3 Reasons to Buy United Parcel Service Stock Like There's No Tomorrow

Key Points

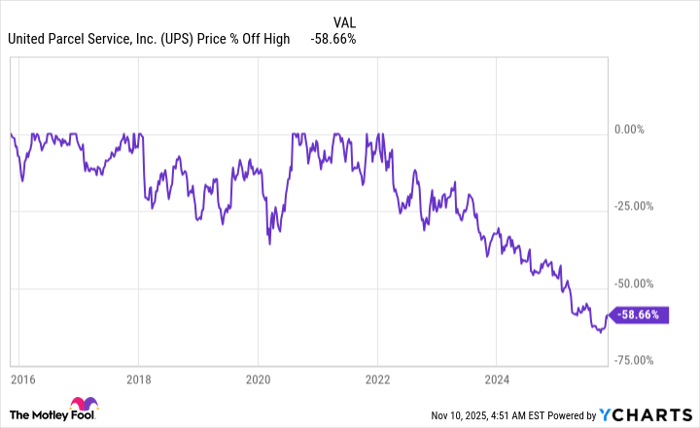

United Parcel Service stock has fallen a huge 50% from its 2022 highs.

Traditional valuation metrics show that UPS' valuation is attractive.

Management's actions are slowly starting to show some progress.

- 10 stocks we like better than United Parcel Service ›

United Parcel Service (NYSE: UPS) has a lofty 6.8% dividend yield, which might be enticing to income investors. But a dividend payout ratio over 100%, coupled with the business reset taking shape, pull the stock out of the dividend camp and put it firmly into the turnaround arena. From that vantage point, UPS could be very attractive. Here are three reasons why.

1. United Parcel Service is deeply unloved

Emotions on Wall Street generally swing from overly enthusiastic to overly pessimistic. During the coronavirus pandemic's height, when online shopping was the only option for many consumers, demand for shipping services spiked. Investors bid up the price of UPS as if demand would never return to normal. When demand did, in fact, return to normal, shares plummeted. They are now down over 50% from the peak reached in early 2022.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

UPS data by YCharts.

It is worth digging in when Mr. Market, the fictional character created by famed value investor Benjamin Graham, gets extremely pessimistic. UPS has created the infrastructure to move packages around quickly and cost-effectively. What it achieves is logistically impressive and would be very hard to replicate or replace. Even Amazon, which has built out its own delivery services, still uses UPS. The company may have become a little bloated, but package delivery is a necessity, and UPS isn't likely to go away any time soon.

In other words, there's value in the business, even if the market is discounting that value right now.

Image source: Getty Images.

2. UPS' stock looks cheap

Some numbers will help on the valuation front. UPS' price-to-sales ratio is currently around 0.9x, compared to a five-year average of 1.4x. The stock's price-to-earnings ratio is just under 15x, compared to a longer-term average of roughly 18x. And the price-to-book value ratio is 5.1x, compared to a five-year average of 8.5x.

All three of these traditional valuation tools hint at an attractive price. The dividend yield, meanwhile, is near the high end of the stock's historical yield range. That also hints at a value price, though, as noted above, the high dividend payout ratio suggests that the dividend could be at risk as the company works to reset its business. To reiterate, this is a turnaround story more than an income story. If the dividend survives, it's icing on the cake.

3. Early results are what you would hope to see

So investors clearly don't like UPS today. That has pushed the valuation of a necessary and hard-to-replace business to attractive levels. But what is actually going on? UPS' management took a step back and realized that the company had become bloated and wasn't as efficient as it could be. It has undertaken an overhaul to better position the company for the future.

The efforts have included exiting entire business lines, capital investment in technology, reducing headcount, and refocusing on more profitable customers. That last point includes reducing work with less profitable customers, including high-volume but low-profit Amazon business. It makes sense that Wall Street is negative right now when you step back from this. UPS is spending more money and bringing in less revenue, so the income statement is kind of ugly right now.

But the company is starting to see some green shoots. For example, in the second quarter of 2025, revenue per piece in the U.S. market, the most important division within UPS, rose 5.5%. That was followed up by an increase of 9.8% in the third quarter. To be fair, there is a lot more work to be done at UPS, but it looks very clearly like management's efforts are achieving positive results.

UPS: It looks like the inflection point is here

One quarter doesn't make a trend, but two start to look a lot more interesting. UPS' turnaround is hardly complete, but by the time it is, the stock will likely have rallied and it won't be worth buying anymore. If you are a more aggressive investor, UPS' story is starting to look very attractive. Buying now will get you in early, but if you wait until some future tomorrow, you could miss the turnaround opportunity entirely.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and United Parcel Service. The Motley Fool has a disclosure policy.