Analyst Downgrades GEV: Is It Time to Sell?

TradingKey - On Wednesday, Rothschild Redburn analyst Simon Toyne downgraded GE Vernova (GEV) from Neutral to Sell, trimming his price target to 475, meaning fully below with its 600 level at the time of the call.

The company’s recent numbers? “Decent,” Toyne noted. At the heart of the downgrade, however, is one big question mark: can gas turbines, a core driver for GE Vernova, deliver long-term growth?

Historically, the gas turbine business has followed a familiar pattern: cycles of oversupply and sharp cuts, driven mostly by traditional infrastructure demand, government policy, and macro capex swings. In Toyne’s view, we might be heading back into that cycle.

But AI is being billed as the “single biggest driver” of future electricity demand. Toyne doesn’t necessarily disagree—but he does question whether the current projections are a little too confident, a little too early, and market sentiment is too high? Possibly ahead of fundamentals.

I don’t think so.

A Power Supercycle in the Making?

Since bottoming out during the COVID lows in 2020, the U.S. power industry has been staging one of the most consistent recoveries in recent memory. By 2022, demand had stabilized. Now we’re deep into what some are calling a “grid renaissance.”

This cycle is being built on more than just economic growth, Including Widespread electrification, across transportation and manufacturing and • Hardened grid investments to support resiliency and capacity. More importently,exponential demand from AI data centers, The AI part is still debated. But the capex isn’t.

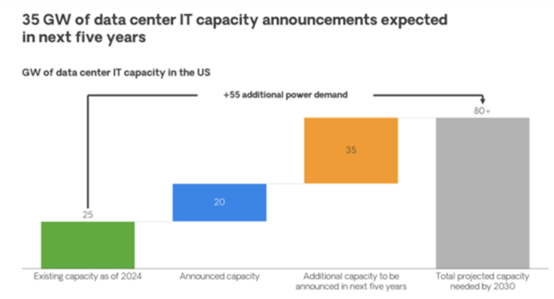

Market skepticism around AI-driven load growth is understandable. Forecasts swing wildly. But ground-level evidence is piling up fast. According to Bloom Energy, confirmed U.S. AI data center power demand has already hit 20 GW as of early 2025. That’s actual contracted capacity—not just chatter. Industry estimates tag an additional 35 GW in construction by next year. And even that could fall short.

OpenAI alone announced power deals totaling 26 GW just last month—without including the full future buildout of its Stargate supercomputing complex. Oracle and SoftBank are looped in too.

Meanwhile, S&P Global’s 451 Research says U.S. data center demand is tracking toward 75.8 GW by 2026, hitting 134.4 GW by 2030. That does not include internal cloud capex pipelines from Microsoft, Google, Amazon, or Apple.

In other words: this thing is bigger than the forecast debate. And it’s already happening.

So, Where Do Gas Turbines Come In?

You’d be forgiven for thinking gas turbines don’t belong in this story. But in reality, they’re becoming one of the most pragmatic tools in the AI buildout toolkit.

Massive data campuses often require power on a gigawatt scale. Grid capacity isn’t always there. Renewables help, but not with guaranteed uptime. Batteries don’t scale fast enough to meet baseload obligations.

That’s where combined-cycle gas turbine (CCGT) plants come in. They start fast. They run reliably. They integrate well with green portfolios. And they can be deployed close to the load when utility transmission falls behind.

This demand is already showing up across OEMs. Siemens just posted an order backlog north of €133 billion. GE Vernova is right behind, with a backlog nearing $130 billion in Q2—one of the highest in company history.

Are Margins Getting Overhyped?

Toyne’s second concern centers on profitability. Specifically, he questions whether GE Vernova can actually deliver the margin expansion the market is pricing in.

Gas turbines have never been known for ultra-stable bottom lines. They depend heavily on long-cycle project timing, regulatory tailwinds, and large industrial buyers. Toyne points to past volatility and implies we may be due for a reversion.

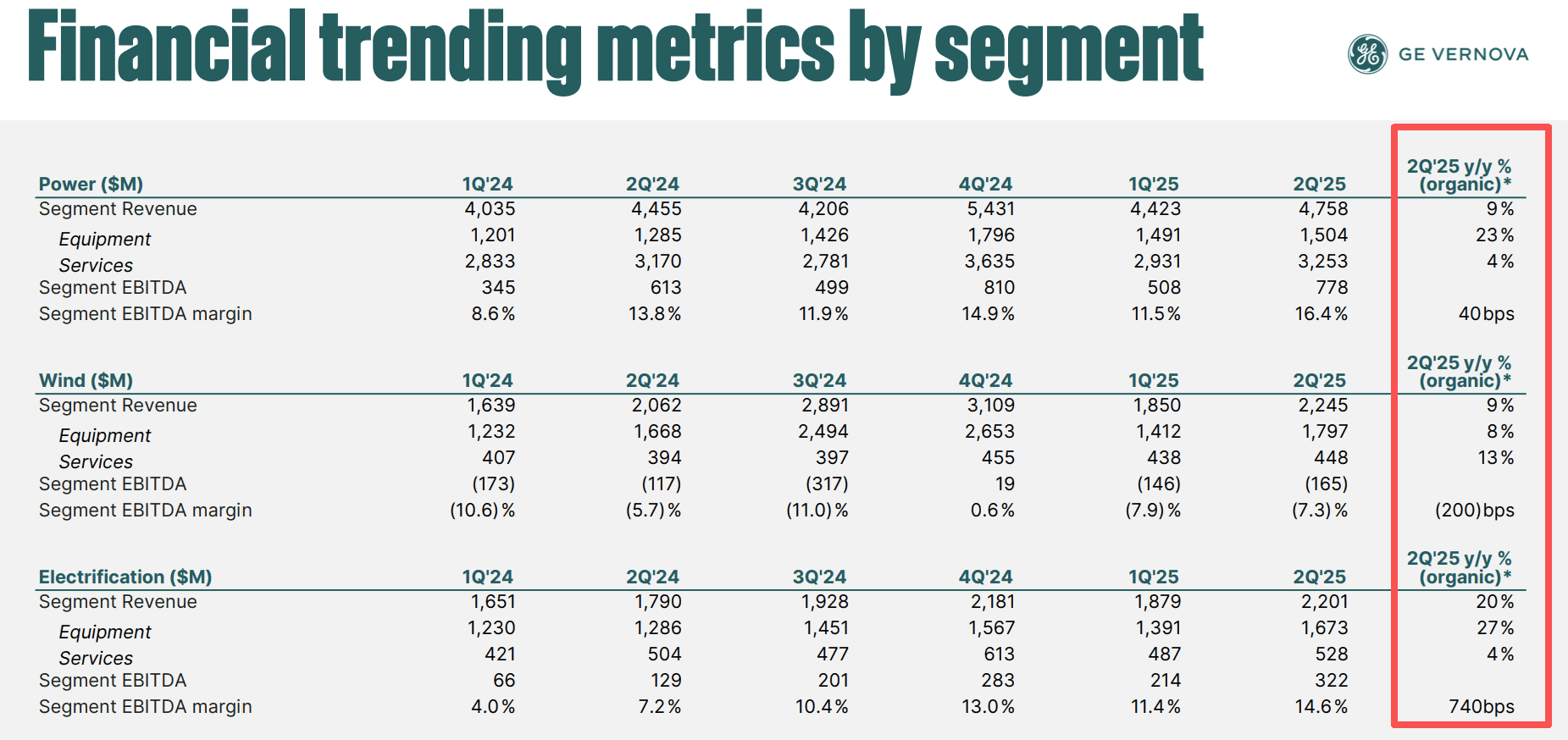

But the most recent numbers suggest something else. In Q2 2025, GE Vernova delivered: 1) Power segment EBITDA margin: 16.4% (up from 13.8%);2) Electrification margin: 14.6% (nearly double from 7.2%).3) Wind is still in transition, but expected to breakeven in the second half.

On that basis, management raised full-year margin guidance to a range of 8%–9%. This isn’t just cleanup from the spinout. The business structure is actively improving.

Earlier this year, UBS analyst Amit Mehrotra laid out a much more bullish roadmap. His base case: GE Vernova could hit up to 70% compound earnings growth over the next five years.

The thesis is based on A mix of reasons: AI-driven demand that can be fulfilled; Equipment order books that de-risk near-term revenue; And long install timelines that give delivery visibility in long term.

Meanwhile,GE Vernova, Siemens Energy, and Mitsubishi Heavy Industries account for over 75% of the global gas turbine market. That kind of market share gives pricing power.

With massive new capacity planning coming online, only a few global players can actually fulfill these orders in time. That’s especially important as countries push for higher energy security, and hands-on control over net-zero infrastructure.

Nuclear—and specifically, small modular reactors (SMRs) is another potential driver.

In 2025, GE Vernova got approval from Ontario to move forward with its BWRX-300 design, marking the first SMR deployment approved in a Western country. A second pilot unit is planned in Oak Ridge, Tennessee.

The real kicker is unit economics. SMRs are factory-manufactured, highly replicable, and potentially far cheaper than legacy nuclear builds. If the technology scales, it could become a core part of GEV’s earnings profile over the coming decade.

Toyne isn’t wrong to be cautious. Margins could compress. Projects could slip. Growth could stall. That’s always the nature of long-cycle industrial names.

But the story on GE Vernova isn’t just about power plants anymore. This might not be a case of overdone optimism.