday, it recovers slightly at around $113,500.

If BTC continues its pullback, it could extend losses toward its next support level at $111,980.

The Relative Strength Index (RSI) reads 42 on the daily chart, below its neutral level of 50, indicating bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bearish crossover last week, suggesting a downward trend.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery toward its daily level at $116,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.