Meet the Epic Artificial Intelligence (AI) Stock Whose Revenue Is Skyrocketing

Key Points

CoreWeave is building an AI-first cloud computing platform.

AI computing equipment has a relatively short lifespan.

CoreWeave is still working toward profitability.

- 10 stocks we like better than CoreWeave ›

Few companies in the artificial intelligence (AI) sector are growing as quickly as CoreWeave (NASDAQ: CRWV) is. At its core, CoreWeave is a cloud computing business that specializes in artificial intelligence infrastructure.

With how in-demand AI computing capacity is right now, it's no surprise that CoreWeave is growing at an incredible pace and shows no signs of slowing down. Investors love to get in on that exciting growth, but is CoreWeave a smart investment option? Let's take a look.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

CoreWeave's growth rate is impressive

With how much money AI hyperscalers are spending on building AI computing capacity, investors are starting to get a bit wary about the potential return on these investments. Instead of building all of the AI computing capacity themselves, contracting out some of that work to a business like CoreWeave makes a lot of sense. The AI hyperscaler reduces its expense burden by paying for computing power from CoreWeave. This isn't as cost-effective as building a data center itself, but it allows for increased flexibility. This has allowed CoreWeave to capture some big-name clients, like Meta Platforms (NASDAQ: META), which inked a deal worth $14 billion.

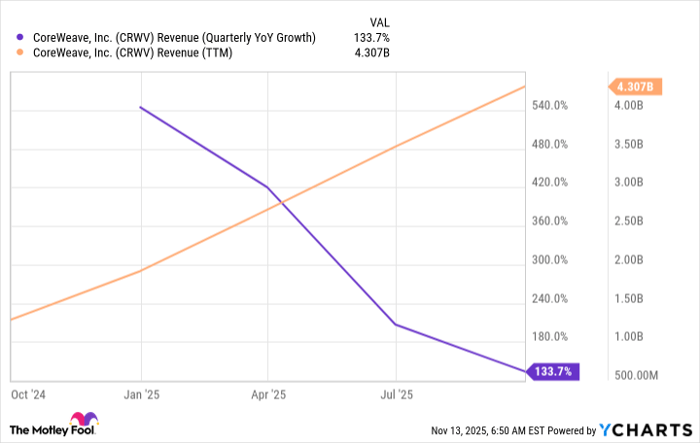

CoreWeave's growth rates have been nothing short of incredible, and its results speak for themselves.

CRWV Revenue (Quarterly YoY Growth) data by YCharts

While the slowing growth rate may concern some investors, it's still more than doubling its revenue each quarter. That's a feat few companies ever achieve, placing CoreWeave in a unique position. However, there's one primary concern with CoreWeave: its profitability.

There's an old saying that you have to spend money to make money. That's true, but there's also a limit. CoreWeave is certainly toying with that limit, as there are questions surrounding the lifespan of this expensive computing equipment.

AI computing equipment doesn't last forever

CoreWeave mostly buys Nvidia graphics processing units (GPUs) for its servers. When running for AI workloads, GPUs can have relatively short lifespans, with some estimates as low as one to three years. However, Nvidia's product launch cycle is also about one year, so the GPUs CoreWeave is buying now won't be the hottest technology even a few months later. This creates a continuous capital influx cycle that can be sustainable if CoreWeave is making a profit.

But that's not the case.

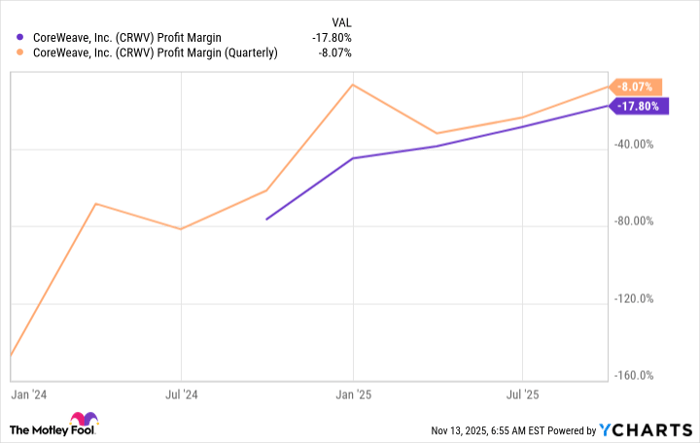

CoreWeave is rapidly improving its margin profile, but it's still unprofitable right now.

CRWV Profit Margin data by YCharts

With the short lifespan of the GPUs it's buying, it's critical that CoreWeave becomes cash-flow-positive and stays that way. However, I don't see that happening anytime soon because it's planning on increasing its footprint.

But the opportunity may be there, as its revenue backlog has now reached $55.6 billion. About 40% of that is scheduled to be used over the next 24 months. So, if we divide it in half, that means CoreWeave should have about $11 billion in revenue over the next 12 months. It expects to generate about $5.1 billion for 2025, so this showcases its impressive growth continuing.

Right now, I'm not interested in CoreWeave because of its unprofitability and cash burn. However, if it can flip that switch and become profitable while growing at an astronomical pace, I'm definitely interested. CoreWeave is going on my watch list for 2026, and it may enter my portfolio if it can cross the profitability threshold, which will be a tough task due to the massive capital expenditure required to build a data center.

As of now, I still think the computing unit providers like Nvidia make for better investments, as they don't have to worry about a quickly depreciating asset because they're selling them.

Should you invest $1,000 in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.