Bitcoin Volume Shelf Indicates Possible Launch To $131,000 – Analyst

Following the steep corrections seen in late July, the Bitcoin market made a modest recovery in the past week, rising by 2.73% according to data from CoinMarketCap. However, another rejection amidst this price resurgence forces the premier cryptocurrency to now trade within the $116,000 price region. While the crypto market awaits the token’s next move, cumulative trading activity signals potential for a major price surge to a new all-time high.

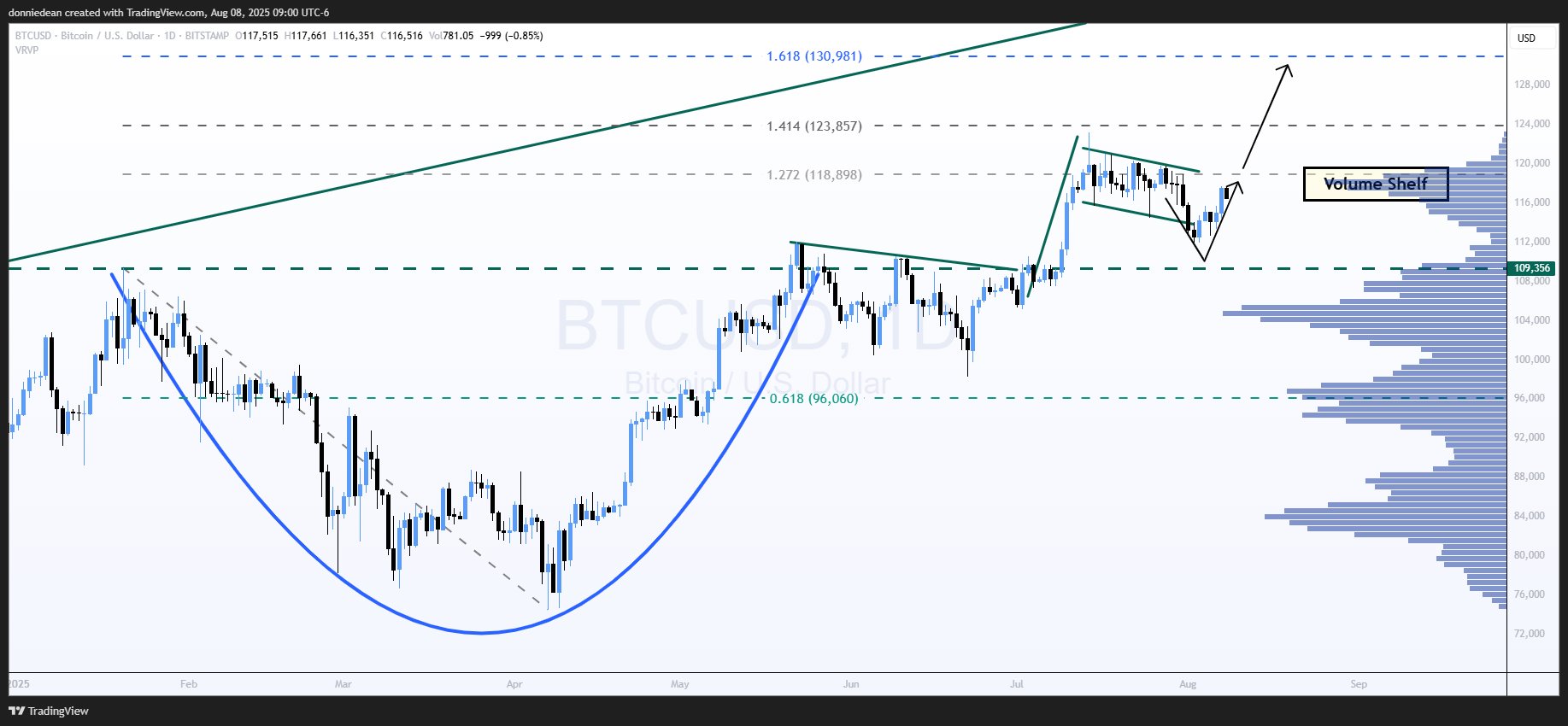

Golden Ratio In Sight: Bitcoin Targets $131K After Volume Shelf Hold

In an X post on August 8, popular financial market analyst Donald Dean shares an interesting bullish price prediction on the Bitcoin market. Based on the existence of a volume shelf on the BTCUSDT daily chart, Dean tips the crypto market leader to soon attain a $131,000 market valuation.

By way of explanation, a volume shelf refers to a price level where a significant amount of trading activity/volume has occurred. In the chart above, this level of trading is indicated by the horizontal bars on the right side of the chart. A volume shelf tends to act as a strong resistance or support zone because many traders are assumed to have bought or sold at this level.

According to Donald Dean’s analysis, Bitcoin is currently hovering around a volume shelf between $116,000 – $118,000, which has been identified as a potential launch area. If Bitcoin can consolidate decisively above this range, it suggests that this level has enough buying interest to potentially act as a springboard for the next leg up.

Interestingly, Dean predicts that this accumulation phase would provide the momentum needed to propel BTC toward the 1.618 Fibonacci extension level, a key technical milestone known as the “golden ratio.” This level, positioned around $131,000, represents the next major price target for the Bitcoin market, signaling a potential 12.93% gain on the present market prices.

Bitcoin Market Overview

At the time of writing, Bitcoin was trading at $116,756, after a minor decline of 0.02% over the past 24 hours. Meanwhile, market trading volume has fallen by 20.97% and is valued at $55.24 billion.

Data from CoinCodex indicates that market sentiment remains strongly bullish, with the Fear & Greed Index at 67. Despite this optimism, analysts expect BTC to hold within its current range, projecting prices of $117,167 in five days and $115,980 in thirty days, and a potential dip to $112,688 over the next three months.