MEXC hit with accusations from an anonymous X account

An anonymous X account known as @Mystral_777 has ignited a storm across crypto Twitter after dropping a 10-part exposé in form of a thread accusing crypto exchange MEXC of everything from $10 million in frozen withdrawals and listing fee extortion to sexual misconduct by executives, including references to leaked videos and alleged hush payments.

The thread includes screenshots, DMs, and direct allegations, none of which have not been independently verified, either by law enforcement, a recognized regulatory body, or Cryptopolitan.

According to Mystral, many crypto projects including CateCoin were charged over $60,000 in listing fees, only to be asked for additional payments prior to listing. When they refused, tokens were never launched on the platform.

A screenshot of an email from an MEXC listing manager shows alleged communication with CateCoin offering “marketing exposure” and urging for a quick reply.

But the most serious accusation from Mystral was that MEXC froze over $10 million in user withdrawals, then closed support tickets without explanations.

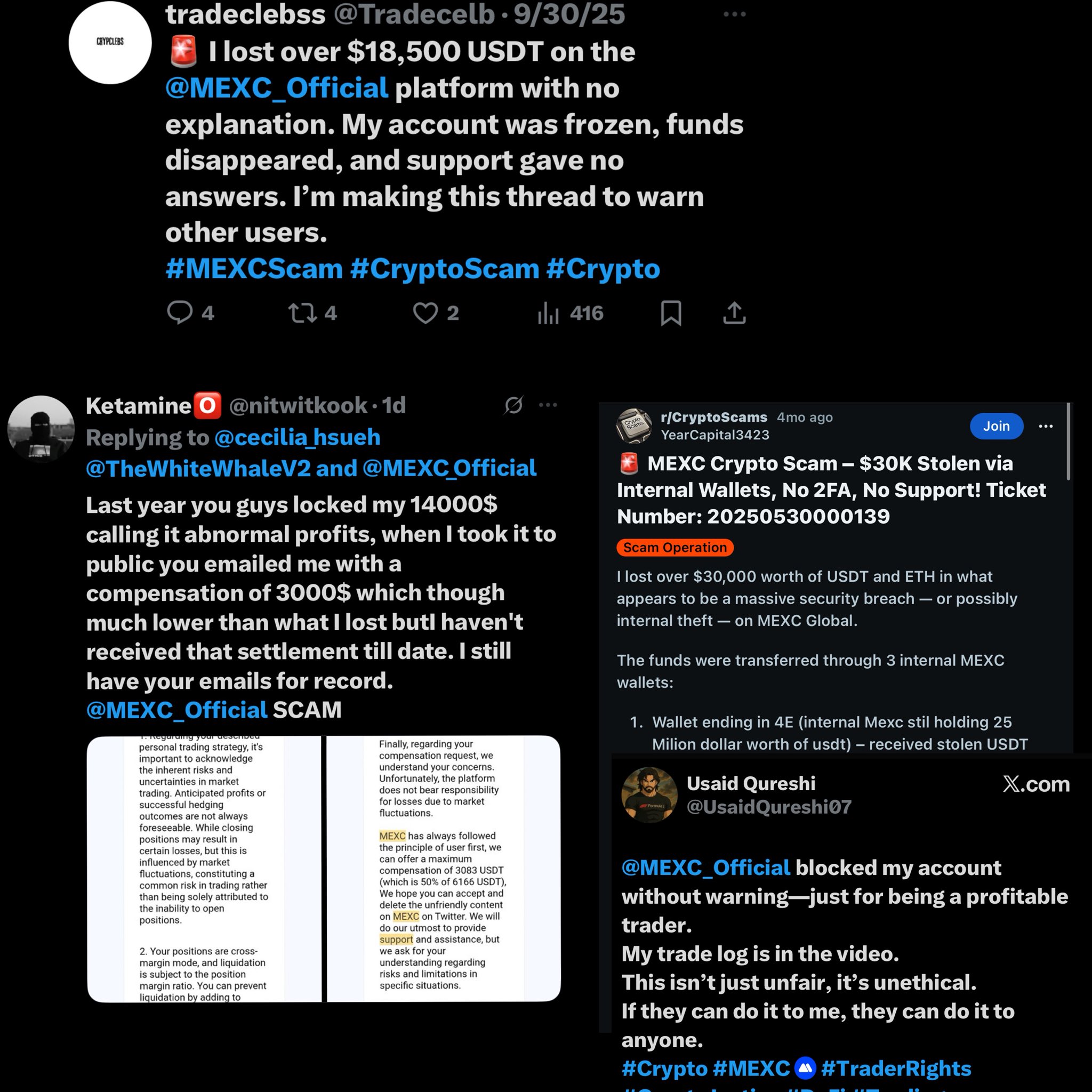

One post from user @Tradecelb says he lost $18,500 USDT. Another, from @nitwitkook, claims MEXC froze $14,000 and only offered $3,000 back after public backlash, and still hasn’t paid.

A third user on Reddit wrote that $30,000 in USDT and ETH were allegedly drained via internal MEXC wallets, with no 2FA and no support response.

Claims of retaliation, manipulation, and fake engagement flood Mystral thread

Mystral also accuses MEXC of trading against its own users, specifically opening short positions right before orchestrated liquidation spikes on low-cap tokens. Many X accounts backed this, alleging MEXC manipulates spot and futures markets, even shorting tokens it lists, and then blocking withdrawals once profits hit.

User @van00sa posted that MEXC had been dumping tokens while shorting them at the same time, and then freezing funds to cover losses. Posts from CryptoVikings, MDXCrypto, and @OxNnachet accuse the exchange of silently profiting off user trades and blocking access when traders become too successful.

One viral post from Mystral’s screenshots claims, “If you lose money, they keep it. If you win big, they lock your funds and accuse you of fraud.”

Mystral also included screenshots alleging MEXC uses bot services to inflate likes, comments, and followers. According to Mystral, 40–50% of MEXC’s engagement across platforms is fake, citing analytics tied to social media botting panels.

Mystral also shared a WhatsApp thread where a whistleblower supposedly claimed that MEXC exec Cecilia Hsueh’s X account was hacked, and that the hacker found “weird orgy vids” on her phone, allegedly involving many other MEXC senior execs.

A video referencing that material was included in the thread, with the X user claiming that the woman in the video was Cecilia, though Cryptopolitan could not confirm that, and some in the comments are saying the video was posted by a porn page on X over a year ago.

Other big accounts, including @zachxbt, have since been demanding more transparency from MEXC, especially around the alleged “shadow owner” named Tony, who, according to Zach, remains hidden behind layers of offshore entities. Zach publicly asked, “Why does MEXC hide its beneficial owner from the public?”

MEXC executive responds to some of Mystral’s accusations, admits internal failures

Roughly one hour after the thread gained traction, Cecilia posted on X: “We f**ked up. We apologize to @TheWhiteWhaleV2, and his money is already released.” She also admitted that:-

“I messed up in communicating with him. I got emotional, and I shouldn’t have. Since I joined MEXC 2 months ago I’ve been fighting behind the scenes to get MEXC to change. We grew really fast—a few years ago, we were a very small exchange, but given our current scale, our risk, operations, and PR teams have not kept up.”

Cecilia also acknowledged that the company’s risk, operations, and PR systems haven’t scaled with growth and promised change was coming.

She didn’t address any sexual misconduct allegations, the leaked images, or the claims about botting or internal wallet theft. However, in a separate post shortly after, she claimed that:- “There’s a difference between risk control disputes and insolvency. MEXC’s financials are solid. The issue is operational.”

Swing trade CryptoVikings replied to her apology saying: “If it took this much for an influencer to get funds back, what hope does a regular user have? There are 1,000+ cases like this.”

When Cecilia replied “We are going to release them,” CryptoVikings pushed back again: “Why now? Why did it take months of backlash for you to act?” Cecilia went silent after that.

User claims $3.3M of his funds were frozen on MEXC with no timeline for release

Still, the backlash continues. Trader @maxleebtc came forward after Cecelia and Mystral’s posts with a separate case of his own, posting screenshots that show 3,300,000 USDT locked in his MEXC account for 20 days, with every withdrawal attempt marked “Withdrawal Failed.”

Max said he originally thought it was just a system issue, but support kept telling him to “please be patient” before later claiming his account showed “abnormal profit.”

The chat log he shared shows MEXC staff allegedly telling him the funds were “crawled back” because of his futures trading performance, with no breakdown of how that decision was made. Max said that he reached out to MEXC’s support many times, but their response has so far been either automated or vague, and the funds remain frozen, allegedly.

If you're reading this, you’re already ahead. Stay there with our newsletter.