Bitcoin Volatility Starts To Cool: Market Prepares For Potential Short Squeeze Rally

Bitcoin is struggling to establish a clear bullish structure in the short term, as selling pressure continues to dominate since the October 10 market crash. The asset remains caught in a volatile range, with traders unsure whether the next major move will mark the start of a recovery or the continuation of a broader correction.

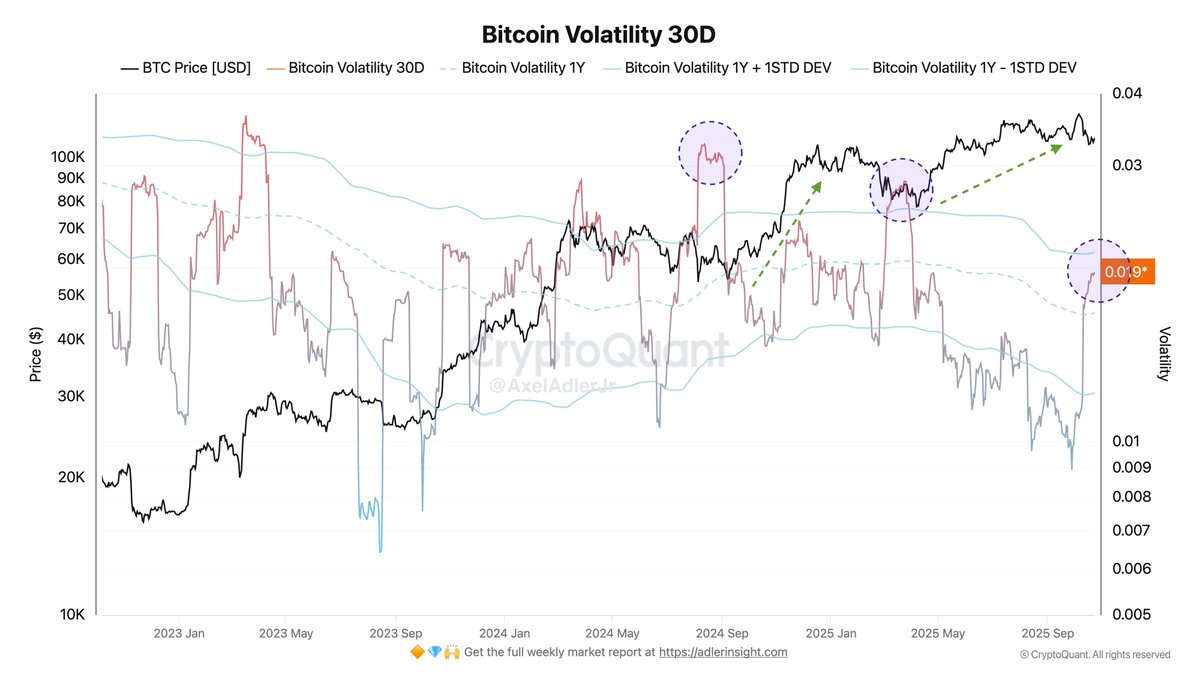

According to CryptoQuant data, volatility on the daily timeframe remains elevated — reflecting the ongoing uncertainty and aggressive repositioning among traders — but the slope of volatility is beginning to decline. This cooling could indicate that Bitcoin is gradually stabilizing after weeks of erratic movement, potentially setting the stage for a massive impulse move once momentum returns.

However, analysts remain cautious about declaring a bullish reversal. Many point to the fragile macroeconomic backdrop — including fluctuating US Treasury yields, geopolitical risks, and investor rotation between risk-on and risk-off assets — as key variables that could determine Bitcoin’s next direction. For now, market sentiment remains mixed, with long-term holders showing resilience while short-term traders continue to exit positions amid uncertainty.

Market Awaits As Bitcoin Consolidates Before Potential Rally

According to top analyst Axel Adler, Bitcoin’s current cooling phase may be a critical setup for the next bullish impulse. Adler explains that once the volatility index begins to decline, the market could finally start to realize accumulated short positions, potentially fueling a short squeeze that drives prices higher. This process often marks the transition from uncertainty to recovery — a pattern observed in past market cycles following high-volatility events.

However, Adler cautions that this scenario depends heavily on the absence of external macro shocks. Any sudden rise in US Treasury yields or renewed gold strength could shift sentiment back into Risk-off mode, prompting capital outflows from risk assets like Bitcoin. In such an environment, even minor rallies could face swift rejection as liquidity retreats toward safer instruments.

For now, the volatility slope is flattening, signaling that the extreme turbulence seen since the October 10 crash may be easing. This stabilization phase often precedes a significant move, as both bulls and bears reassess positioning.

Some analysts share Adler’s cautiously optimistic view, suggesting that Bitcoin could be nearing a short-term bottom. The combination of reduced volatility, potential short covering, and cooling leverage ratios hints that market structure may be resetting in preparation for a bullish reversal.

If macro sentiment stabilizes and risk appetite strengthens, Bitcoin could see renewed momentum toward the $115K–$120K zone. Until then, the market appears to be in a holding pattern — waiting for volatility to subside before confirming the next decisive move.

Bitcoin Tests Resistance Near Amid Market Caution

Bitcoin is currently trading around $111,326, showing a modest rebound after weeks of weakness following the October 10 crash. The daily chart highlights a clear sideways consolidation pattern, with BTC struggling to gain momentum above its 50-day moving average (blue line), which now acts as immediate resistance.

The structure remains fragile, as the 200-day moving average (red line) around $106,000 continues to serve as a critical support level, repeatedly holding the price from a deeper breakdown. A sustained close above $112,000–$113,000 would be the first technical confirmation that bulls are regaining strength, potentially opening the door to a retest of the $117,500 resistance zone — a key liquidity level where sellers previously rejected the price.

However, the broader trend remains neutral to slightly bearish as long as BTC trades below the cluster of moving averages. The market still shows hesitation, reflecting uncertainty across macroeconomic indicators and persistent risk-off sentiment.

Bitcoin appears to be in a recovery attempt, but it needs stronger volume and a clear break above $113K to confirm bullish continuation. Otherwise, failure to maintain current levels could result in another retest of $108K–$106K, where buyer support remains concentrated.

Featured image from ChatGPT, chart from TradingView.com