4 US Economic Signals That Could Derail Bitcoin’s Recovery This Week

Several US economic signals are in the pipeline this week, although not as hot as the ones witnessed in the past week.

By frontrunning the following events, traders and investors can buffer their portfolios against sudden impact.

Initial Jobless Claims

This US economic signal, due every Thursday, will indicate the number of United States citizens who filed for unemployment insurance for the first time last week.

Economists surveyed by MarketWatch expect a modest increase to 221,000 after the 218,000 reported in the week ending July 26.

“Initial claims for jobless benefits fell last week [the one ended July 26] and are running below their year-earlier level. Continuing claims continue to point to a slightly less tight labor market compared to a year ago,” economist correspondent Nick Timiraos indicated.

This US economic signal is particularly important as labor market data progressively grows as a significant macro for Bitcoin (BTC).

The jobless claims data will follow the nonfarm payroll (NFP) data, released on August 1. The NFP data exacerbated Bitcoin’s recent drop, coming in well below expectations.

With data signaling a deteriorating labor market, potential dollar instability could push retail and institutional investors toward crypto in the long run.

If last week’s jobless claims continue the trend of coming in higher than the previous week or, worse, exceeding expectations, the perceived labor market weakness could bode well for Bitcoin as investors pivot against economic uncertainty.

For perspective, a surprise increase in jobless claims would signal economic weakness, potentially supporting looser Fed policy. Such an outcome would be bullish for risk assets like crypto.

ISM Services PMI

Beyond labor market data, crypto markets will also be watching the ISM Services PMI (Purchasing Managers’ Index).

This economic indicator, derived from monthly surveys of private sector companies, measures business activity in areas such as new orders, inventory levels, production, supplier deliveries, and employment.

After a reading of 50.8% in June, economists project a modest increase to 51.1% in July. If the ISM Services PMI rises above the expected 51.1%, it signals stronger economic activity and could dampen hopes for Fed rate cuts. Such an outcome is potentially bearish for Bitcoin as tighter liquidity persists.

However, a lower-than-expected reading, especially below 50, would suggest economic weakness and raise expectations of monetary easing, likely boosting crypto prices.

If the data meets forecasts, markets may tread water, with traders awaiting more decisive indicators like jobless claims.

In Tuesday’s run-up to this particular US economic signal, Bitcoin’s next move hinges on whether the services sector shows signs of overheating or slowdown, key elements to the Fed’s inflation and policy stance.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

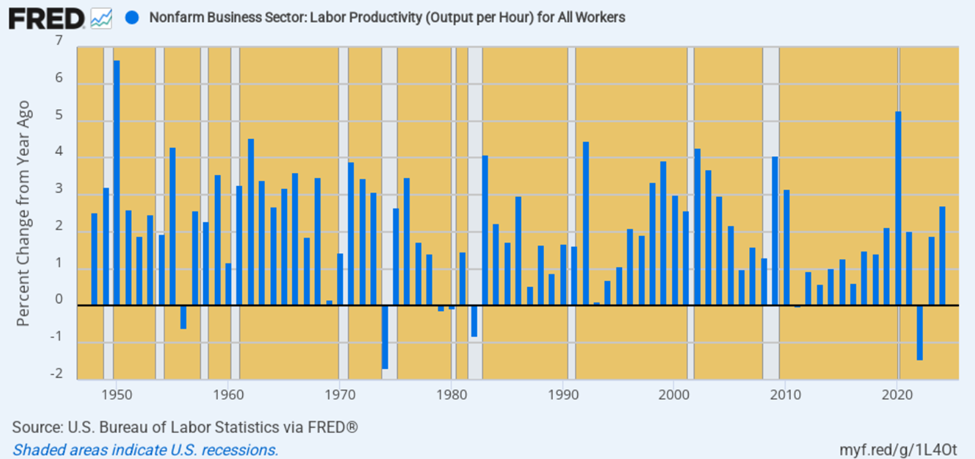

US Productivity and Unit Labor Costs

Further, the US productivity and unit labor costs will be critical watches this week, due Thursday, August 7. Together, they reveal whether wage growth is inflationary.

These data points indicate wage growth in the second quarter (Q2). In Q1, US productivity dropped by 1.5%, but now economists project a 1.9% increase.

Annual US Productivity Growth, 1948 to 2024. Source: David Stockman on X

Annual US Productivity Growth, 1948 to 2024. Source: David Stockman on X

Meanwhile, US unit labor costs were 6.6% higher in the first quarter, but economists project a modest surge of 1.3% in Q2.

Rising labor costs without increasing productivity would indicate sticky inflation, which is expected to bode positively for Bitcoin.

More closely, the mismatch could shift Fed expectations, with crypto known to respond well to signs of disinflation or economic slowdown.

However, if labor costs rise at the same pace as productivity, companies can afford to pay more without raising prices. Such a scenario would support real wage growth without triggering inflation. This is still generally bullish for Bitcoin as it promotes economic growth without tightening liquidity.

When labor costs fall while productivity rises, it is a highly disinflationary and business-friendly scenario. This is bullish for the crypto as falling inflation pressures raise the odds of rate cuts or liquidity support, favoring risk assets.

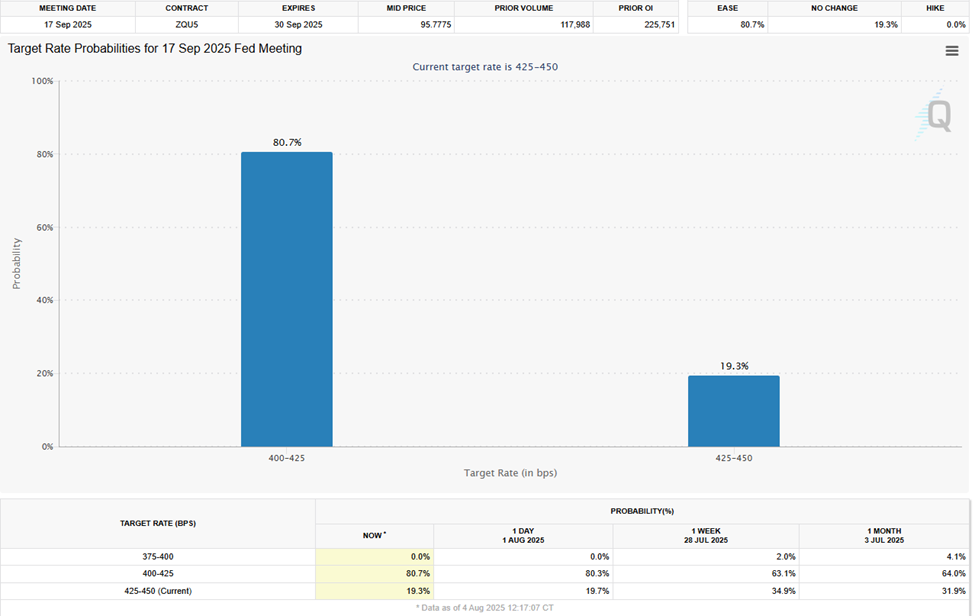

Fed Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Fed Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Based on the CME FedWatch Tool, interest rate bettors see an 80.7% chance the Fed will cut interest rates in the September 17 meeting.

Atlanta Fed President Raphael Bostic Speech

Beyond data points among US economic signals, traders and investors also monitor comments from policymakers. This week, the Atlanta Fed President Raphael Bostic will speak on Thursday, and markets will be keen for signals on policymakers’ economic outlook.

Atlanta Fed President Raphael Bostic is known to lean hawkish on monetary policy, favoring a cautious approach to interest rate cuts.

“If you’re hoping for rate cuts, don’t hold your breath. Atlanta Fed President Raphael Bostic recently stated he only supports one rate cut this year, highlighting the Fed’s uncertainty due to tariffs,” one user said recently.

As one of the Fed’s policymakers, Bostic’s tone on inflation, rates, or balance sheet policy can sharply shift market expectations.

If his remarks are hawkish, it would be bearish for Bitcoin. However, a dovish stance would be bullish, especially if it contrasts with Powell’s tone.