Think It's Too Late to Buy IonQ Stock? Here's the 1 Reason Why There's Still Time.

Key Points

The long-term impact of quantum computing could be several trillion dollars.

IonQ has been developing its technology for 30 years.

The company says its push into quantum networking will double the company's addressable market.

- 10 stocks we like better than IonQ ›

Quantum computing is expected to be the next wave of innovation beyond artificial intelligence (AI) that could lead to major technological breakthroughs that traditional computers are not capable of executing. The enthusiasm for its potential has sent share prices of IonQ (NYSE: IONQ) soaring more than 300% over the past year.

Given that steep (and quick) rise, it's natural for investors to feel like they have missed their chance with such a stock, but great companies don't just double or triple; they deliver multibagger returns over decades. IonQ might just be getting started.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

IonQ just recently made a huge breakthrough that could lead to tremendous growth over the next decade and beyond.

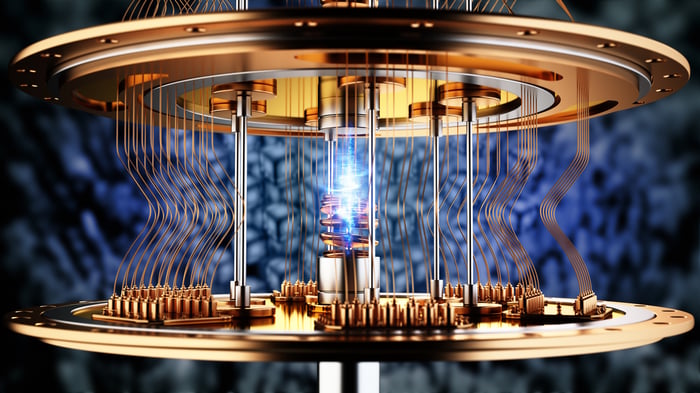

Image source: Getty Images.

IonQ's opportunity could be bigger than anyone thinks

IonQ has been developing quantum computing for 30 years, and it could be on the verge of accelerating the commercialization of its technology. The goal is to expand into quantum networking, which could unlock tremendous upside for the company's revenue.

In September, IonQ announced it had successfully transformed visible-wavelength photons into telecom wavelengths. This paves the way for isolated quantum computers separated by long distances to link together over existing fiber optic networks, ultimately paving the way for a quantum internet.

The long-term economic impact of quantum computing is estimated to eventually reach into the trillions. He didn't provide a specific estimate, but CEO Niccolo de Masi recently said quantum networking will at least double the company's market opportunity.

Given the transformative effect this could have on the economy, IonQ's current $18 billion market cap doesn't appear all that expensive, but it is currently trading at a very high multiple of its trailing revenue. Investors will have to be prepared for volatility in the share price, but for an investor who can patiently hold the stock for 10 years, it is not too late to invest in IonQ.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 27, 2025

John Ballard has positions in IonQ. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.