Michigan Consumer Sentiment Index expected to deteriorate further in September

- September’s preliminary Michigan Consumer Sentiment Index is expected to have eased to 58.0 from 58.2 in August.

- US consumers are likely to maintain a pessimistic view of the economic outlook.

- Friday’s Consumer Sentiment is expected to strengthen the case for Fed easing.

The University of Michigan (UoM) is expected to release the preliminary figures of its monthly Consumer Confidence Index for September on Friday. This survey covers U.S. consumers’ views on their personal finances, business conditions, and purchasing plans, and is typically released alongside the University of Michigan Consumer Expectations Index and the University of Michigan Consumer Inflation Expectations.

Consumption is a key contributor to the US Gross Domestic Product (GDP). In that sense, the UoM Consumer Sentiment Index and Inflation Expectation figures have a solid reputation as forward-looking indicators for US economic trends, and their release tends to have a significant impact on US Dollar (USD) crosses.

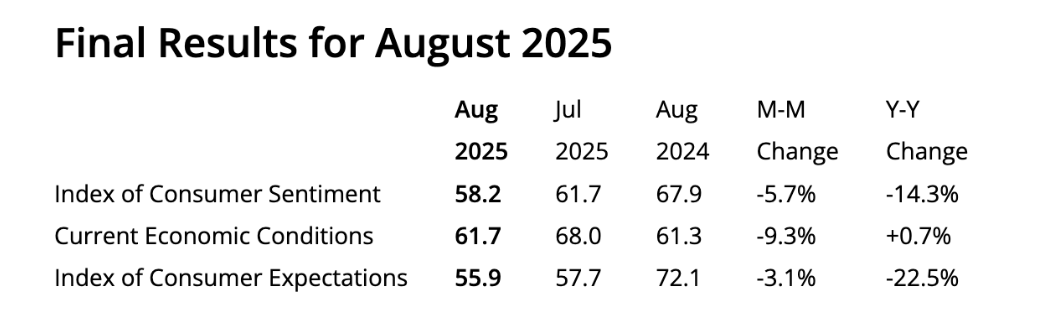

Regarding preliminary September’s reading, the UoM Consumer Sentiment is expected to show further deterioration, to 58, from an already soft 58.2 level seen in August.

Market participants will also focus on the five-year Consumer Inflation Expectation reading, which rose to 3.5% in August from July’s 3.4%.

What to expect from September’s UoM Consumer Sentiment Index report?

September’s Consumer Sentiment data comes after a raft of grim employment indicators, with the last episode being a sharp downward revision of US job creation. The US Bureau of Labor Statistics (BLS) reported on Tuesday that the preliminary revision of the Current Employment Statistics (CES) national benchmark to total Nonfarm employment for the 12-month period through March 2025 was -911,000, or -0.6% fewer jobs than initially reported.

Later in the week, a sharp increase in US Initial Jobless Claims added to evidence of the labour market deterioration. This, coupled with a moderate uptick in consumer prices in August, has practically confirmed a September Fed interest rate cut and one or two more cuts before the year-end.

With this in mind, today’s consumer sentiment figures are likely to support those views. If August’s report reflected an increasing pessimism about the current economic conditions and the overall economic outlook, things seem to have only worsened in September.

Consumer Sentiment is expected to have dropped to 58.0 in September from 58.2 in August and 61.7 in July. These figures are nearly 15% below the levels of August last year, which highlights the negative impact of US President Donald Trump’s trade policies on US consumption.

Source: University of Michigan

All in all, not the best news for the US Dollar, which is suffering amid rising concerns that the Federal Reserve might have fallen behind the curve with rate cuts. A mix of weak employment, relatively moderate inflation, and deteriorating consumer sentiment provides an ideal scenario for the US central bank to resume its monetary easing cycle.

When will the UoM Consumer Sentiment Index be released, and how could it affect EUR/USD?

The University of Michigan will release its Consumer Sentiment Index, together with the Consumer Inflation Expectations survey, on Friday at 14:00 GMT. The market consensus points to further deterioration in US consumer sentiment, which would add downside pressure to the US Dollar. However, geopolitical tensions in the Eurozone might offset the impact on the EUR/USD pair as frictions between Russia and Poland have undermined confidence in the common currency.

The EUR/USD rally has been halted below late July highs of 1.1790, but downside attempts have been contained above the 1.1700 area so far, which maintains the immediate positive trend in place.

To the downside, the early September lows, near 1.1610 and 1.1630, are key levels for bears, while, on the upside, resistance at 1.1780 (September 9 high) and 1.1790 (July 24 high) need to be broken to extend the broader bullish trend towards the year-to-date highs, at 1.1830.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Sep 12, 2025 14:00 (Prel)

Frequency: Monthly

Consensus: 58

Previous: 58.2

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.