3 Reasons to Buy Progressive Stock Before 2026

Key Points

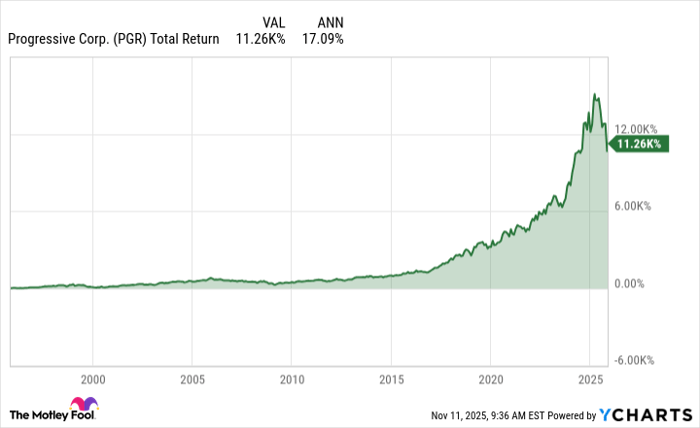

Progressive is a leading auto insurer in the U.S. that has a long history of delivering market-beating returns.

The company consistently outperforms its peers thanks to superior risk management and pricing ability.

The business has pricing power, and it is well-equipped to grow alongside the economy and in inflationary periods.

- 10 stocks we like better than Progressive ›

The stock market has gotten expensive! According to the Shiller price-to-earnings ratio, which tracks long-term valuations, we're nearing the most expensive market ever. In this backdrop, it can feel intimidating to put money to work, but opportunities are always available somewhere. The Motley Fool recommends holding at least 25 different stocks to provide diversification and smooth out your investment returns over time.

One standout option to consider is Progressive (NYSE: PGR). It has faced some industry-specific challenges this year; as a result, the stock is down 25% from its all-time high. However, I think the dip presents a fantastic buying opportunity for investors. Here are three reasons why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Robust market share in a high-demand industry

Progressive's primary business is automotive insurance, a product that is always in demand because people want to protect themselves against financial losses. Additionally, every state requires some form of minimum liability coverage to drive, and auto lenders often require full insurance on leased or financed vehicles, making coverage non-optional for most drivers. This provides its business with steady demand.

Furthermore, the industry is highly competitive, and Progressive is well-positioned as the second-largest U.S. auto insurer today, with a 15% market share, trailing only State Farm.

Being a top auto insurer means Progressive has a wide-ranging exposure and can spread risk across millions of drivers nationwide. Its scale also enables it to negotiate more favorable repair and parts costs and acquire customers at a lower cost.

2. Superior profitability versus peers

Strong demand for auto insurance provides Progressive's business with a tailwind; however, the company's biggest strength lies in its ability to assess risk and select and price policies appropriately.

Because the auto insurance industry is highly competitive, companies can only compete on price and coverage, striking a balance between the two. If you pursue growth excessively, you may expose yourself to additional risks. But if you don't take on enough risk, you may not grow as quickly.

Progressive strikes a balance between the two. Over the past two decades, the company has consistently generated roughly $8 in underwriting for every $100 in premiums earned. In the highly competitive insurance industry, where all insurers break even, on average, Progressive's stellar underwriting stands out.

This is also why the stock has been an excellent performer, averaging returns of 17% compounded annually over the past three decades.

PGR Total Return Level data by YCharts

3. An excellent hedge against inflation

In recent years, inflation has risen to its highest level in four decades. The yearly change in the consumer price index (CPI), a key measure of inflation in the economy, came in at 3% for the month of September, and it may not return to the Federal Reserve's 2% target anytime soon. That's because there are structural forces that could push costs higher.

For example, the U.S. is seeking to reshore its supply chains and reduce its dependence on foreign countries for certain goods and services. President Donald Trump has used tariffs as one incentive to reshore, but doing so will require significant investment in infrastructure. This comes while spending on artificial intelligence (AI) is accelerating. All of these new data centers will require increased energy consumption.

Image source: Getty Images.

Furthermore, if labor markets remain tight due to lower immigration and a high retirement rate among an aging baby boomer population, inflation could persist stubbornly higher in the years to come.

For insurance companies, higher average inflation cuts both ways. Claims become more expensive to resolve, including auto repairs and legal settlements. That said, insurers like Progressive have strong pricing power and disciplined underwriting, and over time, they can adapt to rising costs by increasing their premiums. At the same time, bond yields help boost insurers' investment income.

A quality stock for long-term investors

Progressive presents a compelling investment opportunity, as it thrives in a growing economy while also serving as a shield against inflation and rising interest rates, which could persist in the coming years. With the stock down 25% from its all-time high and priced at 12 times earnings, now looks like an excellent time to buy.

Should you invest $1,000 in Progressive right now?

Before you buy stock in Progressive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Progressive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends Progressive. The Motley Fool has a disclosure policy.