Is Dogecoin a Millionaire-Maker Cryptocurrency?

Key Points

The cryptocurrency industry enjoys long-term tailwinds from increasingly favorable U.S. government policy.

Dogecoin's infinitely rising supply is cause for concern.

- 10 stocks we like better than Dogecoin ›

While Dogecoin (CRYPTO: DOGE) initially started as a parody of Bitcoin, the original meme coin is far from a joke today. With prices up by over 45,000% since its inception in late 2013, a $10,000 position would be worth an eye-popping $4.5 million today, assuming you were able to hold through all the ups and downs. That's much easier said than done.

However, while Dogecoin's long-term performance has been positive, recent months have seen the asset give back much of its gains. Prices have already dropped 48% year to date as the election rally fades. Let's explore the pros and cons of Dogecoin to decide if it can bounce back.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The larger cryptocurrency industry looks solid

While Donald Trump's victory in the 2024 election turned out to be a buy-the-rumor, sell-the-news event for Dogecoin, it has proven to be a tremendous boon for the industry as a whole. The new administration has sharply pivoted away from the Biden era's litigation-heavy approach to regulation, instead prioritizing clarity and dialogue.

New legislation, such as the Genius Act, established clearer rules around stablecoins. At the same time, the establishment of a U.S. Bitcoin strategic reserve boosts the asset class's legitimacy in the eyes of international investors. The U.S. may be poised to take things a step further with a possible bipartisan Crypto Market Structure bill that aims to classify some cryptocurrencies as digital commodities and could lay the groundwork for how institutions can integrate them into their business models.

While these regulatory tailwinds won't necessarily boost cryptocurrency prices immediately, they could have a long-term beneficial effect by encouraging more risk-averse financial institutions like university endowments, pension funds, and insurance companies to allocate more of their portfolios to the asset class. Unlike retail investors, large institutions have deep pockets and a buy-and-hold mindset, which could help smooth out the industry's notorious price volatility.

Will Dogecoin benefit from this?

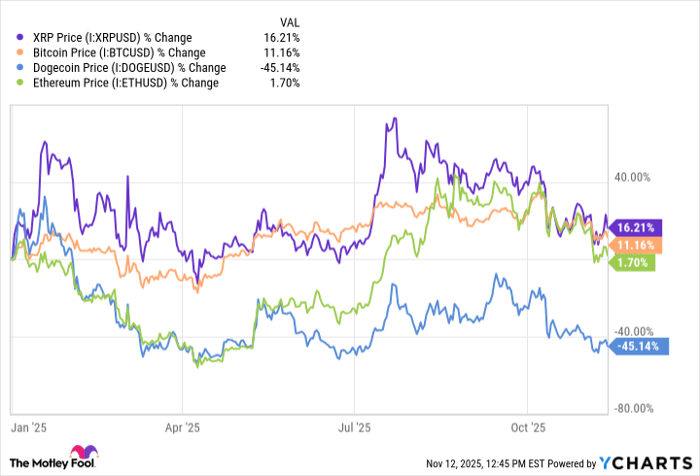

This year, the more mainstream, arguably "blue chip" cryptocurrencies like Bitcoin, Ethereum, and XRP have responded much better to the regulatory wins than Dogecoin. Dogecoin's near-term underperformance may be attributed to its unconventional investor base.

XRP Price data by YCharts.

While the blue chip cryptocurrencies have done a good job of breaking into the mainstream, Bitcoin and Ethereum both boast spot ETFs, while XRP's developer RippleLab has applied for a U.S. banking license. Dogecoin's brand image remains highly speculative, and this won't be an easy stigma to shake because of the asset's origin as a meme coin.

Imagine that McDonald's suddenly started trying to portray itself as a health food company, or that fossil fuel giant Exxon launched an electric car. Often, how you start is how you finish. And Dogecoin's brand image lends itself more to boom-and-bust speculation than long-term holding.

The asset's design also comes with some long-term challenges. Unlike Bitcoin, which has a fixed number of coins that can ever be mined, Dogecoin's supply is programmed to expand infinitely. There are currently 151.84 billion units of Dogecoin in circulation, and this number will increase by 5 billion units every year forever. That's an extra 9,500 Dogecoin minted every minute, or 13.7 million per day. With such heavy dilution -- roughly 3.3% in 2025 -- Dogecoin can certainly feel like a joke for long-term investors.

Dogecoin is for speculating, not investing

Image source: Getty Images.

The fine line between investing and speculating is even thinner than normal when it comes to the cryptocurrency industry. That said, Dogecoin has glaring fundamental weaknesses compared to the alternatives. The asset excels in capturing short-term spikes in cryptocurrency demand, but with built-in dilution and a retail-driven investor community, it will usually give back most of its gains when market sentiment cools down. Millionaire-making returns are possible. But there is a lot of risk.

Should you invest $1,000 in Dogecoin right now?

Before you buy stock in Dogecoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dogecoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.