Hyperliquid price forecast: Bullish interest builds amid user recovery

- Hyperliquid holds at $25 by press time on Monday, aiming to test the overhead resistance trendline.

- Network data suggests a short-term recovery in daily users while weekly fees hit their lowest in December so far.

- Derivatives data reveals a rise in bullish interest as Open Interest surges with the funding rate.

Hyperliquid (HYPE) trades at $25 at press time on Monday, holding the 3% gains from the previous day. The perpetual exchange sees a recovery in active users, while weekly fees collected decline to the lowest level so far this month. Derivatives data show a surge in retail activity, with active positions in HYPE futures rising, and the funding rate indicating bullish interest.

Still, the technical outlook for Hyperliquid remains mixed as selling pressure wanes, but multiple resistances loom.

Retail interest sparks amid user recovery

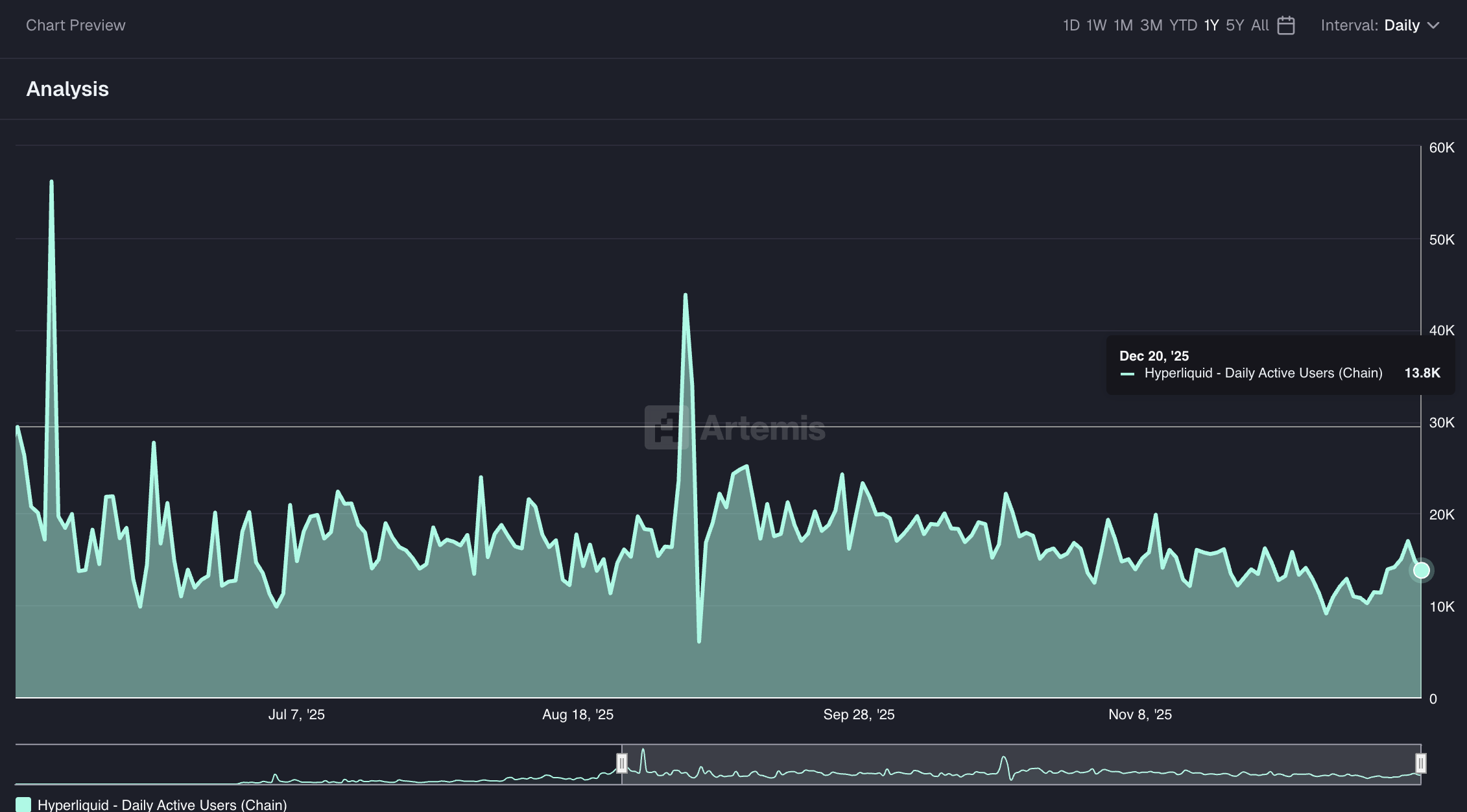

Artemis data shows that the daily active users stood at 13,800 on Friday, up from 9,100 on December 6. This indicates a short-term recovery in a larger declining trend. If the broader cryptocurrency market stabilizes, it could catalyze a steady increase in active users and boost demand on Hyperliquid.

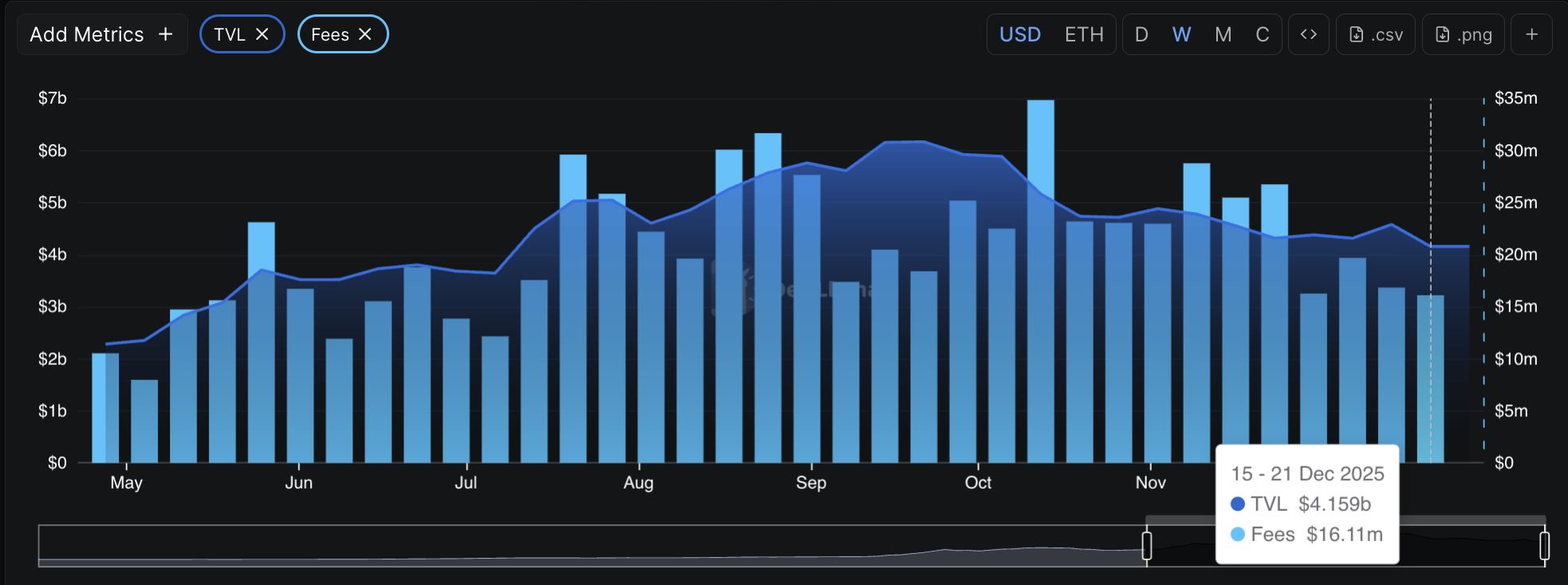

DeFiLlama data shows that fees collected last week totaled $16.11 million, the lowest weekly total so far in December. This suggests that despite the short-term recovery in user count, it pays lower fees, indicating a low risk appetite.

Still, on the derivatives side, retail interest in the HYPE token is heating up. CoinGlass data shows that the HYPE futures Open Interest (OI) is at $1.42 billion, a 4.86% increase in the last 24 hours. Additionally, the funding rate stands at 0.0073%, reflecting buy-side dominance as traders are paying a premium to hold long positions.

Hyperliquid recovers as selling pressure wanes

Hyperliquid holds steady at $25 at press time on Friday, extending a lateral shift after last week's five-day decline. The immediate resistance for HYPE lies at the S1 Pivot Point at $26.03, followed by a resistance trendline connecting the October 30 and December 4 highs, at $28.00.

If the exchange token exceeds $28, it could aim for the 50-day Exponential Moving Average at $32.36.

The technical indicators on the daily chart suggest that the selling pressure has reduced. The Relative Strength Index (RSI) is at 37, pointing upwards as it exits the oversold zone. This indicates a short-term reversal as selling pressure reached unsustainable levels.

Meanwhile, the Moving Average Convergence Divergence (MACD) approaches the signal line, inching closer to a potential crossover, which would confirm a bullish shift in trend momentum.

On the downside, a potential reversal in HYPE could find support between the October 10 low and the S2 Pivot Point at $20.82 and $20.15, respectively.