[IN-DEPTH ANALYSIS] Eurozone: EUR/USD Short-Term Outlook – One Word "Rise"; Two Words "Keep Rising"; Three Words "Continue to Rise"

Executive Summary

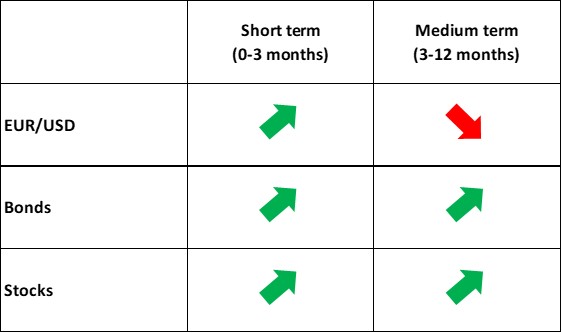

TradingKey - In the short term (0-3 months), the EUR/USD exchange rate is expected to rise, primarily driven by developments on the USD side. Factors such as Trump’s tariff policies, slowing U.S. economic growth, massive U.S. debt levels, and the Federal Reserve resuming its rate-cutting cycle will weaken the USD index. On the Eurozone side, despite ECB rate cuts, a shift in EU fiscal policy provides robust support for the euro. Additionally, the narrowing of real interest rate differentials between the U.S. and the Eurozone will further bolster the euro. Regarding other assets in the Eurozone, we are optimistic about German, French, and Spanish bonds, as well as European equities.

Source: Refinitiv, TradingKey

Source: Refinitiv, TradingKey

* Investors can directly or indirectly invest in the foreign exchange market, bond market and stock market through passive funds (such as ETFs), active funds, financial derivatives (like futures, options and swaps), CFDs and spread betting.

1. Exchange Rate

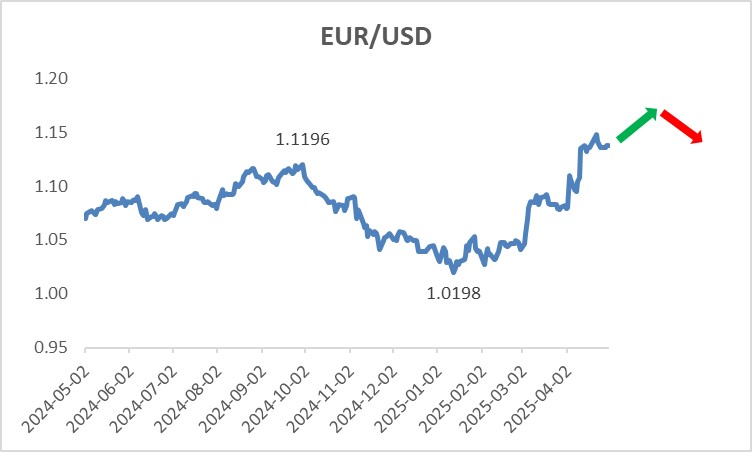

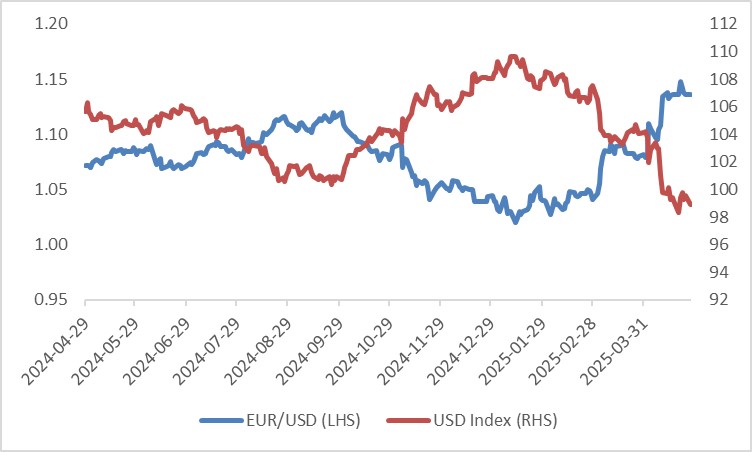

On 17 March, we called that the USD index would continue to decline (see “[IN-DEPTH ANALYSIS] Trump Policies: Market Overreacted, Remain Bullish on Stocks”). Since then, the EUR/USD exchange rate has been rising. In theory, ECB rate cuts should lead to capital outflows and a weaker euro, but this has not been the case due to a combination of external and internal factors, with external factors playing a dominant role. Since early 2025, Trump’s tariff policies have disrupted global supply chains. This, together with U.S. Treasury debt of over $36 trillion raising market concerns, has driven significant USD index declines (Figure 1).

Internally, the EU’s shift toward expansionary fiscal policy, particularly in Germany, has strongly supported the euro. Recent announcements of large-scale fiscal stimulus targeting defence and digital infrastructure have fuelled investor optimism about an EU economic recovery. This has spurred capital inflows, boosting the euro.

Looking ahead, these factors are expected to persist in the short term (0-3 months), continuing to drive EUR/USD higher. Moreover, as U.S. economic growth weakens and inflation declines, the Federal Reserve is likely to resume rate cuts, narrowing the U.S.-Eurozone real interest rate differential and further supporting the euro. However, in the medium term (3-12 months), a sustained U.S. economic slowdown could drag down global growth, prompting a USD rebound due to its safe-haven status, which will weaken the euro. Overall, we expect EUR/USD to rise in the short term before declining later.

Figure 1: EUR/USD and USD Index

Source: Refinitiv, TradingKey

* To learn more about the current economic situation and outlook, refer to the final section, "Macroeconomics", in this article.

2. Bonds

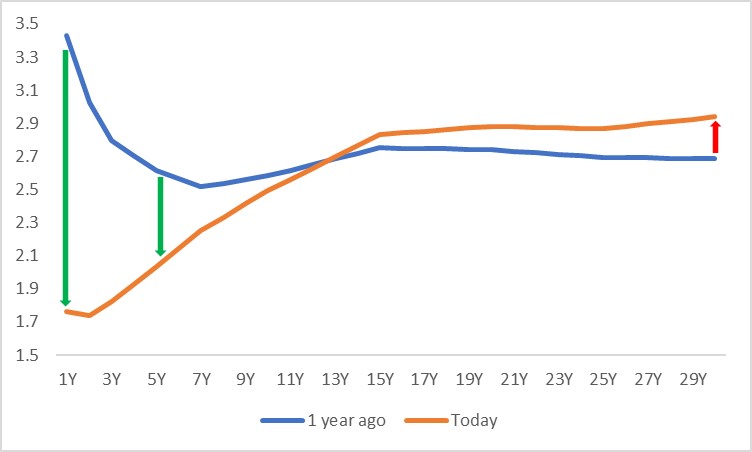

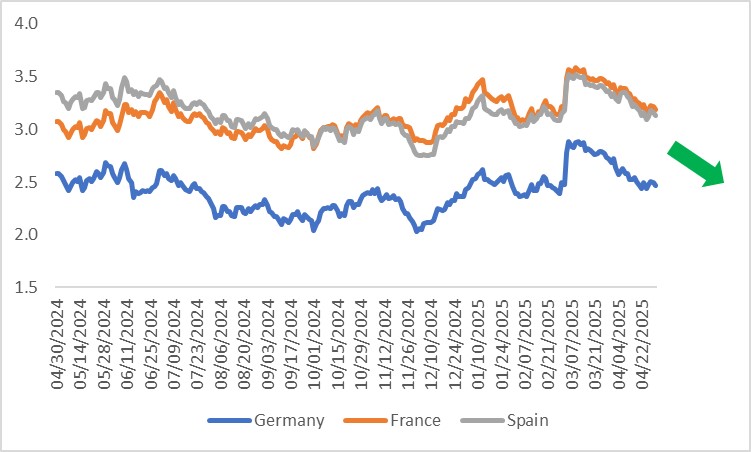

Weak domestic demand and external tariff pressures are slowing Eurozone growth, creating opposing forces for German government bonds. On one hand, a dim economic outlook and declining inflation will push the ECB to continue cutting rates, driving German yields lower. On the other hand, Germany’s fiscal expansion plans to support growth may increase bond supply, exerting upward pressure on yields. We believe the former effect will outweigh the latter, resulting in a net decline in German yields.

In terms of duration, as rate-cut expectations dominate German bonds and fiscal expansion limits significant declines in long-term yields, short-term yields are expected to fall more than long-term yields, steepening the yield curve (Figure 2.1).

Across countries, French and Spanish bond yields are likely to decline alongside German yields. However, due to German bonds’ stronger safe-haven appeal amid a gloomy economic outlook, French and Spanish yield declines will likely be smaller, meaning their bond prices will rise less than German bonds (Figure 2.2).

Figure 2.1: German Government Bond Yield Curve (%)

Source: Refinitiv, TradingKey

* The Yield Curve is a curve that illustrates the relationship between bond yields and their maturities, commonly used to analyse interest rate levels across different bond terms. The horizontal axis represents the remaining maturity of bonds (e.g., 1 year, 10 years, 30 years), while the vertical axis shows the bond yields. Generally, if the curve's movement is driven by central bank policy rates, short-term (front-end) yields exhibit larger changes. Conversely, if driven by economic fundamentals, long-term (back-end) yields experience greater fluctuations.

Figure 2.2: German, French and Spanish 10-Year Government Bond Yields (%)

Source: Refinitiv, TradingKey

3. Stocks

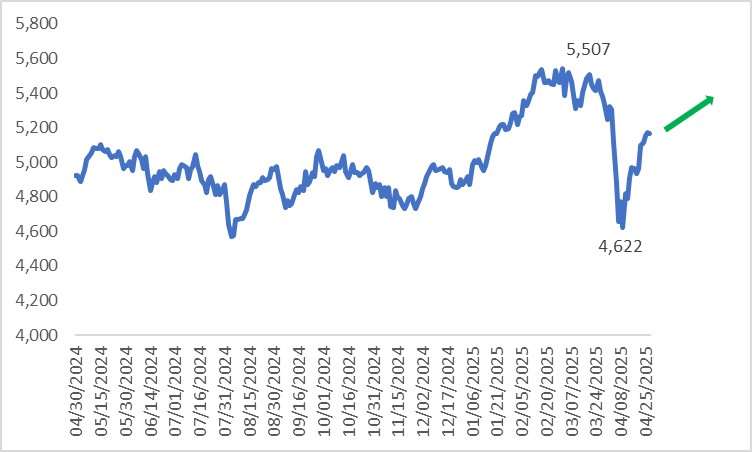

Under pressure from U.S. tariffs, the Stoxx 50 Index fell from a periodic high of 5,507 on 19 March to a low of 4,622 before rebounding. Looking forward, supported by both monetary and fiscal stimulus, European stocks are expected to continue rising (Figure 3). As roughly 60% of European stock index revenues come from outside the Eurozone, stock selection is critical. Given the expected short-term EUR/USD appreciation, investors should prioritize European companies with greater exposure to domestic demand.

Figure 3: Stoxx 50 Index

Source: Refinitiv, TradingKey

4. Macroeconomics

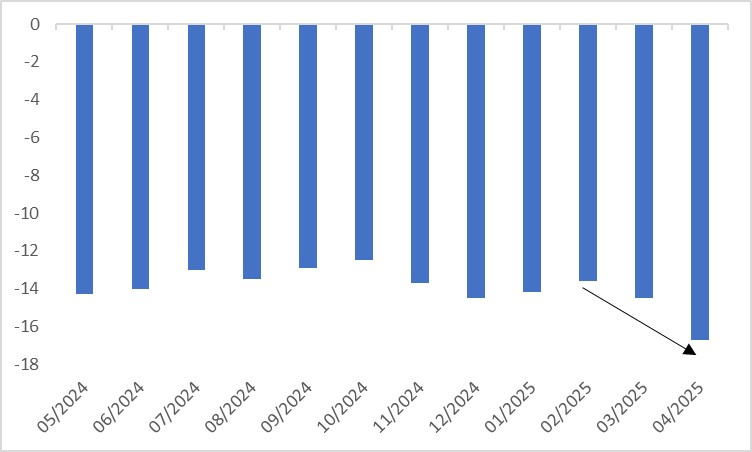

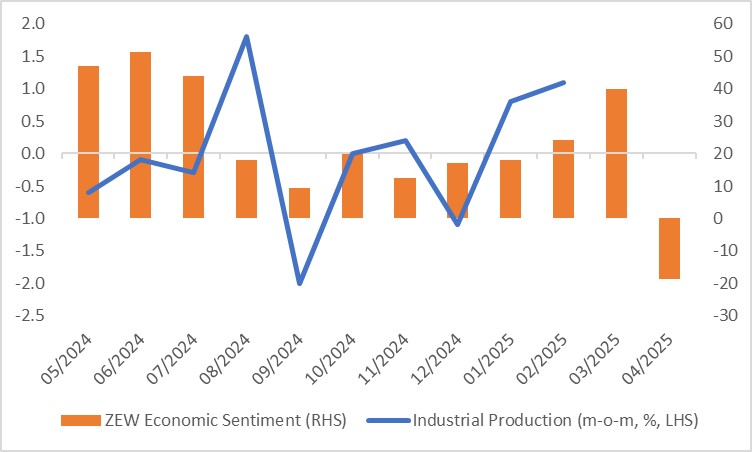

Political instability, weak domestic demand, and global economic slowdown continue to cloud the Eurozone’s economic outlook. On the demand side, consumer confidence has deteriorated since the start of the year (Figure 4.1), leading to production weakness. Although February’s industrial production showed slight month-on-month improvement, a leading indicator, ZEW Economic Sentiment, fell to -18.5 in April (Figure 4.2). Moreover, while April’s Manufacturing PMI exceeded expectations, it remained below the 50-expansion threshold, and Services PMI slipped back below 50.

Figure 4.1: Consumer Confidence

Source: Refinitiv, TradingKey

Figure 4.2: Industrial Production and ZEW Economic Sentiment

Source: Refinitiv, TradingKey

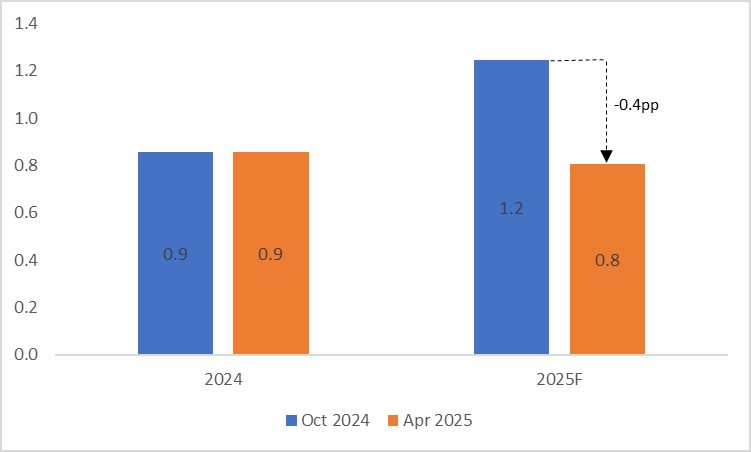

Looking ahead, Trump’s tariff policies pose the greatest threat to the Eurozone economy. On 2 April, the U.S. announced reciprocal tariffs on the EU, prompting the EU to negotiate while preparing countermeasures. An escalating U.S.-EU tariff spiral could further strain the European economy. The IMF’s April 2025 forecast downgraded Eurozone real GDP growth for 2025 by 0.4 percentage points to 0.8% compared to October 2024 (Figure 4.3).

Figure 4.3: IMF’s Real GDP Forecasts (%)

Source: Refinitiv, TradingKey

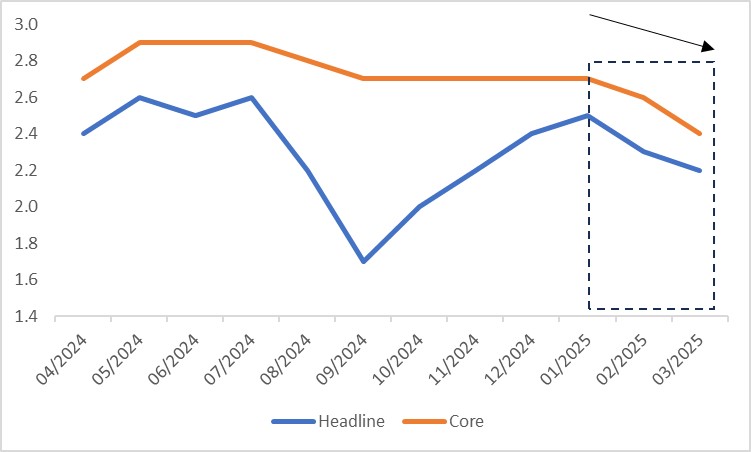

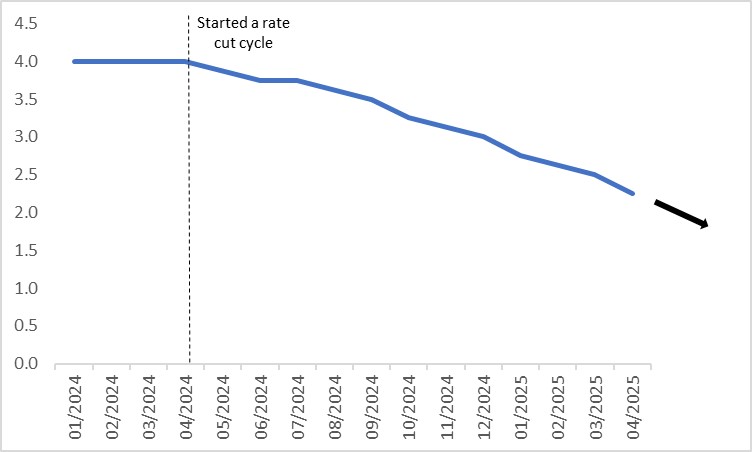

On inflation and monetary policy, both headline and core CPI have been declining since the start of the year (Figure 4.4). Wage growth has also slowed from a peak of 5.3% in Q1 2024 to 4.1% in Q4. This downward inflation-wage spiral will likely prompt the ECB to continue cutting rates over the coming quarters (Figure 4.5).

Figure 4.4: CPI (y-o-y, %)

Source: Refinitiv, TradingKey

Figure 4.5: ECB Policy Rate (%)

Source: Refinitiv, TradingKey

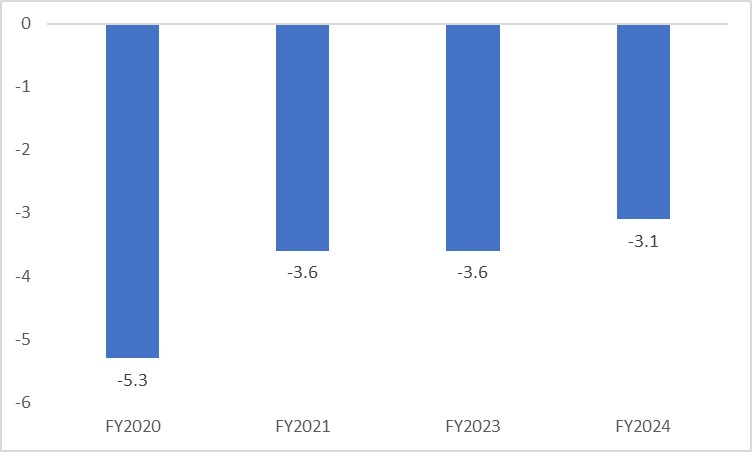

On fiscal policy, following years of shrinking Eurozone government budgets as a percentage of GDP (Figure 4.6), governments have both the capacity and willingness to increase spending to stabilize growth amid economic headwinds.

Figure 4.6: Eurozone Government Budget (% of GDP)

Source: Refinitiv, TradingKey