1 Growth Stock Down 17% to Buy Right Now

Key Points

Netflix sold off for reasons that have nothing to do with its investment thesis.

The streaming giant is producing monster hits across genres and formats, including feature films, animated features, and multipart series.

Netflix should continue to take market share from linear networks over the long run.

- 10 stocks we like better than Netflix ›

Shares of Netflix (NASDAQ: NFLX) fell 10.1% on Wednesday after the company reported a surprise earnings miss due to an ongoing Brazilian tax dispute that resulted in an unexpected $619 million charge.

Consensus analyst estimates had guided for $6.97 in earnings per share; Netflix only delivered $5.87. But to its credit, revenue came in as expected.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

At the time of this writing, the stock is down 17% from its 52-week high, and here's why the sell-off in Netflix is an impeccable buying opportunity for long-term growth investors.

Image source: Getty Images.

Know what game you are playing

When great companies sell off for nonrecurring reasons, I'm often reminded of my favorite chapter from Morgan Housel's book The Psychology of Money. In it, Housel discusses the importance of knowing what game you're playing, describing the stock market as a playing field where multiple games are being played simultaneously.

On this field, there are traders looking to make a quick buck. To them, a stock's price is more important than the business behind it.

Then, there are long-term investors who view the stock price as merely a reflection of sentiment in the moment. They are investing in the company for the long haul, perhaps three to five years, or maybe even decades. There are individual investors like you and me, and there are institutional investors with multibillion-dollar portfolios.

These two forces act like a tug-of-war on the stock price. Over the long run, earnings drive stock prices. But in the short term, traders can have a big impact.

Traders who were riding Netflix higher and betting big on a perfect earnings report didn't get it. The company unexpectedly incurred hundreds of millions of dollars in losses from the Brazilian tax issue.

And that blind-side hit was so strong that it erased over $50 billion in market cap in a single session. But this sell-off has nothing to do with Netflix's investment thesis.

The making of a cash cow

Dig deeper into Netflix's results, and you'll find that the underlying business is stronger than ever.

Without the $619 million expense, Netflix would have exceeded its operating-margin guidance of 31.5%. Full-year revenue is expected to grow 16% year over year, and Netflix expects a full-year operating margin of 29% -- even when factoring in the Brazilian tax issue.

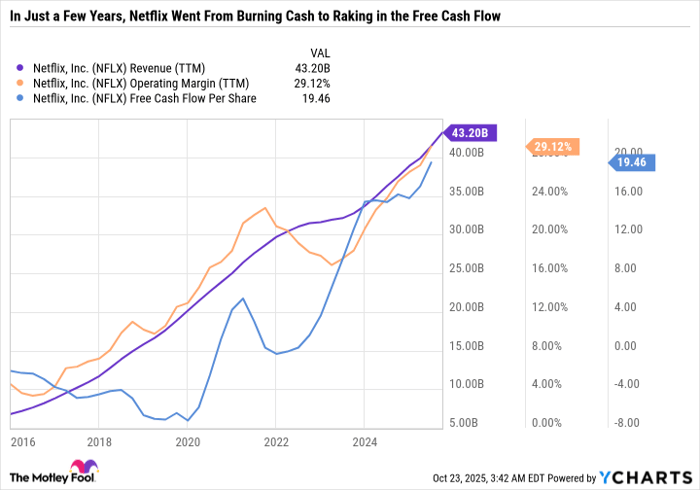

The company said it remains committed to growing revenue, operating margins, and free cash flow. As you can see in the following chart, Netflix has gone from inconsistently profitable to a high-margin cash cow.

NFLX Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Netflix has perfected a formula for content creation, in terms of both quality and quantity. As a subscription business, the streamer must produce or license enough content and maintain an attractive existing library to keep subscribers engaged and to justify price increases. It has aggressively increased prices in recent years without dramatically affecting its subscriber base -- a testament to the value of its service.

Maximizing major hits

One ingredient of Netflix's secret sauce is undoubtedly its major hits. Netflix has such a high content budget that it can afford to take risks, swinging big and often striking out but also hitting some clutch walk-off home runs now and then.

In recent years, Stranger Things, Squid Game, and now KPop Demon Hunters are three good examples of somewhat unexpected hits. These aren't high-budget box office films with star-studded casts and gobs of marketing budgets. But they embody what makes Netflix unique.

Stranger Things originated in the U.S., and Squid Game was initially produced for a South Korean audience and later dubbed in multiple languages. KPop Demon Hunters is an animated film, not a series, which became Netflix's most successful film ever -- animated or live action.

The company is stretching its content further, in terms of franchise flywheels and global markets. The first four episodes of the fifth season of Stranger Things will be released on Nov. 26. Netflix has transformed one eight-episode season into nearly a decade of value creation.

Netflix just tapped Mattel and Hasbro for shared master toy licenses of KPop Demon Hunters. With global interest high, there's a runway for multiple sequels if Netflix chooses.

There are plenty of other examples of smash hits across categories, from reality TV shows to historic dramas and comedies. And despite being the undisputed global leader in streaming, Netflix remains a coiled spring for long-term growth.

In its third-quarter shareholder letter, management cited data that showed its share of TV time grew from 7.5% in the fourth quarter of 2022 to 8.6% in the third quarter of 2025 in the U.S.; in the U.K., it went from 7.7% to 9.4%.

In an industry still dominated by linear networks (i.e., cable), Netflix believes there's room to continue capturing market share by attracting audiences with different interests and expanding its content slate.

Play the long game

Netflix's content range and global distribution make it well positioned to sustain growth over the long term. The business is at the top of its game, and the stock sold off for reasons that may spook traders, but not long-term investors.

Now is the time to take a step back, tap into Housel's wisdom, and remember what game you're playing. If you're investing in Netflix for at least three to five years, this earnings report was a dream come true because it reaffirmed all the reasons it is a great company and gave investors a 10%-off coupon on the stock.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool recommends Hasbro. The Motley Fool has a disclosure policy.