Cardano Price Forecast: ADA eyes breakout as whale accumulation and on-chain data turn bullish

- Cardano price faces rejection around $0.70, a firm close above could trigger a renewed rally.

- Santiment data shows that whale wallets are actively accumulating ADA, signaling growing confidence.

- The technical outlook supports a breakout, as momentum indicators signal fading bearish pressure.

Cardano (ADA) is trading around $0.66 at the time of writing on Tuesday, after being rejected from a key level the previous day. On-chain data shows whale accumulation rising, fueling optimism for a potential breakout. The technical outlook also supports a rally ahead, as momentum indicators signal a fading bearish trend.

Cardano’s whale wallets buy dips

Santiment’s Supply Distribution data supports a bullish outlook for Cardano, as certain whales are buying ADA at recent price dips.

The metric indicates that whales holding between 1 million and 10 million ADA tokens (yellow line) and 10 million and 100 million tokens (blue line) have accumulated a total of 100 million ADA tokens from October 15 to Tuesday. During the same period, wallets holding between 100,000 and 1 million ADA tokens (red line) have shed 30 million tokens.

This shows that the second cohort of whales could have fallen prey to the capitulation event. In contrast, the first set of wallets seized the opportunity and accumulated Cardano at a discount.

[09-1761628619184-1761628619185.37.13, 28 Oct, 2025].png)

ADA supply distribution chart. Source: Santiment

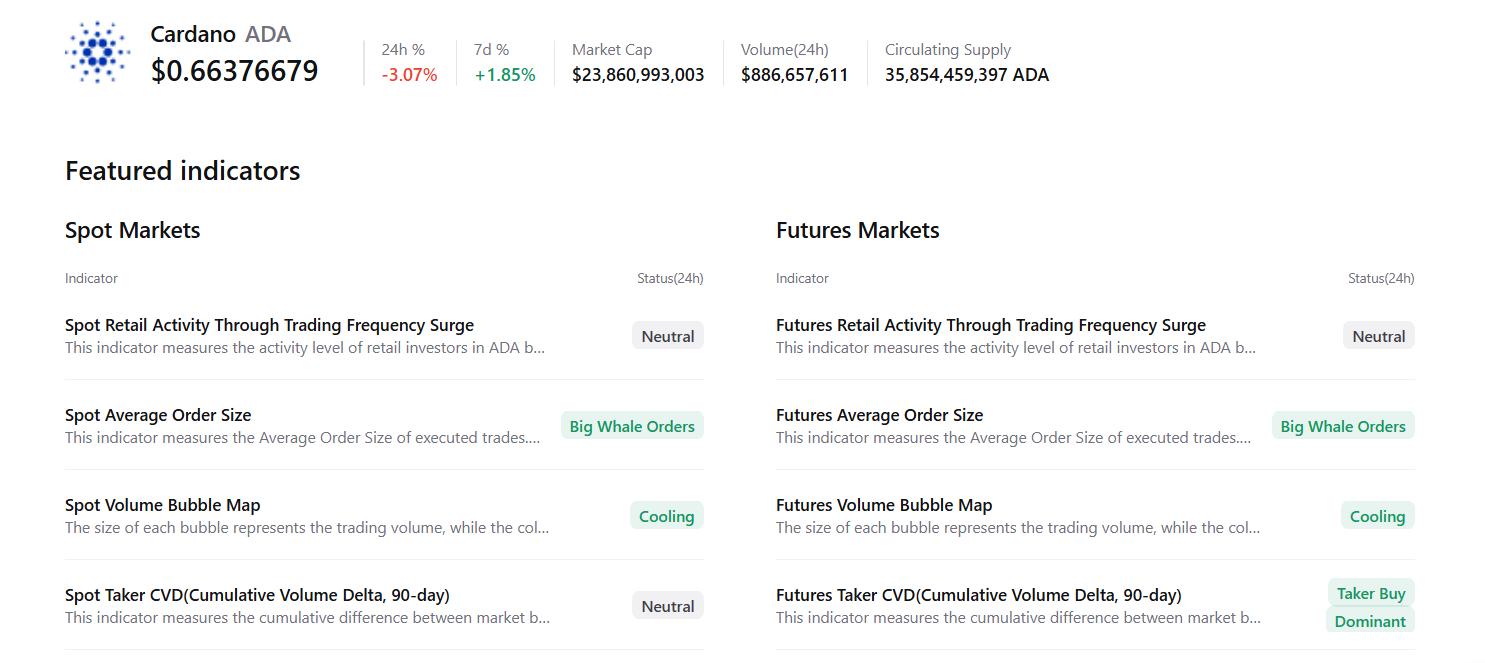

CryptoQuant’s summary data supports the bullish outlook, with both the spot and futures markets showing large whale orders and buy dominance, signaling a potential rally ahead.

Cardano Price Forecast: ADA shows signs of fading bearish momentum

Cardano price faced rejection from the 61.8% Fibonacci retracement at $0.69 on Monday. This level roughly coincides with the daily resistance at $0.70, making it a key zone of resistance. At the time of writing on Tuesday, ADA hovers at around $0.66.

If ADA breaks and closes above $0.70 on a daily basis, it could extend the rally toward the next daily resistance at $0.84.

The Relative Strength Index (RSI) on the daily chart is 43, moving up toward the neutral 50 level, indicating fading bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on Sunday, providing a buy signal and supporting the bullish thesis.

ADA/USDT daily chart

On the other hand, if ADA faces a correction, it could extend the decline toward the 50% retracement level at $0.61.