Crypto markets edge higher as President Trump delays 50% tariff on EU goods to July 9

Major cryptocurrencies post mild gains on Monday as market sentiment improves.

Donald Trump postpones the implementation of a 50% tariff on EU goods from June 1 to July 9, easing near-term trade tensions.

European Commission President Ursula von der Leyen requested the delay during a call with Trump, signaling the start of renewed negotiations.

The cryptocurrency market is recovering modestly during Asian hours on Monday, supported by easing geopolitical tensions after US President Donald Trump announced a delay in the planned 50% tariff on European Union goods. The news came in via Trump’s Truth social media account on Monday that the implementation date has been pushed from June 1 to July 9 following a request from European Commission President Ursula von der Leyen, who confirmed that negotiations would begin promptly, easing near-term trade tensions.

Trump extends tariff deadline on imports from the EU

Donald Trump announced on Monday on his Truth social account that he has agreed to extend the implementation date for the 50% tariff on EU goods from June 1 to July 9. This news came following Friday’s announcement to impose 50% tariffs on imports from the European Union as Brussels sent an unfavorable trade proposal to Washington.

“I received a call today from Ursula von der Leyen, President of the European Commission, requesting an extension on the June 1st deadline on the 50%...,” Trump said.

He continued: “I agreed to the extension — July 9, 2025 — It was my privilege to do so.”

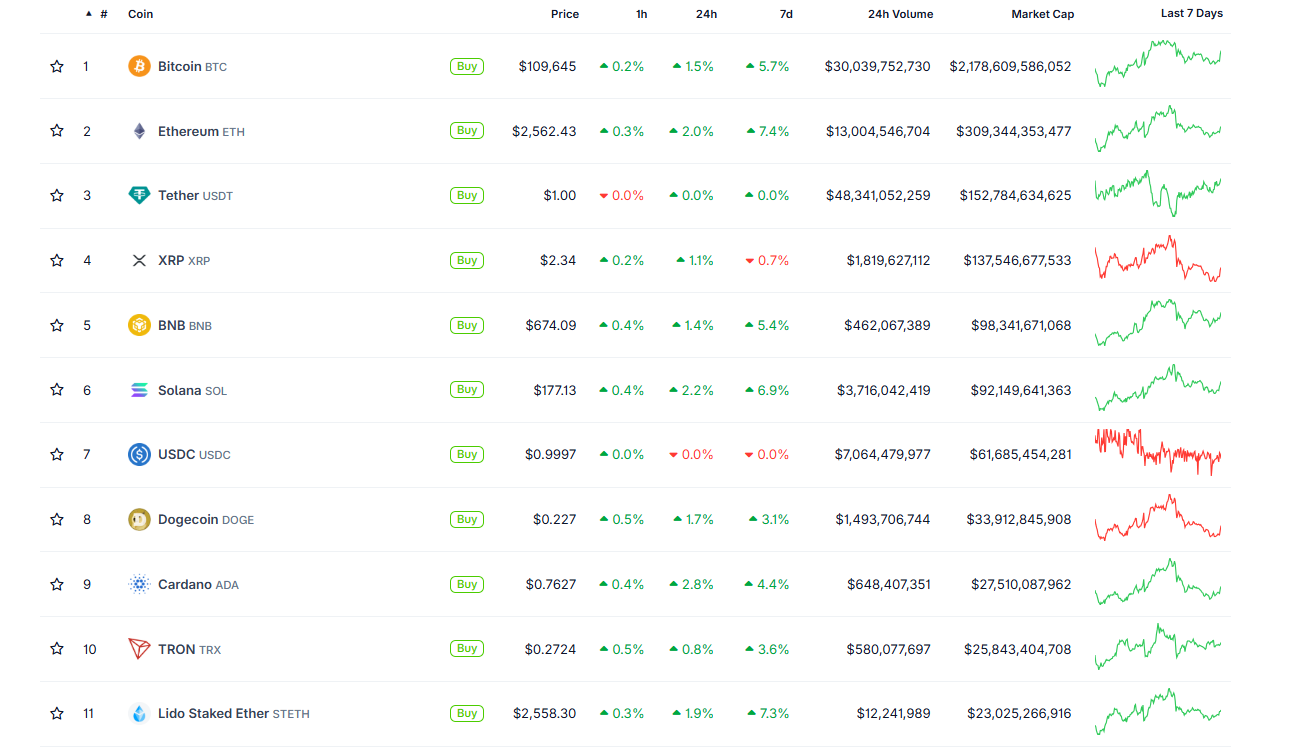

This announcement provided a slight boost to investor sentiment. During the early Asian trading session, the overall crypto market reacted positively, with major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) edging higher, as shown in the chart below.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.