Wall Street Warns Investors About Palantir Stock

Key Points

Palantir has seen demand for its software soar in recent quarters, and that’s translated into enormous revenue growth.

The company also has done an outstanding job of balancing revenue growth with profitability.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) has amazed investors quarter after quarter with its earnings growth -- this is thanks to a more than 20-year-old, well-established software business and the company's integration of artificial intelligence (AI) into its platforms. Customers from governments to commercial players have flocked to Palantir for software that's helped them become more efficient and has supercharged their operations.

Palantir's stock performance has reflected this success, as the shares have soared more than 2,400% over the past three years. This is fantastic news for those who got in early on this company's story, but in recent times, even as Palantir continues to report explosive growth, some analysts have expressed concern about one big problem that this company and its investors face. In fact, most Wall Street analysts who cover the stock don't recommend buying it right now -- the most common recommendation currently is a "hold."

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Let's find out why Wall Street is warning investors about this AI player that's seen its shares skyrocket.

Image source: Getty Images.

Palantir's success story

First, though, it's important to take a look at how and why Palantir has become so successful. As mentioned, the company isn't new to the software business, and over time developed high-quality platforms that help its customers analyze and make better use of their data -- which often are quite scattered. This unorganized data is no problem for Palantir. The company has been able to bring this valuable information together for its customers so they may use it to launch game-changing decisions or plans.

In Palantir's early days, it relied on the U.S. government for most of its business, but in recent quarters -- especially after the launch of its Artificial Intelligence Platform (AIP) two years ago -- the commercial customer has emerged as a key growth driver. Companies from United Airlines to mining leader Rio Tinto Group have turned to Palantir and are seeing results. For example, Rio Tinto says AIP has helped it access its unstructured data and take on problems that before seemed too complicated.

Commercial revenue skyrockets

Palantir's latest earnings report, delivered this week, confirmed the ongoing strength of the company's platforms. In the quarter, the tech player recorded double-digit gains in U.S. government revenue, and a triple-digit increase in U.S. commercial revenue. Total revenue advanced 63% to more than $1.1 billion, and importantly, Palantir once again demonstrated that it's balancing this tremendous growth with profitability.

We can see this in its Rule of 40 score, which reached a mind-boggling 114%. To put this into perspective, consider that, generally, a score of 40% is considered good, showing a software player has managed growth and profitability.

On top of this, Palantir raised annual forecasts for revenue, U.S. commercial revenue, adjusted income from operations, and adjusted free cash flow.

In spite of this show-stopping performance, Palantir stock declined after the news. And this brings me back to the problem Palantir faces right now -- the one that has prompted Wall Street to warn investors about buying the stock.

Palantir's big problem

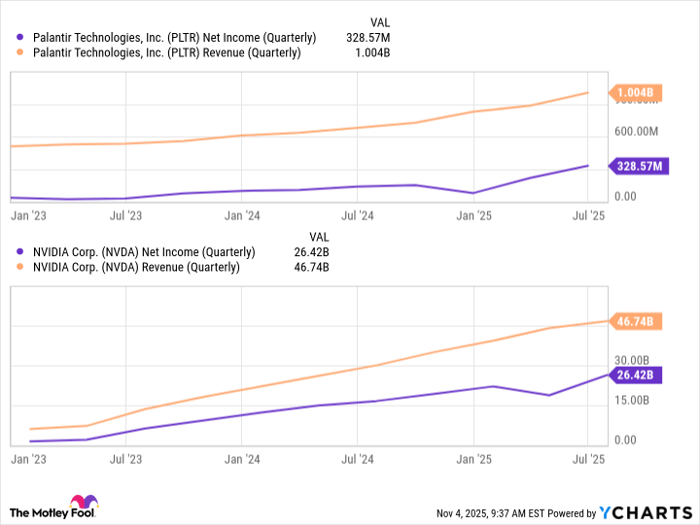

This problem is valuation. Though Palantir is seeing tremendous growth, some say the stock performance well accounts for that and for growth in the coming months. This is because Palantir stock right now trades for more than 300x forward earnings estimates. By comparison, AI chip giant Nvidia, a company with much higher earnings levels, trades for about 45x forward earnings estimates today.

PLTR Net Income (Quarterly) data by YCharts

So, analysts worry that, at this valuation, Palantir stock may be ripe for a decline -- in fact, the average forecast calls for a 16% decrease over the coming 12 months.

Now the big question is: What should investors do? After all, Palantir's earnings are rock solid, demand for its software continues at a healthy pace, and signs such as customer count and deal size suggest we may be in the early days of commercial customer growth.

It's important to remember that valuation includes earnings estimates for the year to come -- but doesn't consider the company's potential a few years down the road. At that point, the valuation picture could change. Still, today's valuation may scare off some investors and put the brakes on Palantir's stock performance in the near term.

All of this means the decision about whether to buy Palantir depends on your investment style. If you're a cautious or value investor, Palantir clearly isn't the right choice for you. But if you're an aggressive investor who owns a diversified portfolio and who aims to hold onto investments for the long term, any dip in Palantir stock could represent a great buying opportunity.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,269!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,268,146!*

Now, it’s worth noting Stock Advisor’s total average return is 1,076% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.