Down 58%, This Fast-Growing Fintech Stock Could Be a Brilliant Buy Right Now

Key Points

Rising credit risk has weighed on fintech stocks like Upstart.

The business has demonstrated a number of improvements this year, even as the stock has pulled back.

Its AI model appears to be adapting to changes in the credit environment.

- 10 stocks we like better than Upstart ›

In many ways, Upstart Holdings (NASDAQ: UPST) has had a banner year. A new artificial intelligence (AI) model has significantly improved conversion rates on loan applications for the AI-powered loan originator. Revenue growth has accelerated, and the company has returned to a profit according to generally accepted accounting principles (GAAP) after struggling earlier in the post-pandemic era.

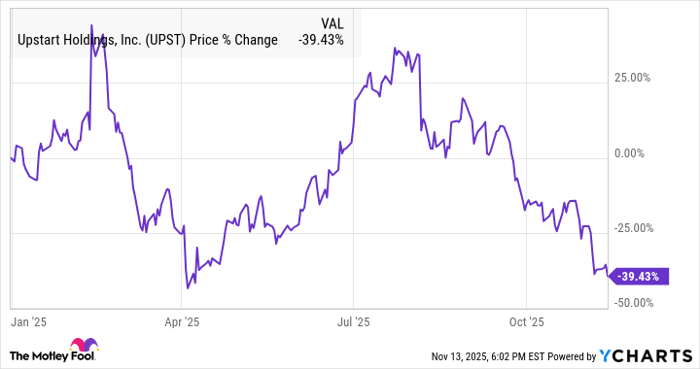

However, you wouldn't know that by looking at the stock chart. As you can see below, Upstart stock has plunged this year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

UPST data by YCharts

The stock is down nearly 40% year to date and off 58% from its peak this year. Going back to its all-time high in 2021, the stock is down nearly 90%.

Like other fintech stocks, Upstart has tumbled lately on concerns about a weakening credit environment. Some regional banks reported larger-than-expected loan losses in the third quarter. Auto delinquencies are on the rise. Consumer sentiment has plunged, and younger and lower-income consumers are pulling back on spending as evidenced by commentary from companies like Chipotle Mexican Grill. The labor market has also weakened significantly in recent months.

Is this sell-off a buying opportunity or a warning for fintech stocks like Upstart? Its third-quarter earnings report offers some clues.

Image source: Getty Images.

Where does Upstart go from here?

Upstart also pulled back on its recent earnings report, giving up 9% on Nov. 6, despite strong results.

The AI-enhanced loan originator continued to see strong growth in the third quarter with transaction volume up 128% to 428,056, driven by increased applications and a conversion rate that improved from 16.3% to 20.6%. Originations rose 80% to $2.9 billion, which drove revenue up 71% to $277 million, though that was slightly below the consensus at $279.6 million.

Margins continued to expand as well, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) up from $1.4 million to $71.2 million, or a margin of 26%. GAAP net income was $31.8 million and adjusted earnings per share was $0.52, up from a loss of $0.06 in the quarter a year ago, and ahead of estimates at $0.42.

Upstart's technology, which achieves better outcomes on approval rates and default rates than traditional FICO scores, is working, and the company is expanding beyond consumer loans and into the large loan market in auto and home loans. Auto loan originations reached $128 million in the quarter, up 5 times from a year ago, and home loan originations hit $72 million, up 4 times from a year ago. Combined, those two categories still make up less than 10% of the company's total origination volume. Additionally, management said its credit performance remained "exceptional." Responding to macro factors like those above, its model became more conservative in the quarter due to the perceived increased risk, which seems to be a healthy sign for the technology and Upstart's business.

What's next for Upstart?

Investors also seemed disappointed by fourth-quarter guidance, which calls for revenue of $288 million, up 31% from the quarter a year ago, but below the consensus at $303.7 million.

The guidance seems to reflect the same conservatism and a sequential decline in conversion rates, though rising application volume, which reached its highest level in three years, is a positive sign for underlying growth.

Upstart now trades at a price-to-sales ratio of 4.2, and just 16 times its expected adjusted EBITDA for the year at $227 million, which looks like a great valuation for the stock.

Given its growth potential, technological advantage, and runway in the auto and home loan markets, Upstart offers a ton of upside potential, and the current price looks attractive. While the stock is likely to remain sensitive to the broader credit market, if its model adapts appropriately, the stock should be a long-term winner from here.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Jeremy Bowman has positions in Chipotle Mexican Grill and Upstart. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Upstart. The Motley Fool recommends the following options: short December 2025 $45 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.