Crypto Inflows Near $1 Billion as Rate Cut Hopes Fuel Market Momentum

Digital asset investment products saw $921 million in crypto inflows last week as optimism grew for a potential US Federal Reserve rate cut after softer inflation data. Investors interpreted recent economic signals as a sign of possible easing in monetary policy.

Powerful inflows and anticipation of important US economic decisions are changing the playing field for crypto. Risk appetites, regional dynamics, and investor reactions to macro signals continue to evolve the digital asset market.

Macroeconomic Signals Ignite Crypto Inflows

Investor sentiment in digital asset markets improved recently due to positive macroeconomic news. Lower-than-expected US consumer price index (CPI) figures increased the likelihood of a Federal Reserve rate cut. Expectations are quickly reaching nearly 97% for a 25-basis-point reduction at the next meeting.

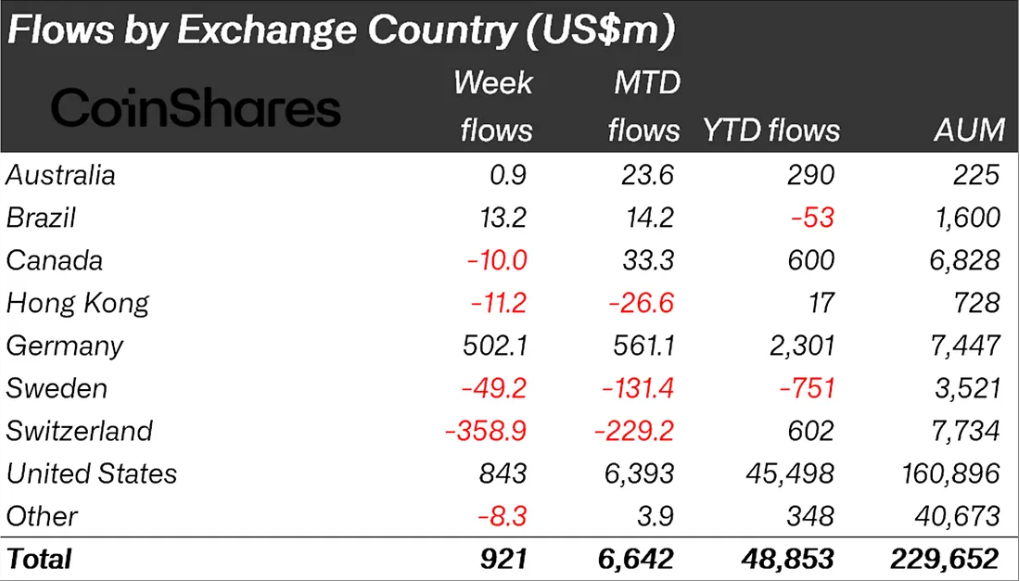

Last week, US inflows led with $843 million directed toward crypto investment products. Germany followed with a near-record $502 million in inflows, while Switzerland experienced $359 million in outflows, mostly due to asset provider transfers, not direct selling.

Crypto Inflows on Regional Metrics. Source: CoinShares

Crypto Inflows on Regional Metrics. Source: CoinShares

The Digital Asset Fund Flows Weekly Report highlighted global ETP trading volumes of $39 billion for the week, well above the 2024 year-to-date average. US participants appeared especially sensitive to the relationship between inflation data and Federal Reserve policy guidance.

Upcoming US economic events, including the Federal Open Market Committee (FOMC) decision and Federal Reserve Chair Jerome Powell’s press conference, are being closely monitored.

This rising optimism drove notable weekly inflows for digital asset products. Analysts point to the market’s acute awareness of any change in macroeconomic indicators, whether positive or negative.

Region and Asset Class Diverge as Flows Accelerate

Although US investors led the inflows, Germany’s $502 million surge reflects Europe’s focus on regulated digital asset products. In contrast, Switzerland’s $359 million in outflows were due to provider transfers rather than net selling.

These differences reveal how local factors, regulatory signals, and institutional activity influence crypto markets.

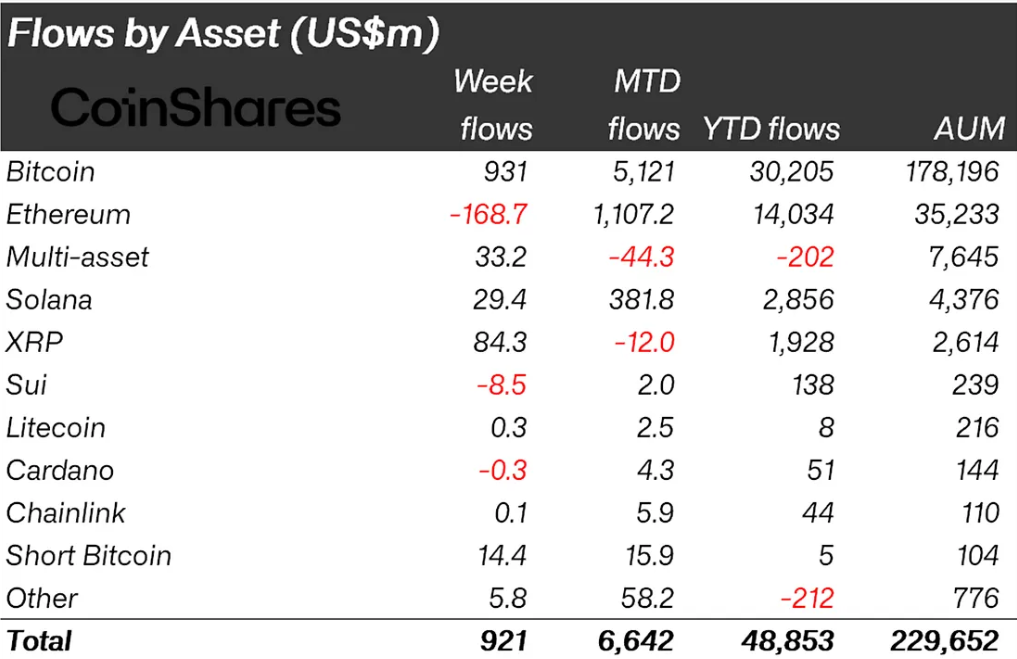

Meanwhile, Bitcoin led all digital assets, collecting $931 million in crypto inflows and raising total inflows to $9.4 billion since the Federal Reserve rate cut signals started. Year-to-date inflows across all digital assets reached $30.2 billion, though this is still below last year’s $41.6 billion record.

Conversely, Ethereum posted its first outflows in five weeks, falling by $169 million. Despite this, demand for 2x leveraged Ethereum ETPs stayed strong, indicating that sophisticated traders are actively positioning around price floors and the possibility of new ETF launches for Solana and XRP.

Flows into Solana and XRP slowed as investors awaited prospective US ETF approvals, illustrating varying levels of confidence in non-Bitcoin assets. The spike in global ETP volumes suggests growing participation and stronger conviction among both retail and institutional players.

Crypto Inflows on Asset Metrics. Source: CoinShares

Crypto Inflows on Asset Metrics. Source: CoinShares

Despite strong inflows, year-to-date totals remain below last year’s high. This trend has led some experts to question whether current momentum can last. Still, as inflation and labor market data dominate, crypto’s role as a gauge of risk sentiment remains evident.