Where Will Palantir Stock Be in 10 Years? My Best Guess

Key Points

Palantir is benefiting handsomely from powerful artificial intelligence (AI) tailwinds.

While the company's outlook is robust, satisfying investor expectations may become harder over time.

This stock appears overbought based on traditional valuation methods.

- 10 stocks we like better than Palantir Technologies ›

Outside of the "Magnificent Seven," I am hard-pressed to think of a company that's benefited from the artificial intelligence (AI) revolution as much as Palantir Technologies (NASDAQ: PLTR). Over the last three years, shares of the data analytics platform have risen by 2,300%.

To add context here, Palantir's market capitalization hovered around $12 billion at the dawn of the AI boom. Today, the company is worth $456 billion -- more than Salesforce and Adobe... combined!

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With so much excitement surrounding Palantir, it's hard to imagine the company's momentum slowing down anytime soon. But if we take a longer timeframe into account?

Image source: Getty Images.

Below, I'll detail how Palantir has come to dominate the AI software industry while also assessing the company's valuation profile and what could be in store over the next decade.

Palantir is in a league of its own...

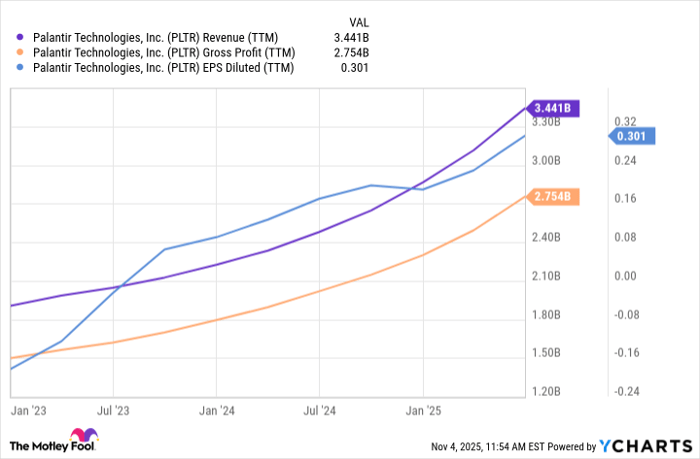

Palantir sells AI-powered analytics software to large corporate enterprises as well as government agencies. If the financial profile below is any indication, Palantir's products are in exceptionally high demand. Revenue is accelerating, gross profit is rising, and earnings growth is compounding.

PLTR Revenue (TTM) data by YCharts

According to the company's third-quarter earnings report, Palantir has $3.6 billion in remaining performance obligations (RPO) from just its U.S. commercial business segment. This is an important metric to understand, as many of the deals Palantir signs are multi-year contracts -- which provides the company with visibility into its sales trajectory and ultimately helps with cost allocation, too.

On top of this, Palantir closed 204 deals during the third quarter -- roughly one-quarter of which were for at least $10 million. Furthermore, the company also closed $2.8 billion worth of contracts in total -- representing 151% growth year over year and a company record.

Given these dynamics, I don't expect the trends illustrated above to plateau anytime soon.

...but so is the company's valuation

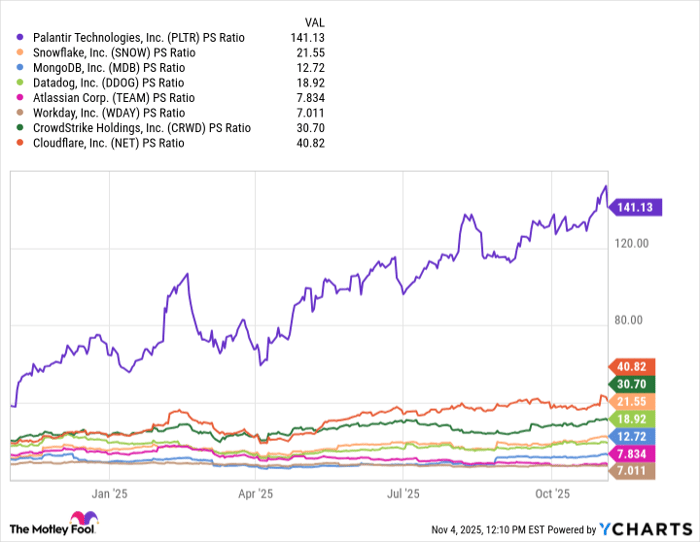

When it comes to valuation, some of the traditional methods include looking at a company's price-to-sales (P/S) and price-to-earnings (P/E) ratios. Looking at these figures alone won't reveal much, but comparing them to a peer set of comparable businesses can help set a benchmark for a company's value relative to its industry cohorts.

PLTR PS Ratio data by YCharts

In the chart above, I've included a comprehensive group of software-as-a-service (SaaS) platforms across various end markets to get a sense of which company types command the highest multiples, and how they stack up against Palantir.

Per the analysis above, it's clear that Cloudflare and CrowdStrike trade at a premium within the broader SaaS realm. This isn't surprising, as both of these businesses operate at the intersection of two emerging markets: AI and cybersecurity.

However, when you take Palantir's P/S multiple of 141 into account, investors can see how overbought the stock has become when compared to other high-growth players.

Taking this a step further, Palantir's P/E ratio of 623 is so extended it's not even useful to look at. The subtle idea to understand is that while the company remains profitable, Palantir's earnings are still relatively nominal -- making profitability-based valuation metrics less applicable.

Prediction: Palantir stock will be worth less in 10 years than it is today

Palantir's meteoric rise over the last few years is nothing short of impressive. But that fact of the matter is that stocks do not rise by several thousand percent without experiencing a hiccup every now and again. In other words, Palantir's share price returns throughout the AI revolution are incredibly abnormal, and smart investors are expecting a pullback to occur at some point.

While Palantir's business is currently firing on all cylinders, it's natural for investors to wonder about the impacts of rising competition and shifting economic cycles, and how these variables will affect long-term demand for AI software in the future. The reality is that no one can accurately predict these outcomes with definitive certainty.

Although Palantir has achieved some form of growth visibility through its existing customer base, investors are going to increasingly demand incremental growth beyond these contracts. If the company cannot deliver or satisfy those expectations, sentiment could change quickly -- potentially sending the stock into a sharp tailspin.

While it may be tempting to follow the crowd into Palantir's seemingly unstoppable rally, a common mistake for beginner investors is to buy a stock based purely on the fear of missing out (FOMO).

All told, I think rising expectations around Palantir's business results could eventually fuel a sell-off in the stock. Taking this a step further, if a correction eventually comes to light, it could be years before shares bounce back to prior highs.

For these reasons, I think Palantir's frothy valuation is making the setup for an eventual price correction increasingly likely.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $591,613!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,905!*

Now, it’s worth noting Stock Advisor’s total average return is 1,034% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Adobe, Atlassian, Cloudflare, CrowdStrike, Datadog, MongoDB, Palantir Technologies, Salesforce, Snowflake, and Workday. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.