GBP/USD hits near 4-year high as Trump eyes Powell successor, Dollar sinks

- GBP/USD rises as US Dollar tumbles on WSJ reporting that Trump may name Powell’s replacement by October.

- Dollar weakens as Fed succession adds confusion; Q1 US GDP revised to -0.5% QoQ.

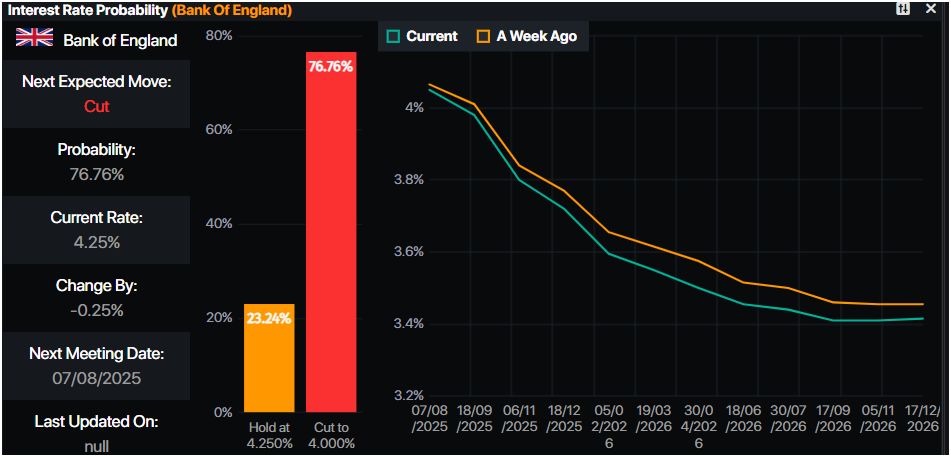

- BoE’s Bailey favors gradual easing; markets price in 76% chance of August rate cut.

The Pound Sterling advances to near four-year highs against the US Dollar on Thursday, as breaking news revealed by the Wall Street Journal (WSJ) suggests that US President Donald Trump might name Jerome Powell's successor to the Federal Reserve Chair in October and September. At the time of writing, the GBP/USD trades at 1.3746, up 0.61%.

Sterling surges to 1.3742 as uncertainty over Fed leadership rattles markets despite mixed US data and dovish BoE tone

The potential replacements for Fed Chair Powell, according to the article, include former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Secretary of the Treasury Scott Bessent.

The news dragged the Dollar lower, as this would create confusion amongst investors, who would need to monitor comments from Powell, alongside the upcoming Fed Chair.

In the meantime, Fed Chair Powell revealed to the US Congress that the central bank remains in a wait-and-see mode, as the Board assesses the impact of tariffs on inflation. He said that if it is a one-time jump, then they could begin to reduce interest rates.

Data in the United States (US) revealed that Initial Jobless Claims for the week ending June 21 came in at 236,000, below estimates and the previous print of 245,000, as reported by the US Department of Labor. Nevertheless, two of the last three readings were higher than expected, exerting upward pressure on the Unemployment Rate.

At the same time, US Durable Goods Orders soared in May, boosted by the increase in commercial aircraft bookings, as revealed by the US Commerce Department. Orders in May rose by 16.4%, almost doubling estimates of 8.5%, up from April’s contraction of -6.6%.

Other data revealed that the US economy in Q1 2025 shrank by more than the previously reported -0.2%, as expected. GDP contracted -0.5% QoQ, revealed the US Bureau of Economic Analysis (BEA).

Across the pond, the UK economic docket is light, with Governor Andrew Bailey crossing the wires. He said that a gradual and careful approach to further withdrawal of monetary policy restraint remains appropriate. Interest rates would likely continue on a gradual downward path, and he stated that “Monetary policy needs to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.”

Market participants see a 76% chance of a rate cut from the BoE in August.

Source: Prime Market Terminal

Meanwhile, Nick Rees, head of macro research at Monex, projects that Cable would depreciate ahead. He noted, “I think once things calm down and markets have a little bit more time to focus on the UK fiscal situation, I think big, big downside risk is building for the Pound that could start to play out.”

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains upwardly biased, having cleared the 2022 high of 1.3749, with further upside potential seen. Momentum, as measured by the Relative Strength Index (RSI), suggests that the trend could continue, as buyers are gathering momentum.

The next area of interest would be 1.3800. Conversely, if the GBP/USD falls below 1.3750, the first support level would be 1.3700, followed by the June 26 daily trough of 1.3651.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -2.18% | -2.46% | -1.67% | -0.93% | -1.90% | -1.96% | -2.20% | |

| EUR | 2.18% | -0.32% | 0.56% | 1.28% | 0.24% | 0.24% | -0.06% | |

| GBP | 2.46% | 0.32% | 0.93% | 1.61% | 0.57% | 0.55% | 0.25% | |

| JPY | 1.67% | -0.56% | -0.93% | 0.72% | -0.27% | -0.24% | -0.64% | |

| CAD | 0.93% | -1.28% | -1.61% | -0.72% | -0.93% | -1.04% | -1.33% | |

| AUD | 1.90% | -0.24% | -0.57% | 0.27% | 0.93% | -0.03% | -0.31% | |

| NZD | 1.96% | -0.24% | -0.55% | 0.24% | 1.04% | 0.03% | -0.29% | |

| CHF | 2.20% | 0.06% | -0.25% | 0.64% | 1.33% | 0.31% | 0.29% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).