Meet the "Infinite Money Glitch" That Could Send Tesla Stock Soaring, According to Elon Musk

Key Points

Tesla's electric vehicle sales declined in the first half of 2025, but thankfully returned to growth in the recent third quarter.

Investors are more focused on Tesla's future product platforms like the Cybercab robotaxi and Optimus humanoid robot.

Tesla CEO Elon Musk is particularly bullish on the potential of Optimus, calling it an "infinite money glitch" for businesses.

- These 10 stocks could mint the next wave of millionaires ›

Tesla (NASDAQ: TSLA) is one of the world's largest manufacturers of electric vehicles (EVs), but with that part of its business struggling over the past year, investors have turned their attention to the company's future product platforms, like the Cybercab autonomous robotaxi and the Optimus humanoid robot.

Tesla CEO Elon Musk thinks Optimus, in particular, could be a game changer because of its versatility. During his third-quarter conference call with investors last week, he even called it an "infinite money glitch" for businesses that deploy it at scale, because of its incredible productivity. That's why earlier this year, he predicted there will be so much demand for Optimus that Tesla will eventually become the world's most valuable company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

That implies significant upside for shareholders, but how long can the enthusiasm for Optimus mask Tesla's sluggish EV sales, which still account for the majority of the company's revenue? Read on.

Image source: Tesla.

Humanoid robots could be Tesla's greatest opportunity ever

Optimus presents the most complex manufacturing challenge in Tesla's history. There is no existing supply chain for humanoid robots, so the company has to build most of the components in-house. Plus, designing robotic hands and forearms capable of delivering human-like dexterity is proving far more difficult than Musk imagined, but he thinks Tesla nailed it with the third generation of Optimus, which will launch in the first quarter of 2026.

But complex problems often breed significant opportunities. Musk believes humanoid robots will outnumber actual humans by 2040 because they can be deployed practically anywhere, from manufacturing facilities to offices to households. He says Optimus, specifically, could be five times more productive than a human, because it can operate 24 hours per day, seven days a week. It doesn't need lunch breaks, sick days, vacations or benefits, which is a game changer for businesses.

Musk thinks Optimus sales could generate $10 trillion in revenue for Tesla over the long term. According to the eccentric CEO's recent guidance, Tesla could start mass-producing Optimus 3 toward the end of next year, with the goal of scaling up to 1 million units annually. Then, he says the company will roll out Optimus 4, which could reach 10 million units per year, followed by 50 million to 100 million annual units of Optimus 5 thereafter.

In the meantime, Tesla's core business continues to struggle

In the here and now, over 75% of Tesla's revenue still comes from selling EVs. Unfortunately, the company delivered 720,803 cars in the first half of 2025, which was down 13% year over year. That followed a 1% decline during the whole of 2024.

Sales thankfully picked up in the recent third quarter, with deliveries growing by 7% to 497,099 units. But thousands of Americans likely raced out to buy EVs ahead of the Sept. 30 expiration of the $7,500 tax credit, which means Tesla might have borrowed some sales from the fourth quarter. Unfortunately, that means the final three months of the year could be slower than otherwise anticipated.

Competition remains Tesla's biggest issue. Despite EV sales growing in major markets like China and Europe this year, consumers are buying fewer Teslas in favor of EVs from cheaper brands like BYD. That means Tesla is rapidly losing market share -- for example, the company represented 7.5% of all EV sales in China during the first half of 2025, which was down from 11.7% in the year-ago period.

Tesla recently launched a low-cost version of its popular Model Y, which could revive its passenger EV business. However, Musk has resisted this strategy in the past because he wants the company to focus more on developing its self-driving robotaxi, the Cybercab, which is scheduled to enter mass production around mid-next year.

Tesla has been testing a ride-hailing service in some U.S. cities this year using its passenger EVs with its full-self driving (FSD) software installed. However, these cars require a human safety supervisor in the passenger seat, which adds costs. Musk believes the company could deliver a fully unsupervised service in Austin, Texas, before the end of 2025, which will pave the way for the widespread launch of the Cybercab next year.

Before buying Tesla stock, take note of its sky-high valuation

If Musk is right about Tesla becoming the largest company in the world one day, investors are set for some serious upside. Tesla's market capitalization is $1.3 trillion as I write this, so its stock would have to climb by 238% for it to match the $4.4 trillion market cap of Nvidia, which is currently the world's most valuable company.

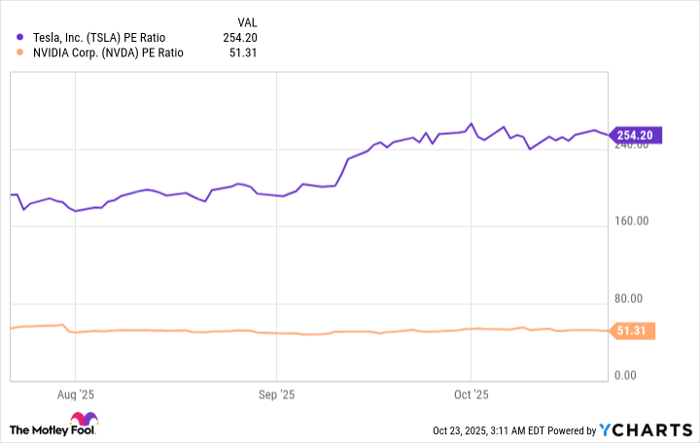

But before investors rush out to buy Tesla stock, its valuation warrants some consideration. Its price-to-earnings (P/E) ratio is an eye-popping 254, making the stock seven times more expensive than the Nasdaq-100 index, and five times pricier than Nvidia:

TSLA PE Ratio data by YCharts

Since Optimus is still at least a couple of years away from achieving scale, I'm not sure if it's wise to pay such a hefty premium for Tesla stock today, given the state of the EV business. It might be better for investors to revisit this opportunity toward the end of next year, when the robot is closer to production, unless its stock offers up a significant pullback before then.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $482,925!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $49,950!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $590,357!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

See the 3 stocks »

*Stock Advisor returns as of October 20, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Tesla. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.