Could Investing $10,000 in Nebius Stock Make You a Millionaire?

Key Points

Nebius has received massive contracts from Microsoft and Meta Platforms for its AI data center capacity.

The company is set to bring more capacity online, and that should translate into stronger growth for the company.

Nebius' top-line growth is expected to take off, and that's likely to translate into significant upside for investors.

- 10 stocks we like better than Nebius Group ›

Nebius Group (NASDAQ: NBIS) has made its shareholders significantly richer in the past year, thanks to a massive increase of 350% in its stock price. So, if you invested $10,000 in Nebius stock a year ago, your holding would now be worth just under $45,000.

This stunning rally was the result of the skyrocketing demand for cloud-based artificial intelligence (AI) infrastructure. The company provides an end-to-end data center platform that's equipped with powerful graphics processing units (GPUs) and a suite of software solutions, which its customers can use to develop AI applications and train and fine-tune AI models, among other things.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Demand for Nebius' offerings is so strong that the company's revenue has been growing at an incredible pace. Major hyperscalers have been purchasing capacity from Nebius, putting it in a solid position to capitalize on a market that's expected to keep growing rapidly over the next decade. Does this mean that growth investors should consider adding Nebius to their portfolios? And if one did buy $10,000 worth of the stock now, is it reasonable to expect that investment could grow into a $1 million stake over time?

Let's find out.

Image source: Getty Images.

Nebius is on track to clock outstanding growth for years to come

Nebius released its third-quarter results on Nov. 11. The Dutch company reported a 355% increase in revenue from the year-ago period to $146 million. Its growth could have been even stronger if it had more capacity to sell, but Nebius sold out all of its available data center capacity for the quarter.

Management points out that it is consistently selling out all of its capacity as it brings it online. That's not surprising, as the likes of Meta Platforms and Microsoft are looking to get their hands on whatever AI cloud computing capacity is available in the market. Microsoft, for instance, gave Nebius a contract worth $17.4 billion in September, the final value of which could go up to $19.4 billion. Nebius expects the revenue from this deal to start flowing into its coffers in 2026.

Meta Platforms has awarded Nebius a $3 billion contract for a five-year period. Nebius says that "the size of the contract was limited to the amount of capacity that we had available," indicating that it could have received a bigger deal from Meta if it had more capacity to offer.

Currently, Meta Platforms, Microsoft, and others are sitting on huge contractual backlogs that they need to fulfill. As a result, they are ramping up their capital spending substantially to gain access to more capacity, so that they can run AI workloads in the cloud. This is a natural tailwind for Nebius, since it specializes in providing AI-first data centers.

Looking ahead, the demand for AI data center capacity in the U.S. is expected to grow 30-fold between 2024 and 2035 to a whopping 123 gigawatts (GW). Not surprisingly, Nebius is now focused on aggressively expanding its available capacity. It expects to end 2025 with 220 megawatts (MW) of connected data center power capacity, which would be almost 10 times the capacity it had at the end of 2024.

By the end of 2026, Nebius is expecting its connected data center capacity to land between 800 MW and 1 GW -- multiplying its capacity again by between 4 and 5 times in the space of just a year. And the company aims to increase its contracted electrical power capacity to 2.5 GW by the end of 2026, up from its earlier plan of 1 GW.

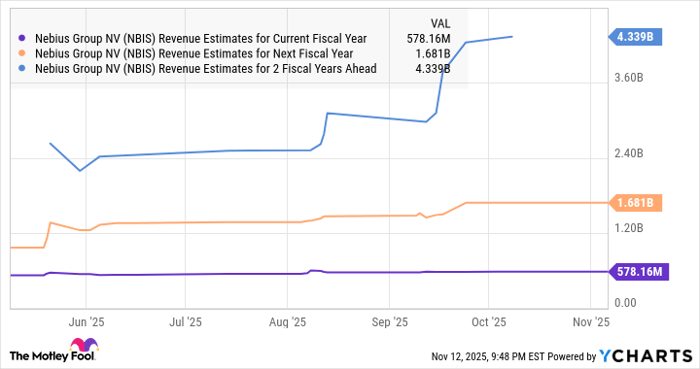

That contracted power capacity will give Nebius the room to deploy more computing capacity. Importantly, it won't be surprising to see hyperscalers such as Meta, Microsoft, and others rushing to purchase the new capacity that it brings online. Hence, it is easy to see why analysts are expecting Nebius' revenue to simply take off.

NBIS Revenue Estimates for Current Fiscal Year data by YCharts.

The size of the company's contracts with Meta and Microsoft, apart from the additional capacity that it is set to bring online, also suggests that it can sustain its outstanding revenue growth rates in the long run.

But can Nebius stock help make you a millionaire?

Putting all your money into one stock in the hope that you strike gold isn't a smart thing to do. After all, any signs of a slowdown in Nebius' growth could send the stock crashing.

On one hand, Nebius could fit into a potential millionaire-maker portfolio, considering the remarkable growth that it is expected to deliver.

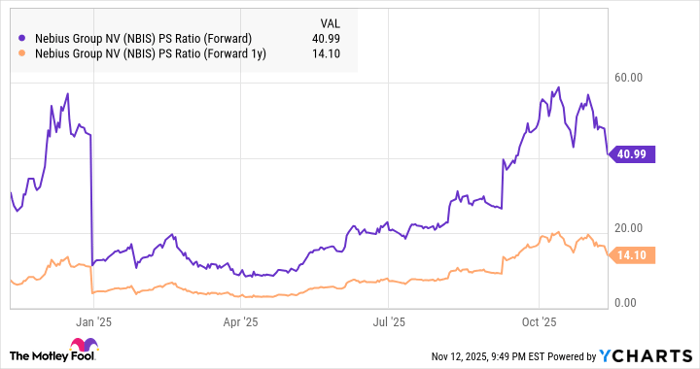

However, it's an expensive stock to buy right now, trading at a whopping 54 times sales. Of course, the company's growth rate and its order backlog could help it justify that valuation over time, which is the reason why its forward sales multiples are much lower.

NBIS PS Ratio (Forward) data by YCharts.

If Nebius trades at even 9 times sales and achieves $4.34 billion in revenue in 2027, its market cap could jump to just over $39 billion in just over two years. That would be a 64% increase from current levels. However, its actual gains could turn out to be much better, since it has the potential to deliver much stronger growth.

So, Nebius looks like a nice fit for a diversified portfolio. That's why if you're someone with $10,000 in investible cash and you're looking to put that money into a growth stock, Nebius could be an ideal choice.

Should you invest $1,000 in Nebius Group right now?

Before you buy stock in Nebius Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nebius Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,785!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 17, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.