Why D.R. Horton Stock Fell 12% in October

Key Points

Revenue and profits both fell in the home builder's fourth-quarter earnings report.

Some Wall Street analysts lowered their expectations for the stock.

D.R. Horton's guidance doesn't call for a recovery in 2026.

- 10 stocks we like better than D.R. Horton ›

Shares of D.R. Horton (NYSE: DHI), the U.S.'s largest homebuilder, slipped last month. The company continued to struggle with sluggish homebuying demand, even as mortgage rates have fallen.

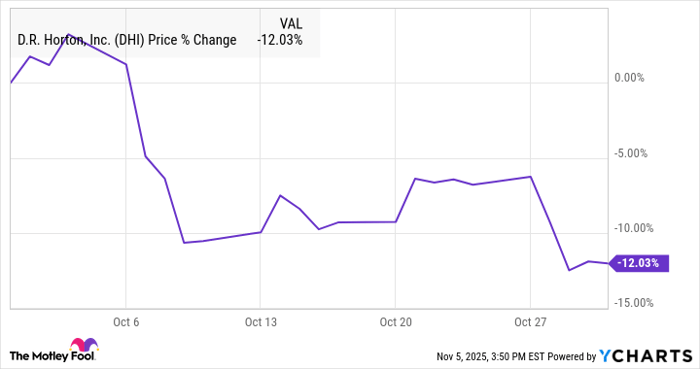

The biggest catalysts for the stock in October were an analyst downgrade that pushed shares lower early in the month and an underwhelming earnings report near the end of October. By the end of the month, the stock had given up 12%, according to data from S&P Global Market Intelligence.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

As you can see from the chart below, the stock mostly fell in separate stages.

DHI data by YCharts.

What's happening with D.R. Horton

To kick off the month, a class action lawsuit was filed against D.R. Horton, charging that it had misled homebuyers about the monthly costs of buying its homes. The stock didn't immediately respond to that news, but it could have weighed on the stock later in the month as reports of the lawsuit spread through the media.

D.R. Horton's first step back came on Oct. 7, when the stock fell 6% after an analyst downgrade.

Evercore ISI lowered its rating on the stock from outperform to in line and cut its price target from $185 to $169. The research firm noted that homebuilder stocks had rallied through the summer on hopes that falling mortgage rates would help drive a rebound in demand, but that has not yet played out.

Evercore thinks margins need to hit bottom before valuation multiples in the sector start expanding again, and it doesn't see that happening soon.

Bank of America echoed those concerns in a note on Oct. 10, lowering its price target from $175 to $165. It said that housing demand remains sluggish and incentives are elevated, weighing on profits.

The big news on D.R. Horton during the month came out on Oct. 28 as it reported fourth-quarter earnings. The company beat top-line estimates at $9.42 billion, even as revenue fell 3.3% to $9.68 billion.

The bottom line is what counts, though. Earnings per share fell from $3.92 to $3.04 as costs rose, missing expectations at $3.29. The company repurchased 9% of shares outstanding over the past year, meaning that net income was down even more.

The results seem to confirm the fears of the analysts above, and the stock fell 4% on Oct. 29 in response to the report.

Image source: Getty Images.

What's next for D.R. Horton

Looking ahead to fiscal 2026, the company expects revenue of $33.5 billion to $35 billion, which was below the consensus of $34.9 billion at the midpoint and basically flat from $34.3 billion in revenue in 2025. D.R. Horton also expects to close 86,000 to 88,000 homes, above last year's mark of 84,863.

Macroeconomic trends imply that average home prices will rise while unit sales are falling. That's a tough spot for D.R. Horton, even though mortgage rates are coming down.

A lot can change in the next year, and the housing market could start to turn around, but the weakening in the labor market and in consumer discretionary spending bodes poorly for a recovery in home purchasing.

Should you invest $1,000 in D.R. Horton right now?

Before you buy stock in D.R. Horton, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D.R. Horton wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $592,390!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,196,494!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Bank of America is an advertising partner of Motley Fool Money. Jeremy Bowman has positions in Bank of America. The Motley Fool has positions in and recommends D.R. Horton. The Motley Fool has a disclosure policy.