Bitcoin Long-Term Holders Always Sell During Bull Market— What’s Different This Time?

The price of Bitcoin began the new month on a rough note, continuing its tumultuous run from October. On the afternoon of Friday, November 7, the premier cryptocurrency briefly fell below the psychological $100,000 level for the second time in the past week.

The struggles of the Bitcoin price in recent weeks have been attributed to a shift in the behavior of investors, especially a class known as the long-term holders (LTHs). A prominent crypto expert on X has come forward with more insights as to the impact of the LTH behavior on BTC price.

BTC Apparent Demand Growth Turns Negative

In his latest post on the X platform, CryptoQuant’s Head of Research, Julio Moreno, acknowledged that the Bitcoin long-term holders have indeed been offloading their assets over the past few weeks. The crypto expert, however, noted that this increased selling activity by LTHs is not something new.

According to Moreno, it is quite normal for Bitcoin long-term investors to shave off some of their holdings during the bull markets, as they look to take some profits while prices are high. What has been different this time around is that there has been no corresponding demand to mop up these offloads.

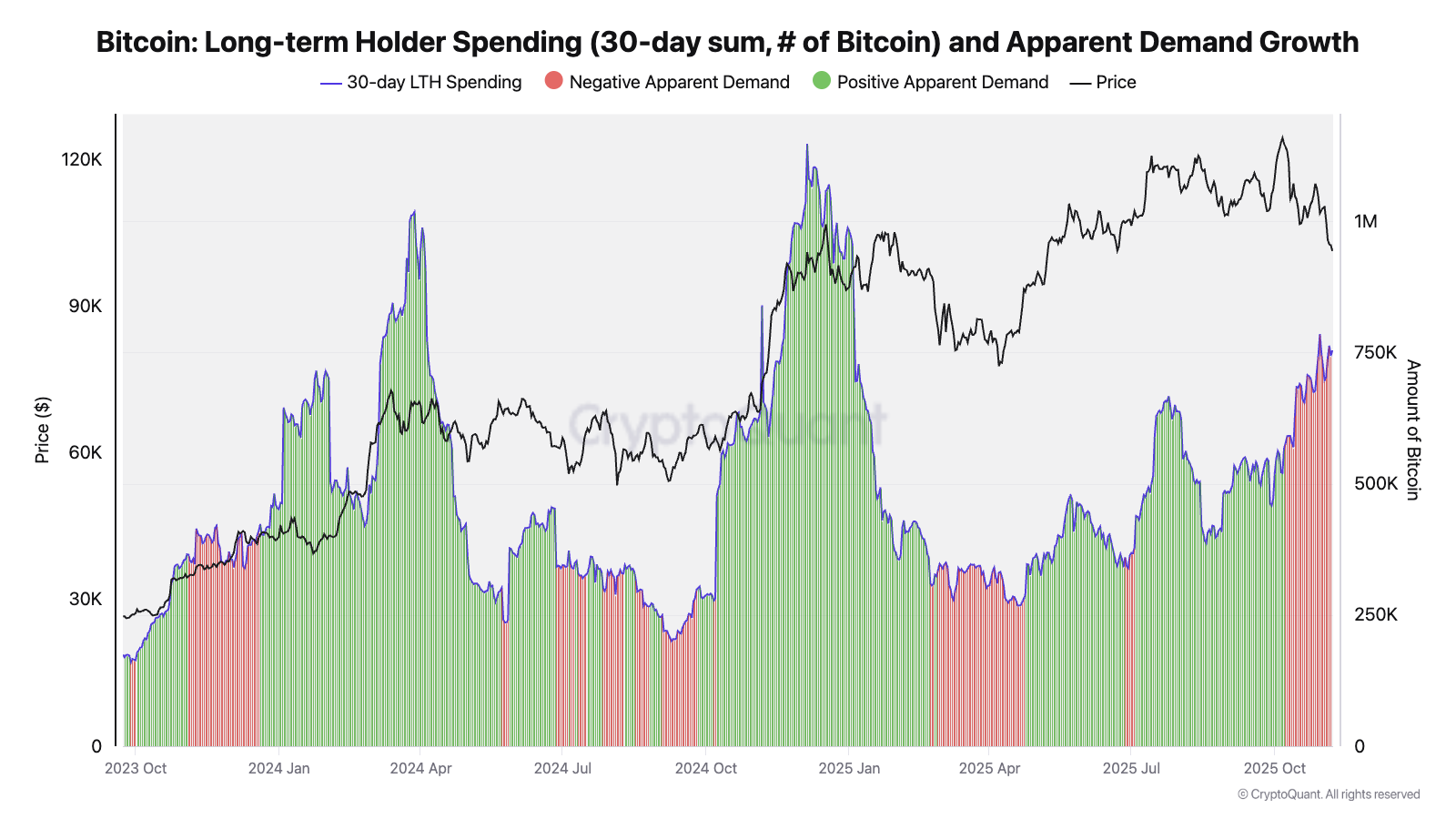

To back this, Moreno shared a chart comprising the long-term holder spending and apparent demand growth in the past few years. For context, apparent demand growth measures the difference between how much of an asset (Bitcoin, in this case) is being acquired compared to the quantity being created (mined).

The CryptoQuant Head of Research noted that the Bitcoin price had reached new all-time highs in the past during periods of increased long-term holders selling—albeit with positive apparent demand growth. As observed in the chart, this occurred during all-time-high rallies of January-March 2024 and November-December 2024.

The highlighted chart also shows that the Bitcoin long-term holders have been selling since October, which is not particularly out of place. However, the apparent demand growth has been contracting, implying that there has been no buy pressure to absorb the LTH supply at higher prices.

Ultimately, this on-chain observation suggests that less focus should be placed on the selling activity of the Bitcoin long-term holders. If there is to be a turnaround for the price of BTC over the coming weeks, a positive apparent demand growth would need to be in place first.

Bitcoin Price At A Glance

As of this writing, the flagship cryptocurrency has recovered back above $100,000 and is valued at around $103,700, reflecting an almost 3% jump in the past 24 hours.