Top Crypto Gainers: Official Trump, Helium, Hedera shine bright among rising altcoins

- Official Trump outperforms the broader market, rising 13% on Monday, while bulls face 50-day EMA resistance.

- Helium extends the upcycle in a falling channel pattern as mobile signups hit 500,000.

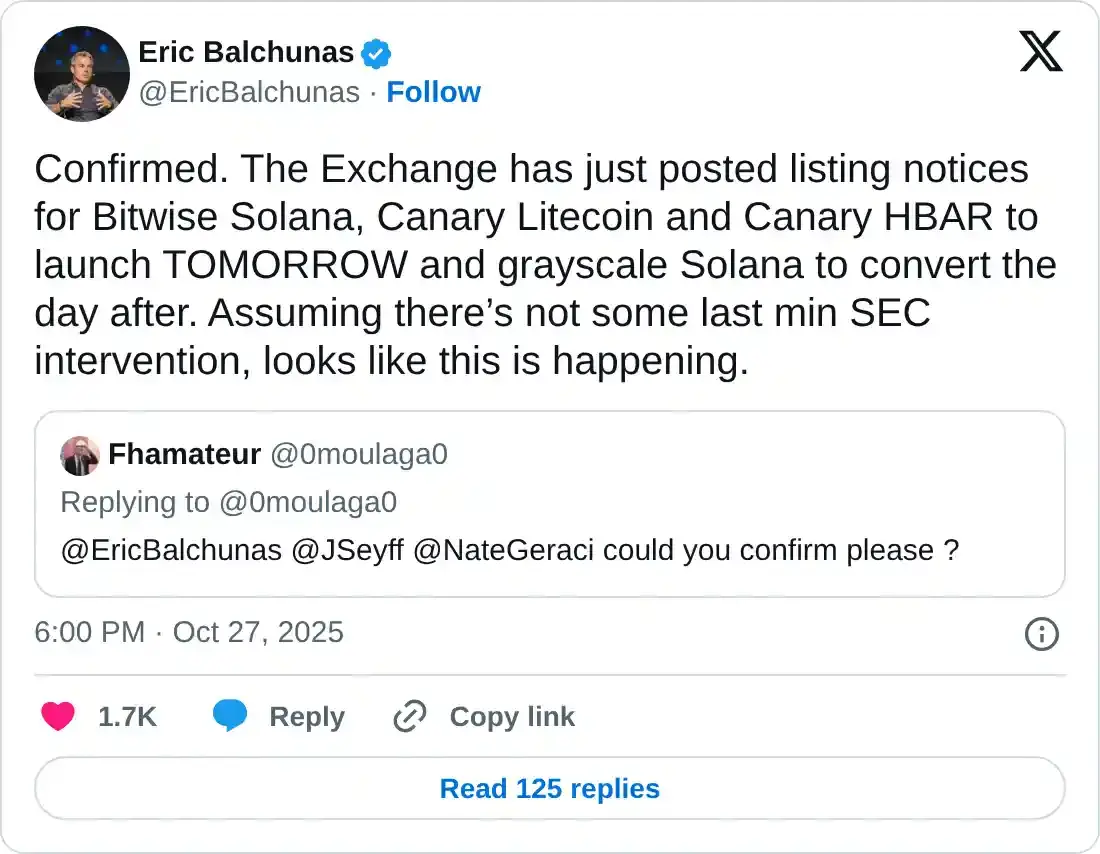

- Hedera jumps nearly 10% over the last 24 hours as the Canary HBAR ETF is confirmed for listing on Wednesday.

Altcoins such as Official Trump (TRUMP), Helium (HNT), and Hedera (HBAR) have outpaced the top 200 cryptocurrencies over the last 24 hours. The technical outlook for TRUMP and HNT suggests a falling-channel breakout is possible, while HBAR prepares to extend gains from the W-shaped reversal.

Furthermore, the Helium mobile signups have reached the 500,000 milestone and the Canary HBAR Exchange Traded Fund (ETF) will start trading on Wednesday.

Official Trump token aims for a potential channel breakout rally

The Official Trump token edges lower by over 1% at press time on Tuesday, after Monday's 13% jump. The TRUMP token struggles to surpass the 50-day Exponential Moving Average (EMA) at $7.113.

If the intraday losses flip positive, a decisive close above this average line could target the overhead resistance trendline, part of the falling channel pattern, at $7.927.

In the event of a pattern breakout, the R1 Pivot Point at $8.373 could serve as the immediate price target.

The Moving Average Convergence Divergence (MACD) rises above its signal line and approaches the zero line, indicating a rise in buying pressure. Additionally, the Relative Strength Index (RSI) on the same chart reads 56, leaving room for further growth before entering the overbought zone.

TRUMP/USDT daily price chart.

On the flip side, a key support for the TRUMP token remains at the S1 Pivot Point at $6.323.

Helium recovery gains traction as DePIN records 500,000 signups

Helium trades above $2.250 at the time of writing on Tuesday, holding steady after the 7.66% gains from the previous day. Similar to TRUMP, the Decentralized Physical Infrastructure Network (DePIN) token is facing resistance from the 50-day EMA at $2.290, within a falling channel pattern.

Helium mobile signups. Source: Helium

If HNT extends the uptrend above this dynamic resistance, it could target the declining trendline at $2.400. In case of the channel’s bullish breakout, the rally could target the $2.782 level, last tested on October 9.

Corroborating the surge, Helium mobile signups have officially reached a milestone of 500,000, indicating a steady adoption of the DePIN.

Technically, a positive shift in momentum signals further upside potential for Helium. The MACD rises towards the zero line after crossing above its signal line on Saturday. At the same time, the RSI at 54 crosses above the midpoint level, indicating a rise in buying pressure.

HNT/USDT daily price chart.

Looking down, the key support for Helium lies at the $2.000 psychological level.

Hedera eyes further gains on Canary ETF approval

Hedera extends its recovery for the fifth consecutive day on the back of Canary HBAR ETF approval, which will start trading on Tuesday. At the time of writing, HBAR price was up 5% on Sunday, adding to the 2.69% gains from Monday.

The Hedera recovery run is approaching the $0.1955 resistance, marked by the October 13 high. If HBAR marks a close above this level, it could target a resistance trendline on the daily chart, formed by connecting the peaks from July 27 and September 18, near $0.2170.

A reversal in the MACD and signal line begins an uptrend after a crossover on Saturday, suggesting a bullish shift. Additionally, the RSI at 53 continues to trend upward, indicating a gradual rise in demand.

HBAR/USDT daily price chart.

If HBAR flips from $0.1955, it could retest the $0.1600 support, marked by the October 11 low.