Meet the Exciting AI Stock That Has More Than Tripled This Year, and Which Nvidia Is Investing In

Key Points

CoreWeave is Nvidia's largest investment.

CoreWeave is providing AI-focused cloud computing infrastructure to its clients.

The biggest issue surrounding CoreWeave is its profit margin.

- 10 stocks we like better than CoreWeave ›

Nvidia (NASDAQ: NVDA) has been one of the undisputed winners of the artificial intelligence (AI) investing trend. It's a critical supplier of high-powered computing software, and it knows where the money is flowing in the AI race. So, if Nvidia takes a stake in a company, investors should pay attention.

According to Nvidia's latest 13-F filing, it only holds shares of six stocks. Its largest investment by far is CoreWeave (NASDAQ: CRWV). Nvidia's stake in CoreWeave totals over 24 million shares, worth over $3 billion. CoreWeave's stock has more than tripled since going public earlier this year, but is still about 25% off its all-time high set in July.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

With CoreWeave being backed by one of the most successful companies in the world, is it worth buying right now?

Image source: Getty Images.

CoreWeave is an AI-first cloud computing business

Not every company competing in the artificial intelligence race has the capabilities to build a giant data center filled with the most cutting-edge chips from Nvidia. They need to rent compute from another company that does. This isn't a new business model; cloud computing companies have been doing this for years. However, only CoreWeave's platform is specifically marketed and designed to fulfill AI needs.

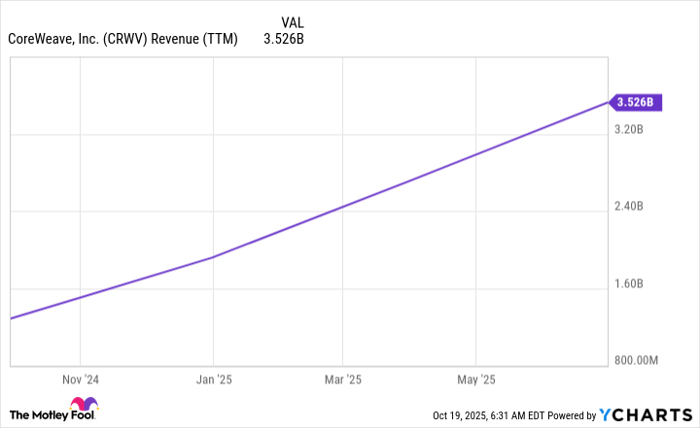

This has caused rapid growth in CoreWeave's business. In Q2, revenue rose 207% year over year to $1.2 billion, with its revenue backlog (deals that it has signed and has yet to realize revenue on) rising 86% year over year to a jaw-dropping $30.1 billion. Few companies have that level of revenue visibility, but CoreWeave has already locked up several years' worth of business.

CRWV Revenue (TTM) data by YCharts.

After seeing numbers like that, it's no wonder the stock has been popular with investors and that Nvidia is a major investor in this business.

At the same time, why is CoreWeave's stock down from its high if it's seeing that kind of success? It all comes down to CoreWeave's profits (or lack thereof).

CoreWeave is operating at a loss

CoreWeave isn't producing any net income. Most of the time, I'm OK with emerging and growing businesses operating at a loss as they capture market share. However, it doesn't make as much sense for CoreWeave to do so.

Graphics processing units (GPUs) from Nvidia have a relatively short lifespan. There are some estimates that GPUs last in Google Cloud's cloud platform for anywhere from one to three years. With that short a lifespan, CoreWeave will need to swap out GPUs quite often. As a result, it's not going to be a business that benefits from scale. A significant portion of its expenses will recur every couple of years when its computing units burn out.

The question becomes: If CoreWeave can't become profitable, now during the massive wave of AI spending, when will it ever be profitable? This is investors' primary concern, and it could also explain why CoreWeave has signed massive deals with AI hyperscalers like Meta Platforms. Although Meta is building out a lot of its own AI infrastructure, if CoreWeave is willing to put up a data center, equip it with short-lived GPUs, and run it at a loss, it likely makes financial sense for Meta to rent from it.

Given all this, I'm going to steer clear of investing in CoreWeave until it can prove that it's a feasible business model. There are plenty of examples of successful cloud computing businesses, so CoreWeave isn't trying to pioneer a new business model. It just needs to use what has already been proven out, and it could transform into a successful company. But the way it is being run now is concerning.

I think investors should buy the GPU supplier, Nvidia, instead, as it's slated to continue selling a massive number of GPUs for years to come.

Should you invest $1,000 in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $590,357!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,141,748!*

Now, it’s worth noting Stock Advisor’s total average return is 1,033% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Keithen Drury has positions in Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.