EUR/JPY pauses as US trade negotiations continue, ECB decision nears

- EUR/JPY steadies as Japan and the EU brace for escalating tensions with the US.

- ECB rate decision serves as an additional catalyst for EUR/JPY.

- EUR/JPY consolidates above moving average resistance near 172.00.

The Euro (EUR) is trading in a tight range against the Japanese Yen (JPY) on Tuesday as trade tensions between the United States and its key partners remain a central focus.

With EU-US and US-Japan trade talks currently underway, EUR/JPY is trading near 172.00 at the time of writing.

Japan and the EU brace for impact as the US tariff deadline nears

Both Japan and the European Union are preparing for a significant increase in tariffs on exports to the US, which are set to take effect on August 1, as negotiations enter a critical stage.

The risk of a broader trade dispute continues to weigh on sentiment, particularly for export-reliant economies such as Japan and the Eurozone.

Japan’s chief trade negotiator, Ryosei Akazawa, is currently in Washington for discussions with the US. This marks the eighth round of trade talks, which are aimed at addressing existing trade measures and preventing additional tariffs on exports.

In parallel, EU officials are holding talks from Brussels. As of now, no in-person meetings between senior EU and US trade representatives have been confirmed.

The outcome of the July 22–23 meetings will be significant. Should talks collapse, the US is expected to move forward with a proposed 30% tariff on EU goods.

In response, the European Union has prepared retaliatory measures targeting US products including digital services and aerospace equipment.

ECB rate decision serves as an additional catalyst for EUR/JPY

The Euro is also facing event risk from the European Central Bank’s (ECB) upcoming rate decision scheduled for Thursday.

While no immediate policy change is anticipated, the accompanying Monetary Policy Statement and press conference are likely to offer insight into the central bank’s assessment of inflation risks, growth dynamics, and potential policy adjustments later in the year.

For EUR/JPY, any shift in tone, particularly toward a more hawkish or data-dependent stance, could influence rate differentials and drive short-term direction.

EUR/JPY consolidates above moving average resistance

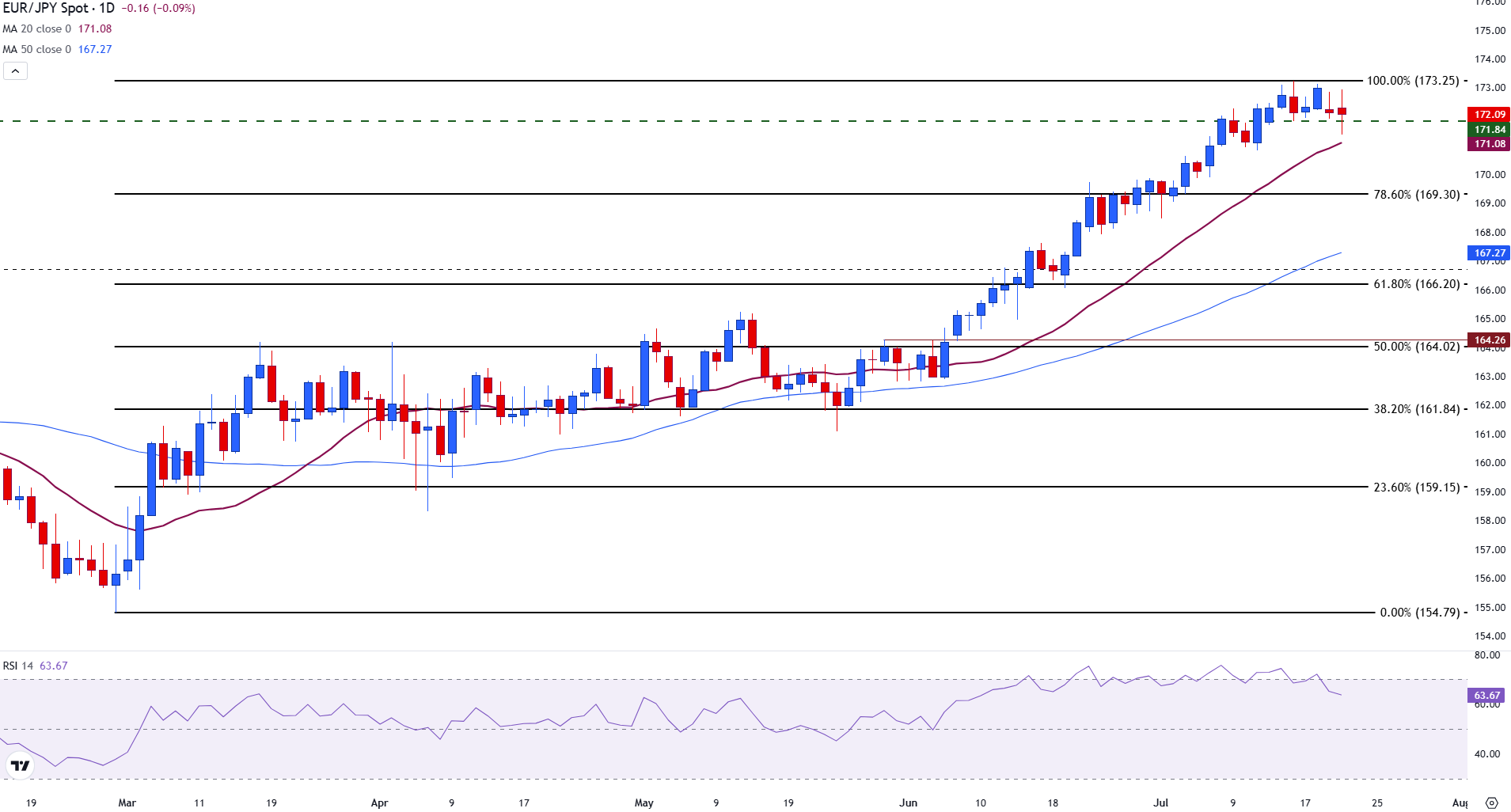

From a technical perspective, EUR/JPY remains in a consolidation phase following a pullback from the 173.25 YTD high, tested last week. The pair is currently trading above the 10-day Simple Moving Average (SMA) support, located near 170.90 with immediate resistance at the intraday high of 172.94, just below the 173.00 psychological level.

A confirmed break above this level would open the way for a potential move toward 173.50, with further resistance near the July 2024 high at 175.43.

EUR/JPY daily chart

On the downside, initial support is seen at 170.50. A deeper pullback could find buyers in the 169.70–170.00 zone, where the 20-day SMA and previous consolidation lows converge.

The Relative Strength Index (RSI) remains near 64 and is pointing lower after exiting overbought territory. This may be a sign that bullish momentum will continue to fade.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.