Ethereum Now Holds $165B in ‘Digital Dollars’ — Bigger Than Singapore & India’s FX Reserves

Ethereum’s ecosystem continues to draw attention as stablecoins on its blockchain reach approximately $165 billion in reserves, positioning it among the world’s largest.

However, ETH’s spot price has softened, dropping below $4,000, reflecting cautious investor sentiment. Market participants are closely watching institutional positioning and on-chain metrics. They want to see if Ethereum’s role as a macro-scale digital reserve can drive renewed price momentum soon.

Global Reserve Role for Ethereum-Based Stablecoins

Stablecoins issued on the Ethereum blockchain have now aggregated around $165 billion in reserves, ranking roughly 22nd among global foreign-exchange holdings. This exceeds some national reserve pools, including Singapore and India, underscoring Ethereum’s evolving role beyond a decentralized smart-contract platform.

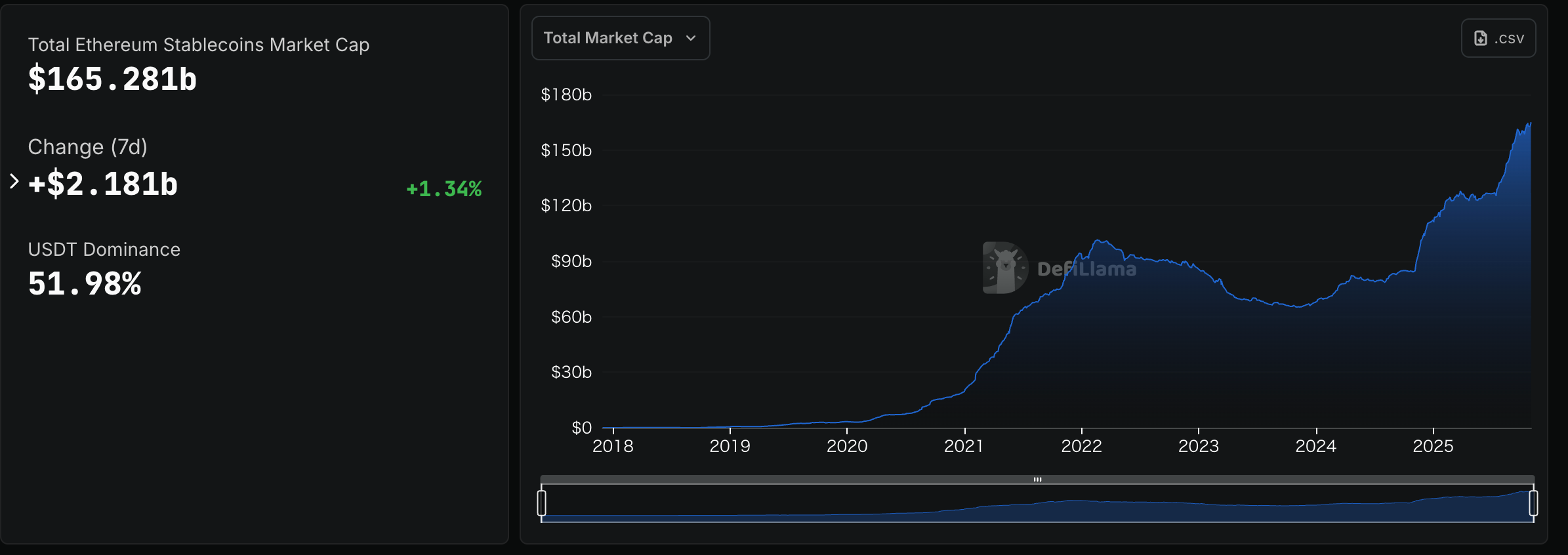

Total Ethereum Stablecoins Market Cap: DefiLama

Total Ethereum Stablecoins Market Cap: DefiLama

Analysts say the development shows structural maturation of the Ethereum ecosystem. Stablecoins are increasingly used as collateral, settlement assets, or digital reserve instruments rather than purely speculative tokens.

“When you really look at this and realize how much $ETH is integrated into stablecoins, you have to be bullish. According to the data, $ETH stablecoins rank among the 20 largest FX reserves, just behind the US,” a crypto investor, BigBob, noted on X.

The reserve accumulation illustrates growing confidence in Ethereum’s underlying infrastructure as a foundational component of digital finance.

Institutional and Trader Positioning Signals

On-chain data and trading activity indicate that institutional participants and large traders strategically positioned for potential ETH rebounds. Long positions have increased, reflecting investor interest in spot exposure and stablecoin-linked liquidity. For example, specific whale wallets hold roughly 39,000 ETH ($150 million) as long-term positions, signaling significant accumulation by major market participants.

Market observers note that these trends resemble traditional reserve asset behavior, highlighting Ethereum’s potential as a macro-level instrument for capital allocation. Investor confidence is growing, but execution remains critical. Tokenomics, staking yields, regulatory clarity, and network performance will determine whether Ethereum can sustain its reserve-level narrative.

In the derivatives market, funding rates have recently turned negative, suggesting a balance between long and short positions and indicating potential for short-term price squeezes. This dynamic, combined with institutional inflows and stablecoin issuance, will likely shape ETH’s trajectory in the coming weeks and months.

ETH Price Trends and Outlook

Amid these developments, Ethereum’s spot price has shown weakness. On October 29, ETH fell below US$4,000; at the time of writing, it stood at $3,912.90. The market appears to be waiting for confirmation of macro narratives, including continued stablecoin flows and increased network activity, before accelerating upward.

Investors remain cautious, with price consolidation reflecting both short-term profit-taking and broader market sentiment. While on-chain metrics suggest accumulation is ongoing, further catalysts—such as institutional inflows or regulatory clarity—may be required to restore upward momentum. Analysts note that if Ethereum continues to prove real-world utility and stablecoin integration, it could reinforce its role as a digital reserve. This may support a price recovery toward $4,200–4,500 in the medium term.