Crypto Today: Bitcoin, Ethereum, XRP extend correction amid fading institutional and retail interest

- Bitcoin slides below $108,000 as risk-off sentiment grips both institutional and retail investors.

- Ethereum bears tighten their grip as US-listed ETFs mark the third day of consecutive outflows.

- XRP remains below its 50-, 100-, and 200-day EMAs amid rising downside risks.

Bitcoin (BTC) is trading in the red on Monday, as bears tighten their grip, highlighting a sticky risk-off sentiment in the broader cryptocurrency market. The largest cryptocurrency by market capitalization remains below $108,000, down nearly 3%.

Altcoins, including Ethereum (ETH) and Ripple (XRP), have not been spared by the bearish wave triggered by macroeconomic uncertainty and risk-off sentiment. Ethereum holds above $3,700 as bulls rush to defend the short-term support. On the other hand, XRP remains above its immediate $2.40 support and is top-heavy.

Data spotlight: Bitcoin, Ethereum face ETF outflows as retail demand wanes

Bitcoin spot Exchange Traded Funds (ETFs) continued to face steady outflows last week, signaling a lack of investor conviction in the crypto market. The 12 US-listed spot ETFs saw approximately $192 million in outflows on Friday. This marked the third consecutive day of outflows, bringing the total net outflow volume to $799 million last week.

Bitcoin ETF stats | Source: SoSoValue

Similarly, retail interest remains suppressed amid a weakening derivatives market. According to CoinGlass data, the Bitcoin Open Interest (OI), which tracks the notional value of outstanding futures contracts, averages $70 billion at the time of writing, down from $94 billion, its peak level in October.

If investors increasingly reduce their risk exposure, the prevailing decline could accelerate toward $102,000, Bitcoin’s October floor price.

Bitcoin Open Interest | Source: CoinGlass

Meanwhile, Ethereum experienced approximately $98 million in net outflows on Friday, extending the bearish streak for the third consecutive day. US-listed ETFs saw $184 million in outflows on Thursday and $81 million on Wednesday.

Ethereum ETF stats | Source: SoSoValue

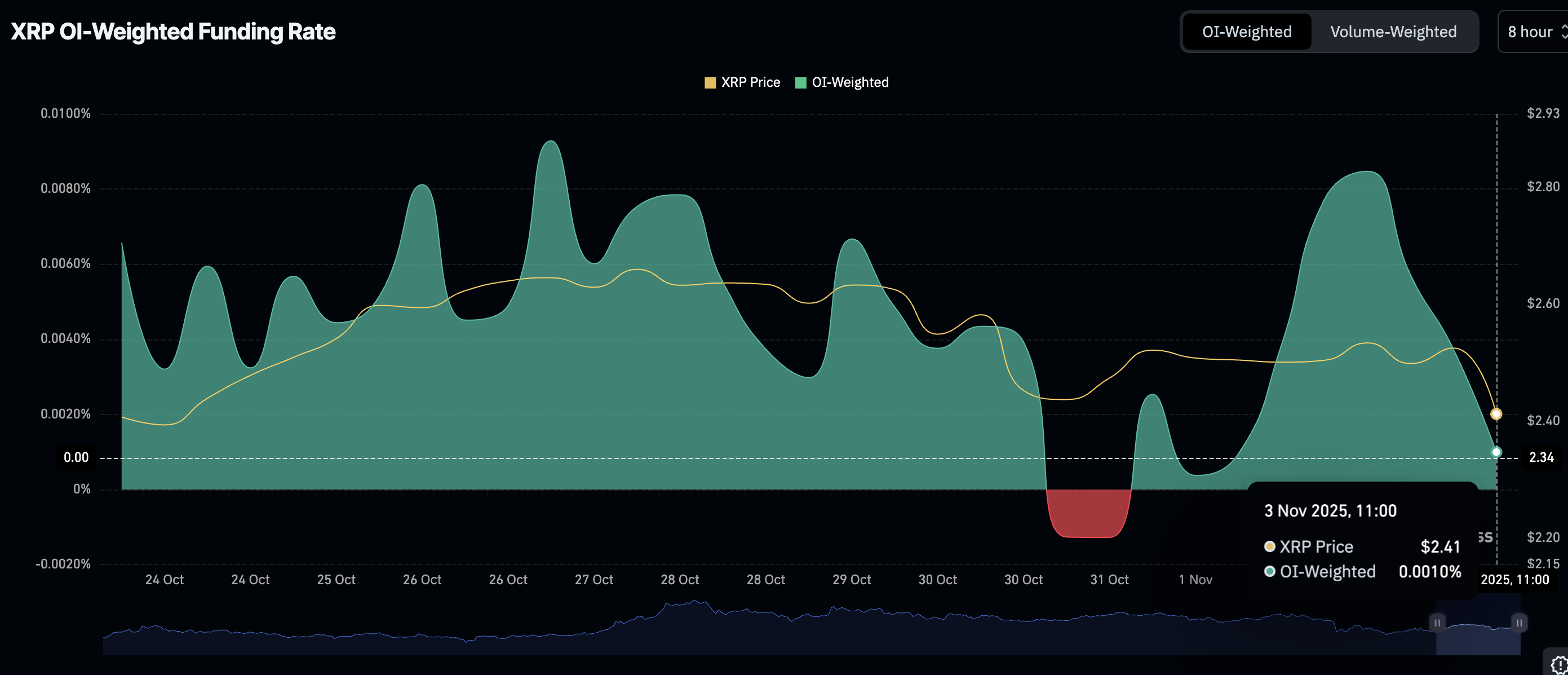

The cross-border money remittance token, XRP, is facing a top-heavy technical structure, worsened by waning retail demand. Since the massive sell-off on October 10, which triggered crypto liquidations worth more than $19 billion, the XRP OI-weighted funding rate has remained significantly suppressed.

CoinGlass data shows the OI-weighted funding rate at 0.0010%, down from 0.0085% on Sunday. This drop implies that traders could be intentionally closing their long positions and piling into short positions, in turn, depriving XRP of the tailwind needed to sustain its recovery.

XRP OI-Weighted Funding Rate | Source: CoinGlass

Chart of the day: Bitcoin testing key support

Bitcoin remains largely in bearish hands at the time of writing on Monday. An engulfing red candle has erased all the gains from the weekend, with BTC falling from above $111,000 and holding above the round-number support at $107,000.

Bitcoin has also lost support from key moving averages, including the 50-day Exponential Moving Average (EMA) at $112,477, the 100-day EMA at $112,334, and the 200-day EMA at $108,373, all of which are currently acting as resistance levels.

BTC/USDT daily chart

The 50-day EMA is about to cross below the 100-day EMA, signaling a Death Cross and the associated risk-off sentiment. Furthermore, the Relative Strength Index (RSI) at 40 and falling indicates that bearish momentum is steadily increasing. A daily close below the immediate $107,000 support could accelerate the decline toward the previous month’s support at $102,000.

Altcoins update: Ethereum, XRP plunge as investors de-risk

Ethereum is trading marginally above its round-number support at $3,700 after extending intraday correction from highs above $3,900. The RSI at 39 and falling on the daily chart validates the bearish outlook, which will likely retest the 200-day EMA support at $3,608 in the short term.

A sell signal triggered by the Moving Average Convergence Divergence (MACD) indicator on the same daily chart earlier in the day encourages investors to reduce their risk exposure.

If support at $3,700 or the 200-day EMA remains intact, and traders buy the dip, a trend reversal could occur, targeting highs above $4,000. Other key areas of interest for traders include the 100-day EMA at $3,956 and the 50-day EMA at $4,060.

ETH/USDT daily chart

As for XRP, risk-averse sentiment continues to prevail, prompting bulls to battle to defend its short-term support at $2.40. The RSI is at 41 and declining on the daily chart, indicating that bears have the upper hand.

Traders should also monitor the MACD indicator, which is signaling a sell in upcoming sessions. This signal manifests when the blue MACD line crosses below the red signal line, increasing the probability of the sell-off extending deeper into the week.

XRP/USDT daily chart

If bulls see the price drop as an opportunity to seek exposure at lower levels, XRP could regain momentum toward the coveted psychological level of $3.00. Traders should also keep in mind potential resistance at the 200-day EMA ($2.60), the 50-day EMA ($2.64), and the 100-day EMA ($2.72).

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.